America's 2022 Slowdown

While Not A Recession, America Experienced A Serious Real Growth Slowdown in 2022

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 22,000 people who read Apricitas weekly!

Otherwise, liking or sharing is the best way to support my work. Thank you!

2022 likely won’t get officially characterized as a recession—of the six indicators that the NBER Business Cycle Dating Committee uses to evaluate the US economy only two (Real Retail/Wholesale Sales and Industrial Production) remain below their peak. Still, it is undeniable that the US experienced a significant real economic slowdown over the last year as the world economy got hit by the aftereffects of Russia’s invasion of Ukraine and global central banks tightened policy to combat sky-high inflation.

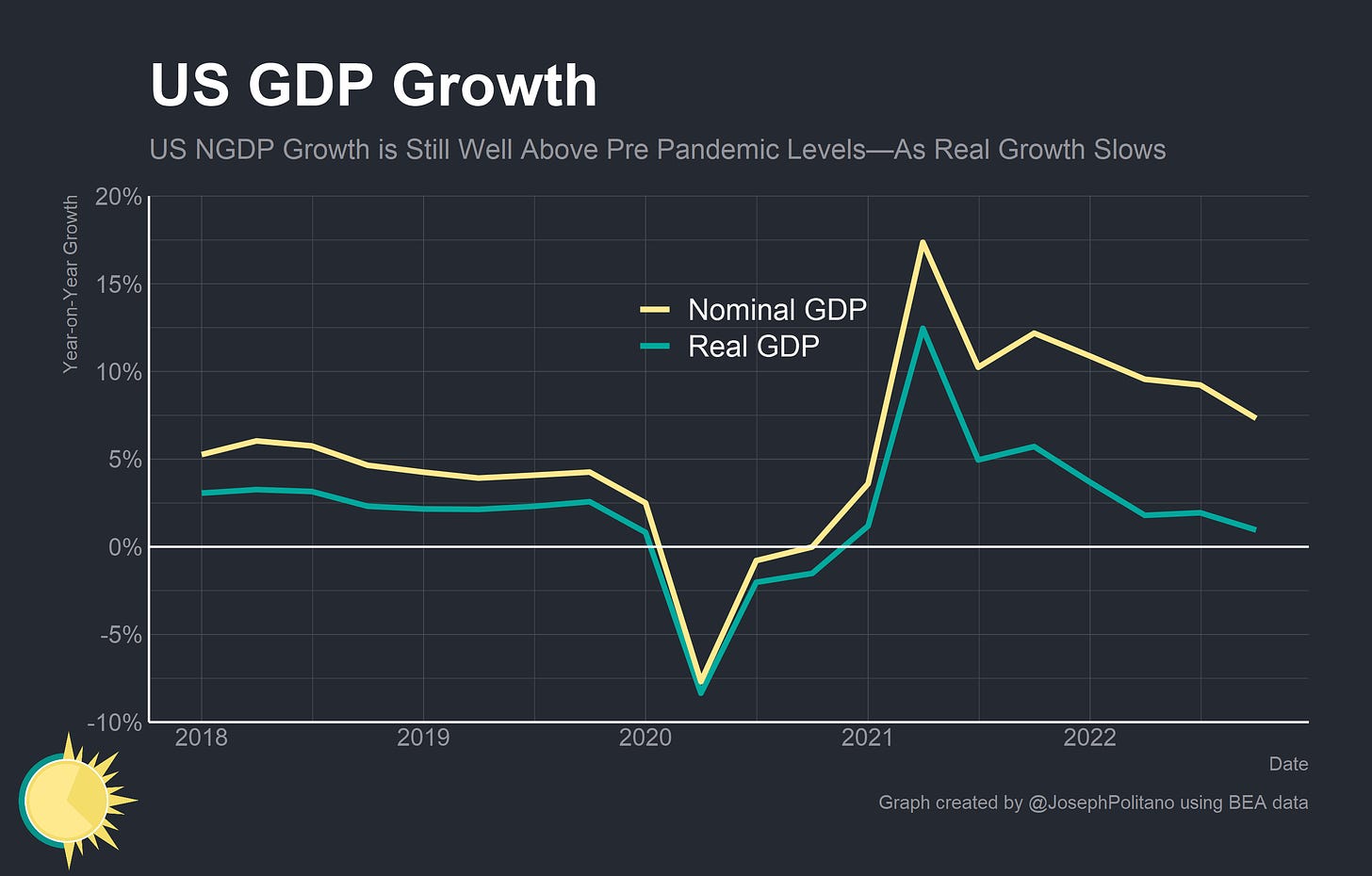

Simultaneously, that real economic slowdown coincided with a robust period of nominal aggregate growth. Before adjusting for inflation, the US economy was 7.3% larger in Q4 2022 than during the same period in 2021—a decline from 2021 growth rates but still a far cry from the 4% year-on-year growth that characterized the pre-COVID period. After adjusting for inflation, real GDP was less than 1% larger in Q4 2022 than in Q4 2021—which would have been the second-lowest annual growth rate of any quarter during the 2010s. So it is both true that the pace of aggregate spending was too high to be consistent with the Fed’s 2% inflation target and GDP growth was below what would normally characterize a normal period of economic growth.

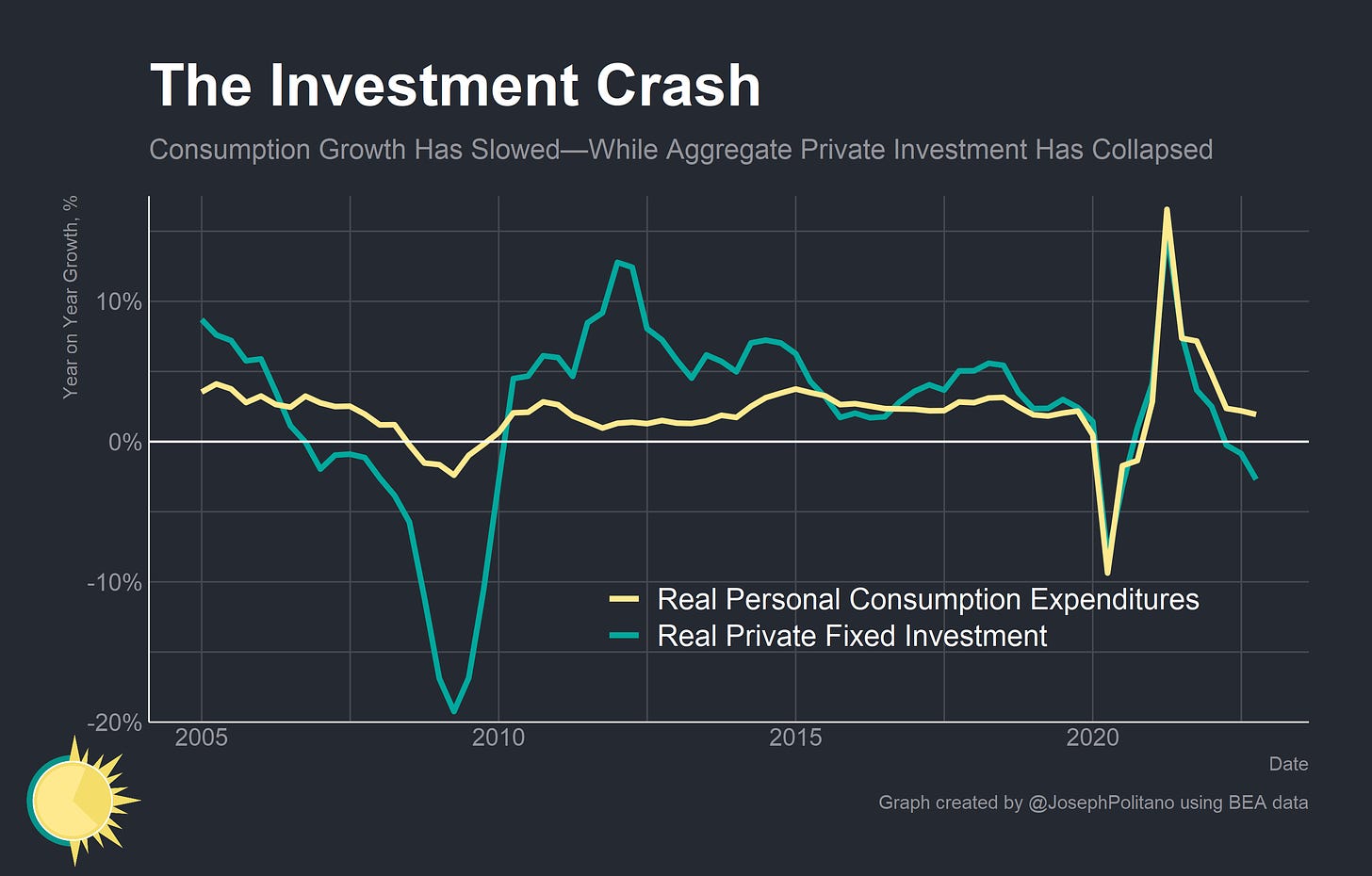

Over the last year aggregate real consumption growth has moderated, but it was real private fixed investment, which represents spending on long-term projects like homebuilding, software development, factory construction, and so on, that actually declined substantially. Housing was the big casualty with single-family residential investment falling to an 8-year low amidst rapid increases in mortgage rates, but fixed investment in nonresidential structures also sank while investment in equipment and R&D stagnated. Higher interest rates, macroeconomic uncertainty, global growth drags, and weakening US real consumption have hurt domestic investment the most—a worrying sign given how critical fixed investments are to increasing long-run economic capacity.

Plus, the underlying slowdown looks worse than recent positive headline GDP numbers make it first appear. Real Final Sales to Private Domestic Purchasers, which excludes government output, inventory growth, and net exports, isolates the core elements of domestic real demand and focuses exclusively on consumption and fixed investment. Since the core of the US economy is driven by that combination of consumption and fixed investment, it’s an extremely important indicator that only tends to decline during a recession. Year-on-year growth in Real Final Sales to Private Domestic Purchasers fell to less than 1% in Q4, and quarterly growth was a meager 0.06%. So the slowdown in real economic growth has been serious even if it is not an explicit recession—and while recession risks are declining they still remain uncomfortably high going forward. But to understand 2023 recession risks, we first have to further analyze the slowdown the US economy experienced throughout 2022.

Keep reading with a 7-day free trial

Subscribe to Apricitas Economics to keep reading this post and get 7 days of free access to the full post archives.