America's Energy Export Boom

Record US Oil and Gas Production Has Allowed the County to Become a Major Net Energy Exporter—and Trade Volumes are Expected to Continue Growing

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 37,000 people who read Apricitas weekly!

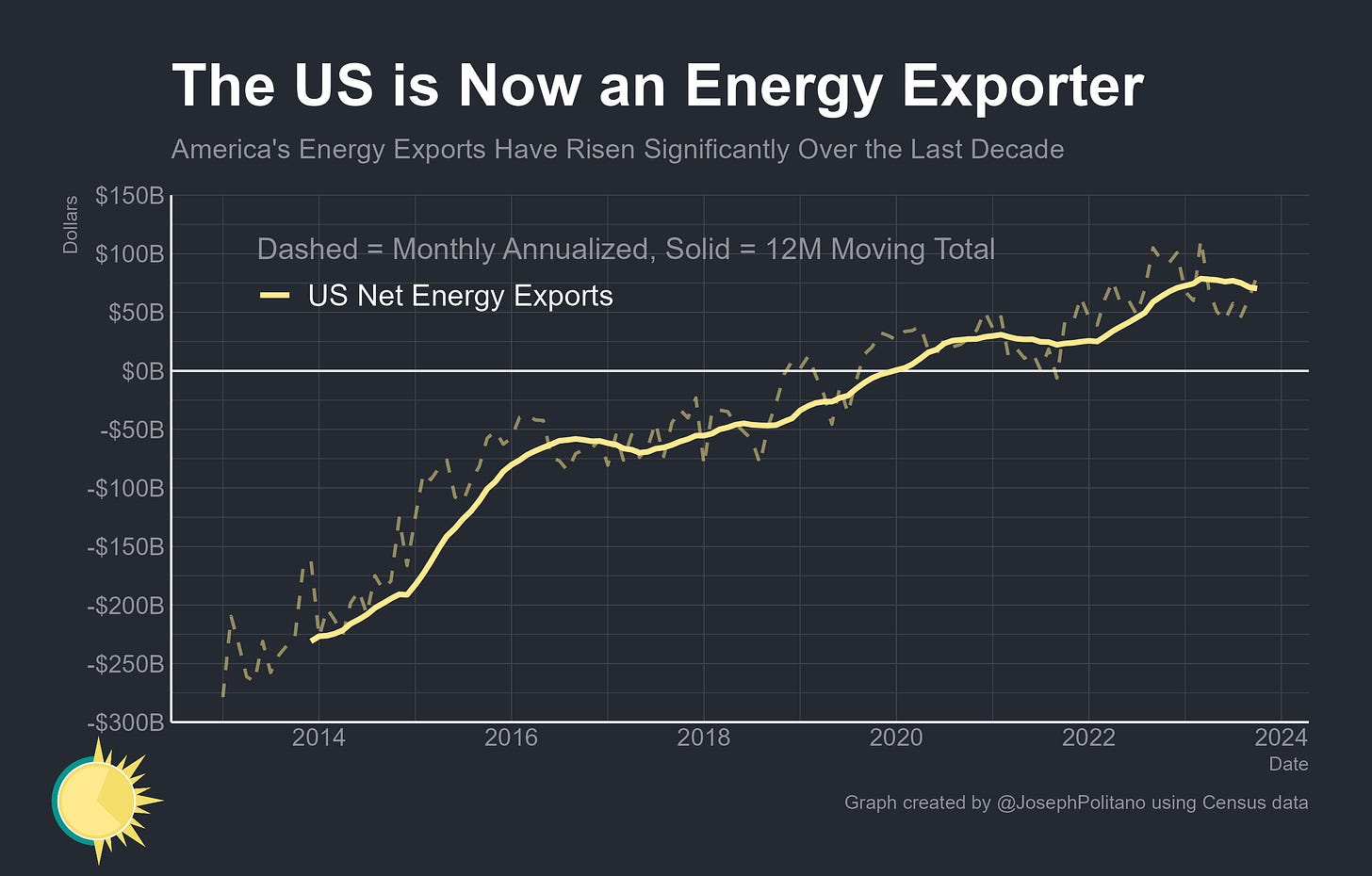

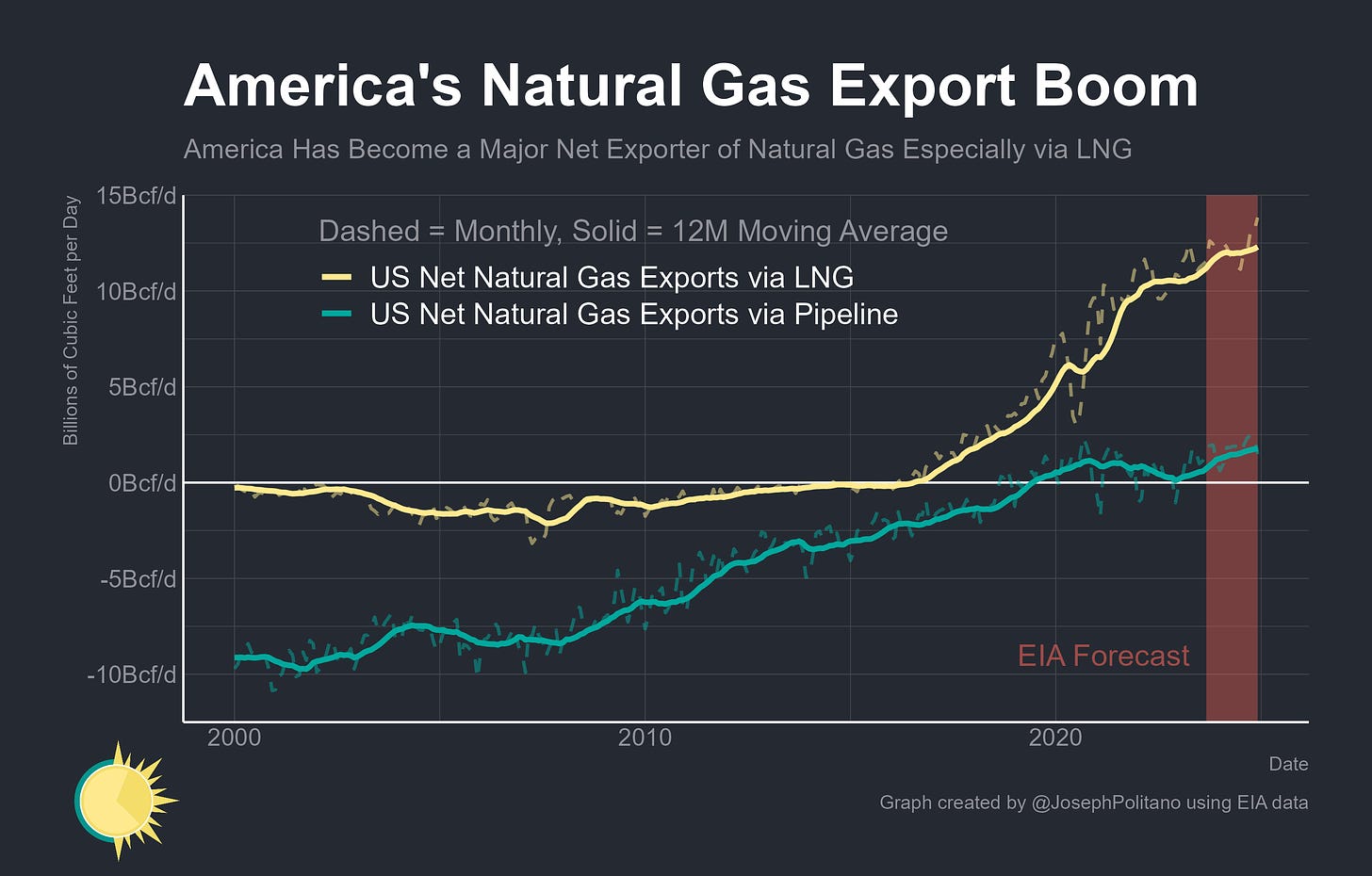

For most of modern American history, the country has had to import massive amounts of foreign energy—its production was among the highest in the world but having a growing, wealthy, hydrocarbon-intensive economy meant that consumption demand grew to far outstrip domestic supply. Oil prices became a massive driver of the overall trade deficit, and policymakers obsessed over energy independence—especially in the wake of the 1970s oil embargo and early 2000s commodities supercycle. The 21st-century fracking boom has completely changed that—the rapid rebound in domestic energy production over the last 15 years has shrunk America’s energy deficit until the country became a net exporter in 2019. As of last year, the country exported vastly more natural gas than it imported and had essentially balanced its petroleum trade.

Now, the US produces more crude oil than any other country by a significant margin, and when looking at total petroleum products (including hydrocarbon gas liquids like propane and biofuels like ethanol) the US makes more than Saudi Arabia and Russia combined. As of September, American crude oil production has set a new record high after finally completing its recovery from the pandemic. Meanwhile US natural gas production, after fully recovering from COVID in late 2021, has continued setting new record highs and is now up 7% from its 2019 peaks.

In other words, the US is now producing more energy than ever before, and that growing surplus is being sent abroad—net US energy exports have reached $70B over the last 12 months despite falling oil and gas prices. In fact, US supply growth has been a large factor behind those falling prices in a year where OPEC+ producers have seen significant ongoing production cutbacks. Those short-term price dynamics are likely to start weighing on domestic US production, yet the longer-term trend is one where America’s fossil fuel demand is weaker as economic growth becomes less energy intensive and energy systems continue slowly decarbonizing—allowing a greater share of growing production to be exported, particularly to other parts of the world with faster and more hydrocarbon-intensive economic growth.

Another Shale Boom

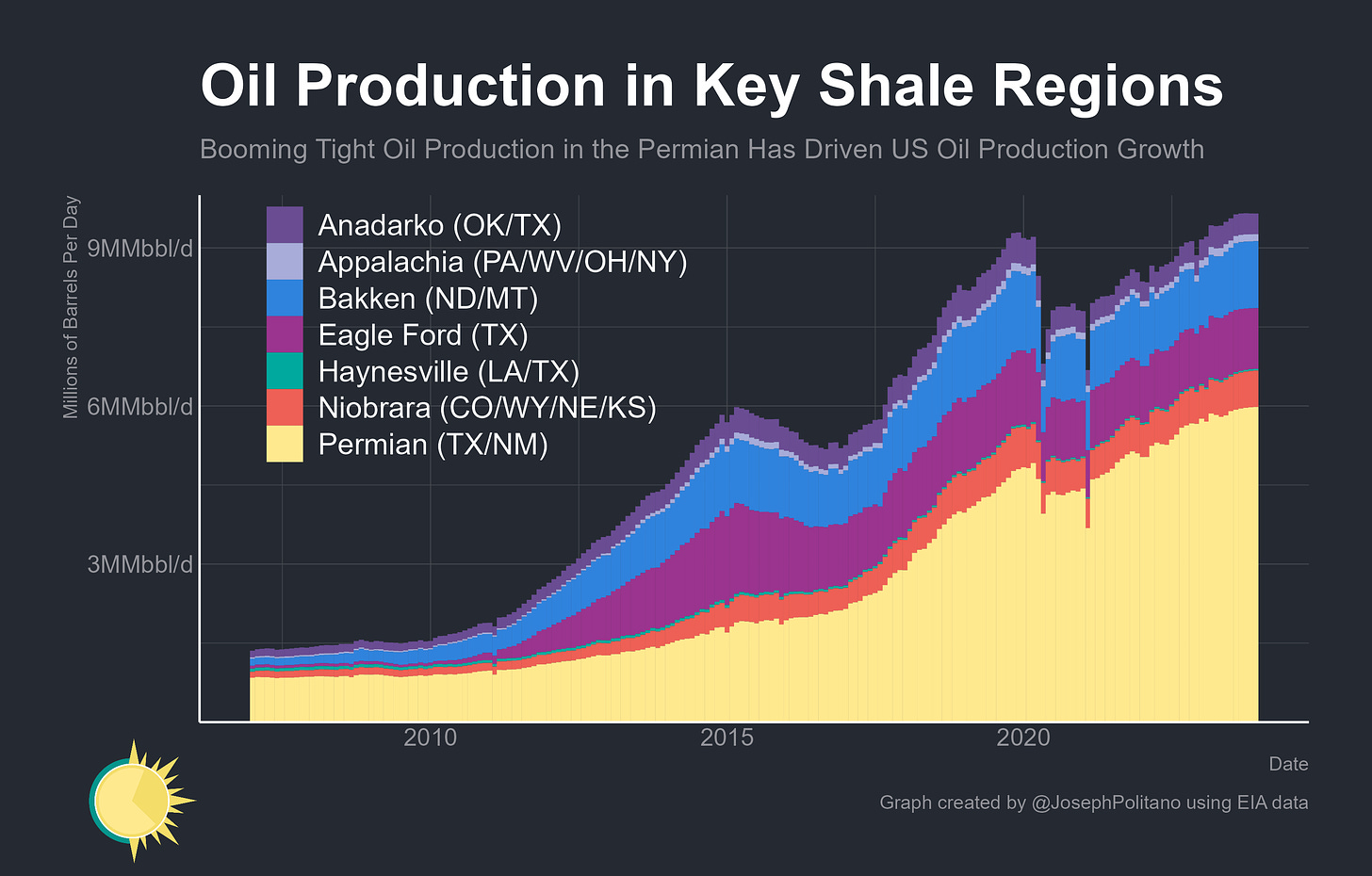

Part and parcel of the long-run rise in US energy production has been the more-than-a-decade-long fracking and shale boom, and production growth over the last few years has been no different. US tight oil output has continued to grow swiftly over the last three years, driven in large part by significant output increases across the Permian Basin of Texas and New Mexico. In fact, crude oil production in the Permian alone is so large that it now exceeds all OPEC members bar Saudi Arabia.

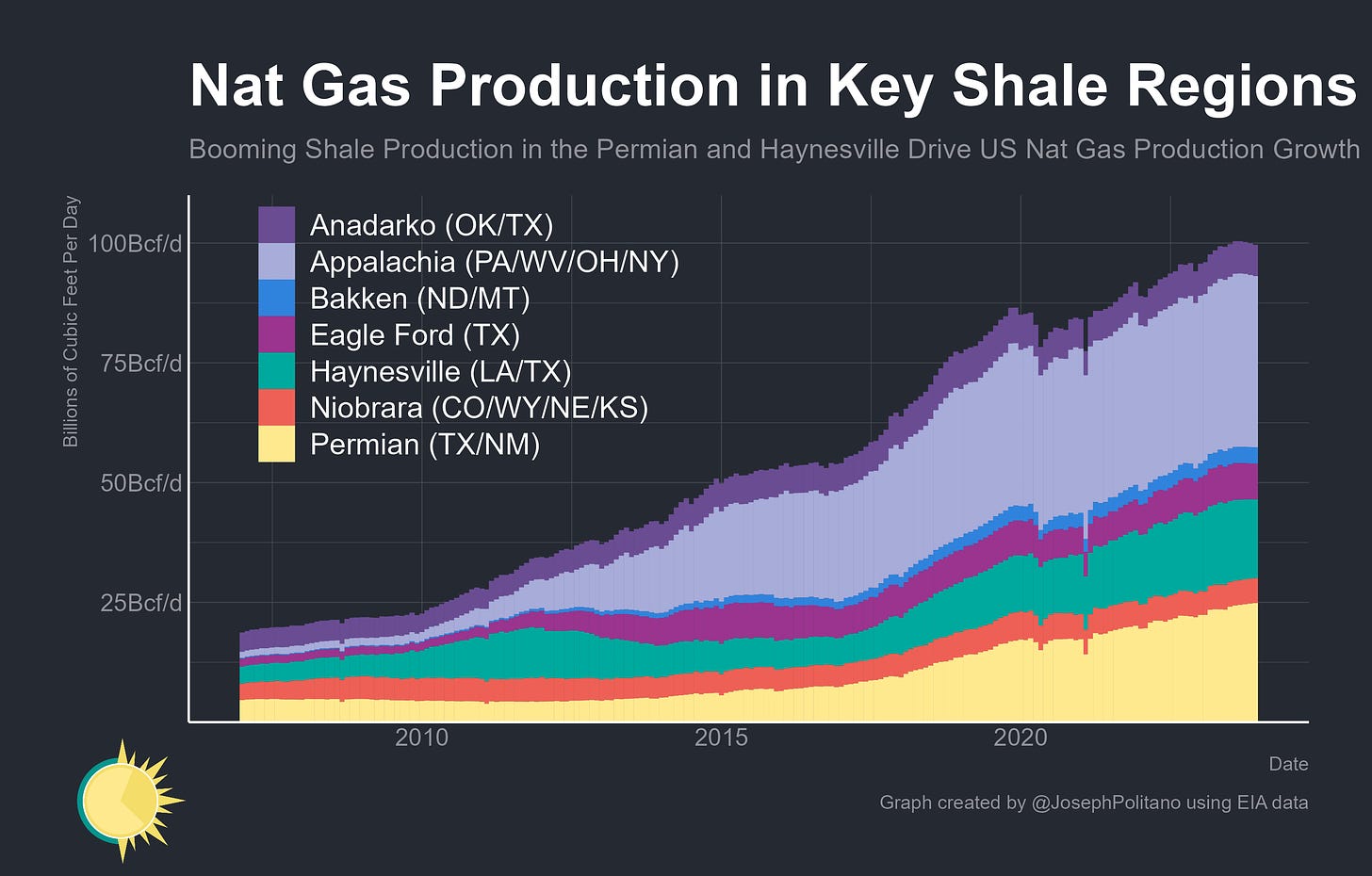

The fracking boom has also dramatically increased US natural gas production. Output in key shale regions is now approaching 100 billion cubic feet per day (Bcf/d) with the Appalachian region still representing the largest share of nationwide output. Recent growth, however, has been concentrated in the Haynesville region of Louisana/Texas and the Permian—in fact, associated natural gas production from oil wells, the vast majority of which comes from the Permian basin, now makes up roughly 14% of total US natural gas production.

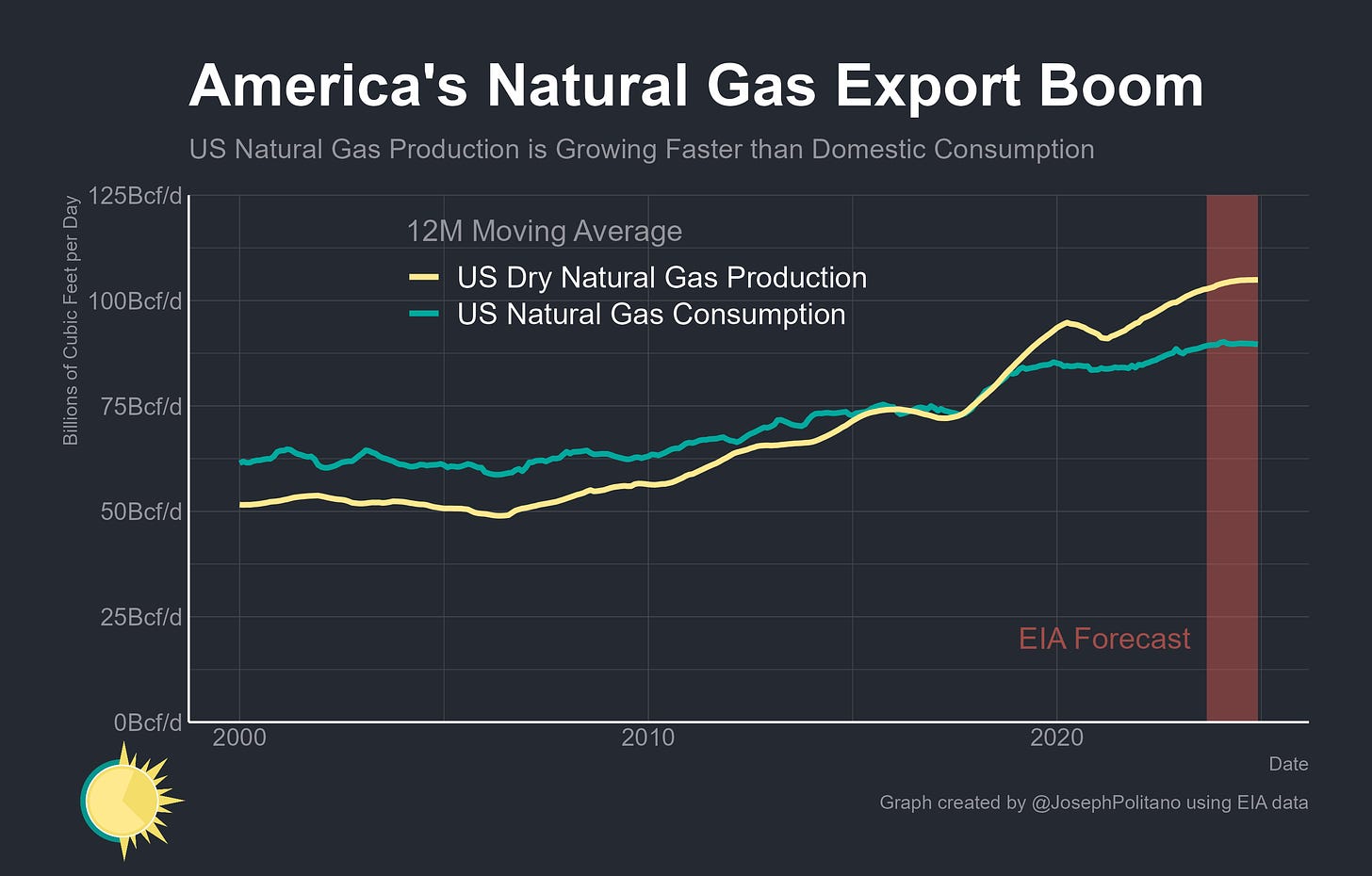

The fracking boom has meant growth in US natural gas production has steadily outpaced growth in consumption over the last 5 years. Most of the demand growth has come from a massive amount of switching from coal-to-gas production for electricity, but even that has its limits. While the US Energy Information Administration (EIA) sees annual US coal power production to shrinking 156TWh in total this year and for natural gas power to pick up 114TWh of the slack, expectations are for much more of future declines in coal generation to be made up with wind and solar power. That growing gap between rising US natural gas production and more steady domestic consumption means net exports continue rising.

Indeed, the last few years have seen the rapid increase in net pipeline exports to Mexico grow to offset the shrinking amount of net pipeline imports from Canada—however, the larger story is in market for Liquefied Natural Gas (LNG). More than 10% of total US dry natural gas production is now converted to LNG at specialized facilities and exported overseas, allowing the US to become the world’s largest exporter of LNG in the first half of 2023 by surpassing Australia and Qatar. Short-term EIA projections are for LNG exports to continue increasing steadily throughout the remainder of this year and into 2024.

Since 2022, the bulk of US LNG exports have gone to Europe in the wake of Russia’s invasion of Ukraine and Putin’s cutoff of key natural gas supplies. In Q3 of this year, American LNG made up 19% of total EU natural gas imports compared to 15% for all Russian sources, though overall LNG imports haven’t been able to make up for the loss of Russian supplies. Still, it has put significant downward pressure on natural gas prices both within the EU and on the broader LNG market.

These record US LNG export flows are expected to continue growing over the next several years—as of right now, the US has roughly 8.85 Bcf/d worth of LNG export capacity under construction and slated to come online by 2028, representing a 64% increase from current capabilities. Plus another 18.26 Bcf/d of export capacity, 130% of current levels, is currently undergoing various federal permitting processes, and massive amounts of new pipelines are being built to supply the new LNG export capacity. Yet it’s not the only booming set of US energy exports.

Keep reading with a 7-day free trial

Subscribe to Apricitas Economics to keep reading this post and get 7 days of free access to the full post archives.