California is Losing Tech Jobs

The Golden State Used to Dominate Tech Employment—But Its Share of Total US Tech Jobs has Now Fallen to the Lowest Level in a Decade

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 42,000 people who read Apricitas weekly!

The tech industry is America’s most cutting-edge sector, among its fastest-growing industries, and a massive contributor to global innovation. During the pandemic, the sector boomed as digital networking and communication became an even more essential part of how humans across the world interacted—leading to a frenzy of growth and hiring activity. However, the industry has been dogged by significant obstacles since then. With monetary policy tightening, the surge in online activity caused by the pandemic fading, macroeconomic uncertainty rising, and key tech financial institutions failing, late-2022 saw the beginning of the so-called “tech-cession,” exemplified by layoffs at high-profile companies like Amazon, Google, and Meta.

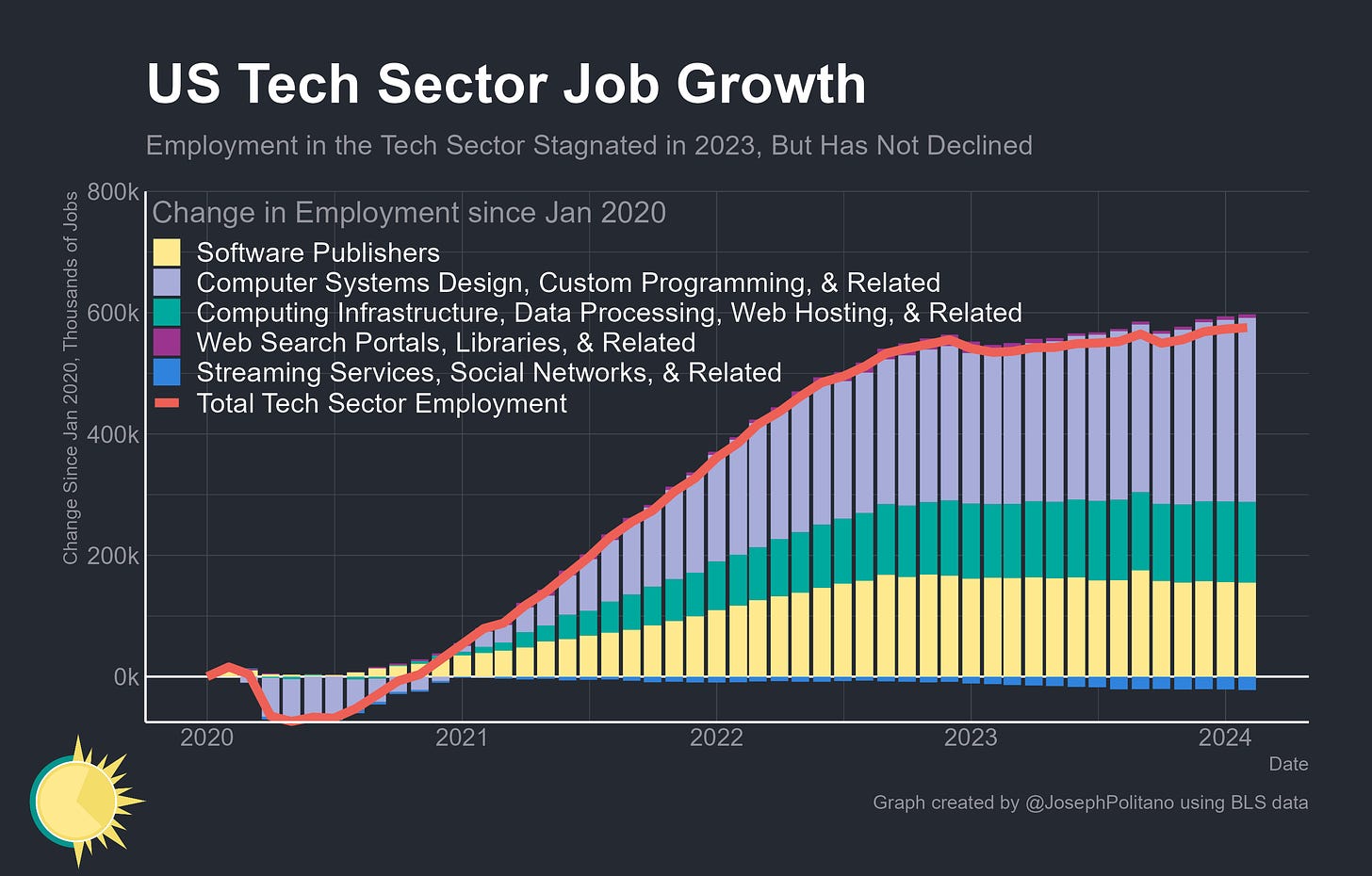

Yet the US has not actually seen tech employment drop during the tech-cession—rather, net job growth in the sector has slowed to a complete crawl throughout 2023 after two years of extremely rapid gains. US tech employers added 308k total jobs in 2021, 180k in 2022, and a mere 32k last year. Although some subsectors saw outright payroll declines, much of the industry’s slowdown was born by workers as reduced hiring and compensation rather than drops in employment.

Nevertheless, many of the tech industry’s traditional hubs have indeed suffered significantly since the onset of the tech-cession—and nowhere more so than California. As the home of Silicon Valley, the state represented roughly 30% of total US tech sector output and got roughly 10% of its statewide GDP from the tech industry in 2021. However, the Golden State has been bleeding tech jobs over the last year and a half—since August 2022, California has lost 21k jobs in computer systems design & related, 15k in streaming & social networks, 11k in software publishing, and 7k in web search & related—while gaining less than 1k in computing infrastructure & data processing. Since the beginning of COVID, California has added a sum total of only 6k jobs in the tech industry—compared to roughly 570k across the rest of the United States.

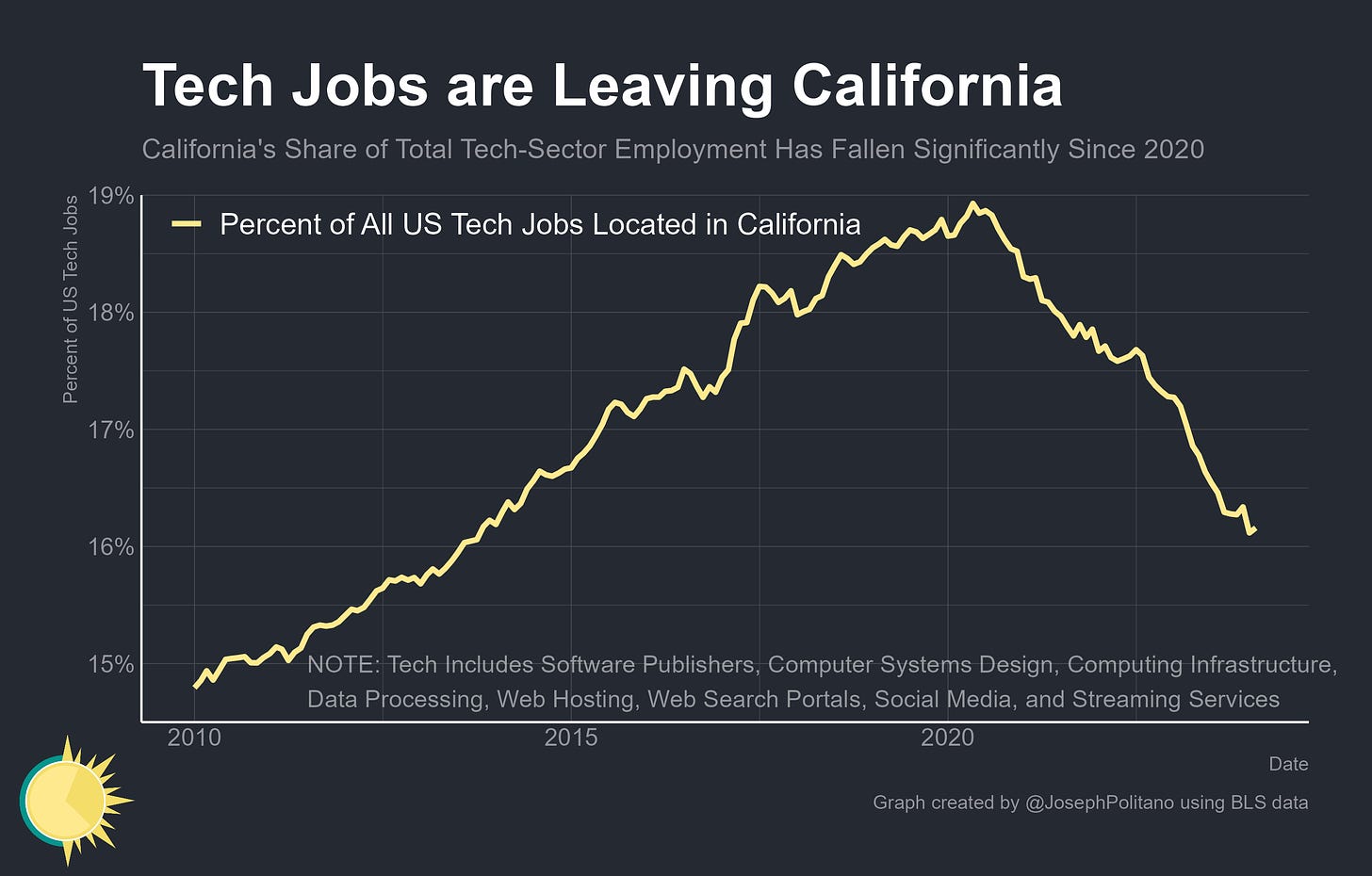

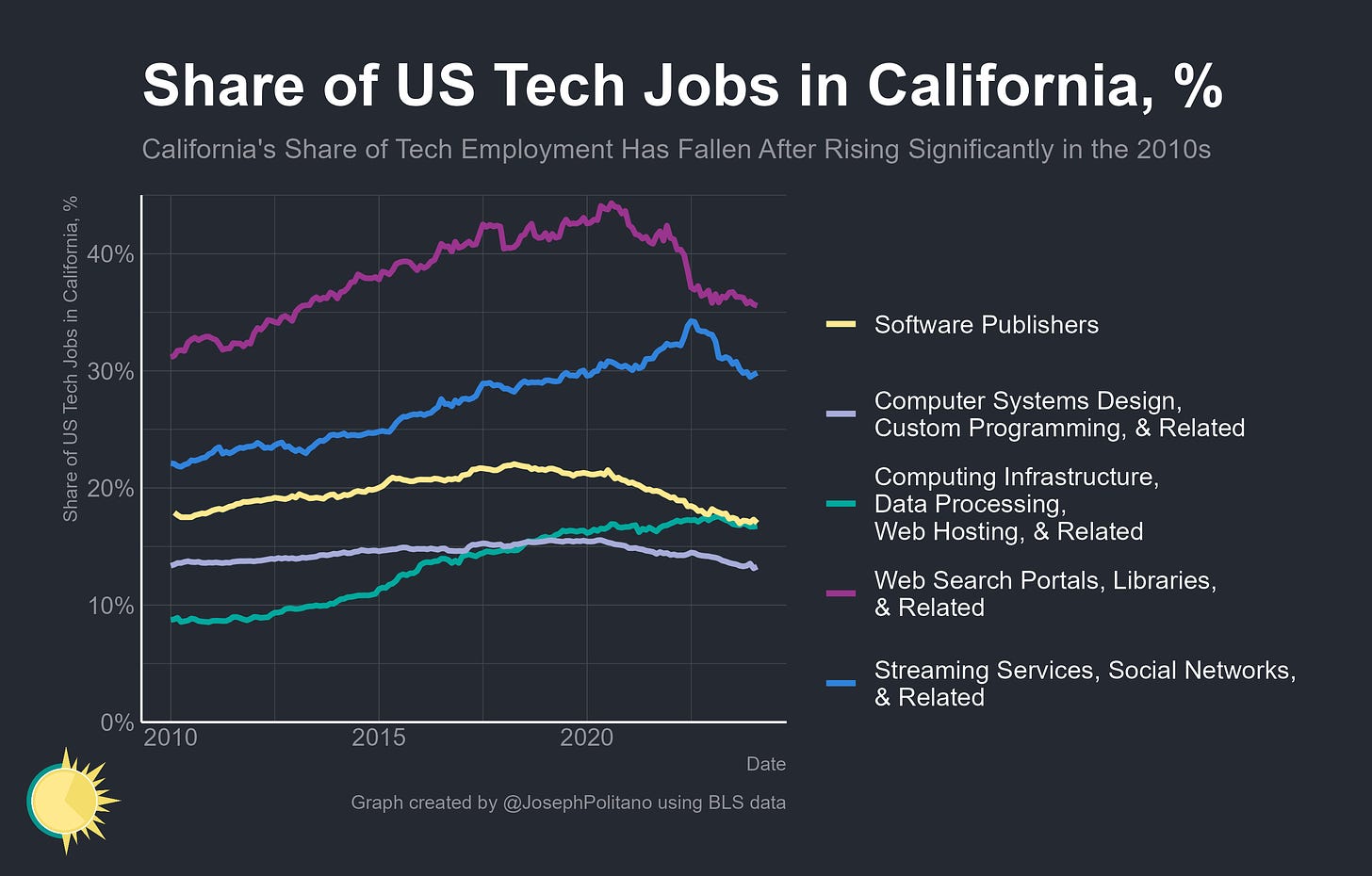

As a result, the share of US tech jobs located in California has fallen significantly since 2020, dropping a full percentage point over the last year and hitting the lowest levels in more than a decade. California had gone from having less than 15% of all US tech industry jobs in 2010 to nearly 19% in late 2019, but the pandemic and ensuing remote work shock immediately reversed that trend. In early COVID California losing ground as a share of the total US tech sector wasn’t an extreme problem though—the whole industry was expanding so rapidly that the state was still adding tech jobs at a robust rate. In 2021 San Francisco and San Jose saw their real GDP jump by 11% and 13.5%, respectively, even as they were becoming a smaller share of overall tech employment.

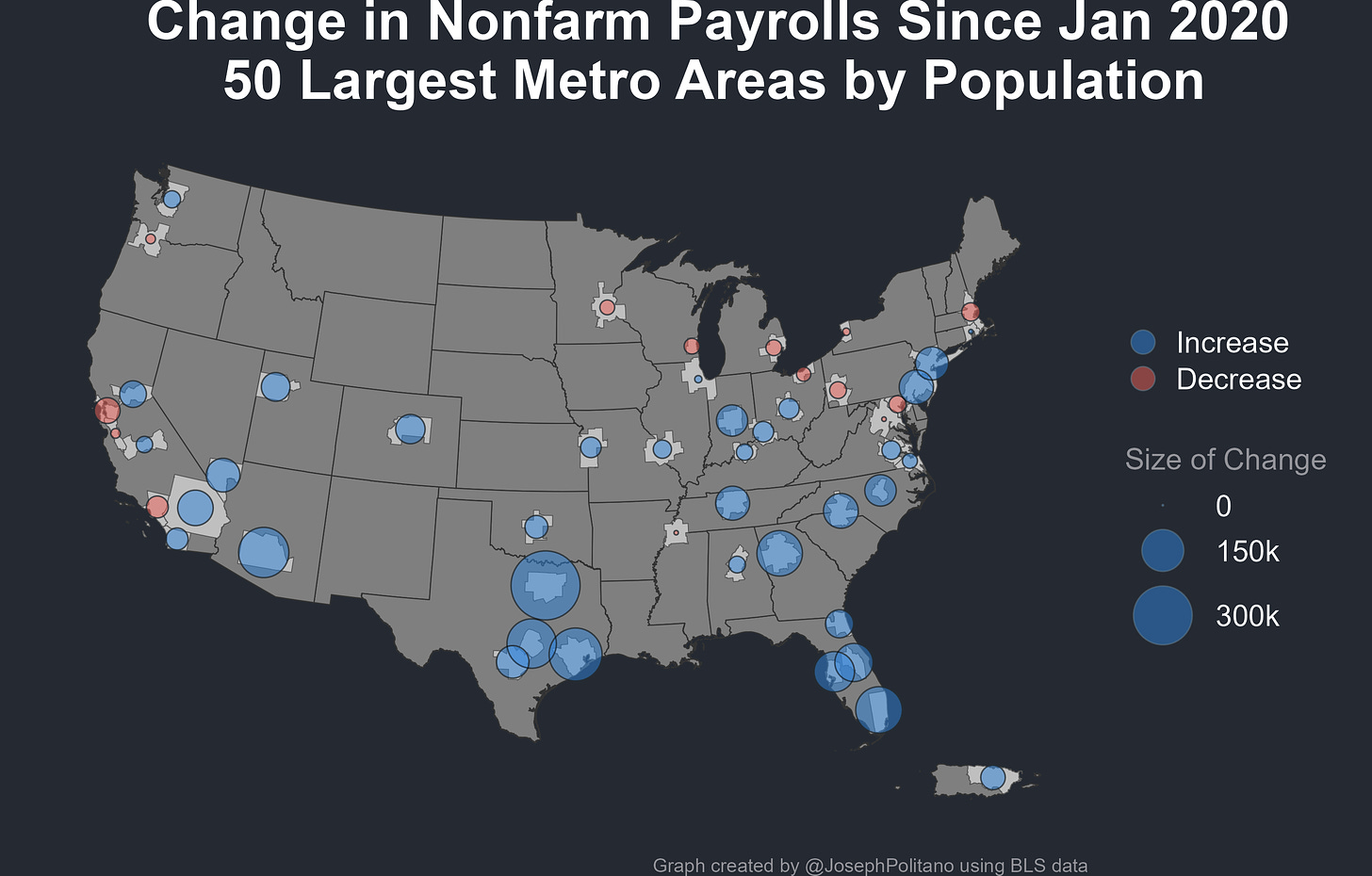

Yet throughout 2022, California went from holding a smaller slice of a growing pie to seeing outright declines in its tech sector, and as a result, many of the states’ tech hubs have still not seen their job markets fully recover from the pandemic. The San Francisco metro area has lost 54k jobs since 2020, the largest drop of any major American city, Los Angeles has lost the second-most jobs at 38k, and San Jose is still down 6k. In fact, the San Francisco and San Jose metro areas continued losing jobs over the last year, joining a small club of major cities with shrinking workforces alongside Portland, Memphis, Milwaukee, and Detroit. Vacant office buildings in downtown SF, once a rarity, are now increasingly common. For California, the loss of tech jobs represents a major drag on the state’s economy, a driver of acute budgetary problems, and an upending of housing market dynamics—but most importantly, it represents a squandering of many of the opportunities the industry afforded the state throughout the 2010s.

California and the Tech-cession

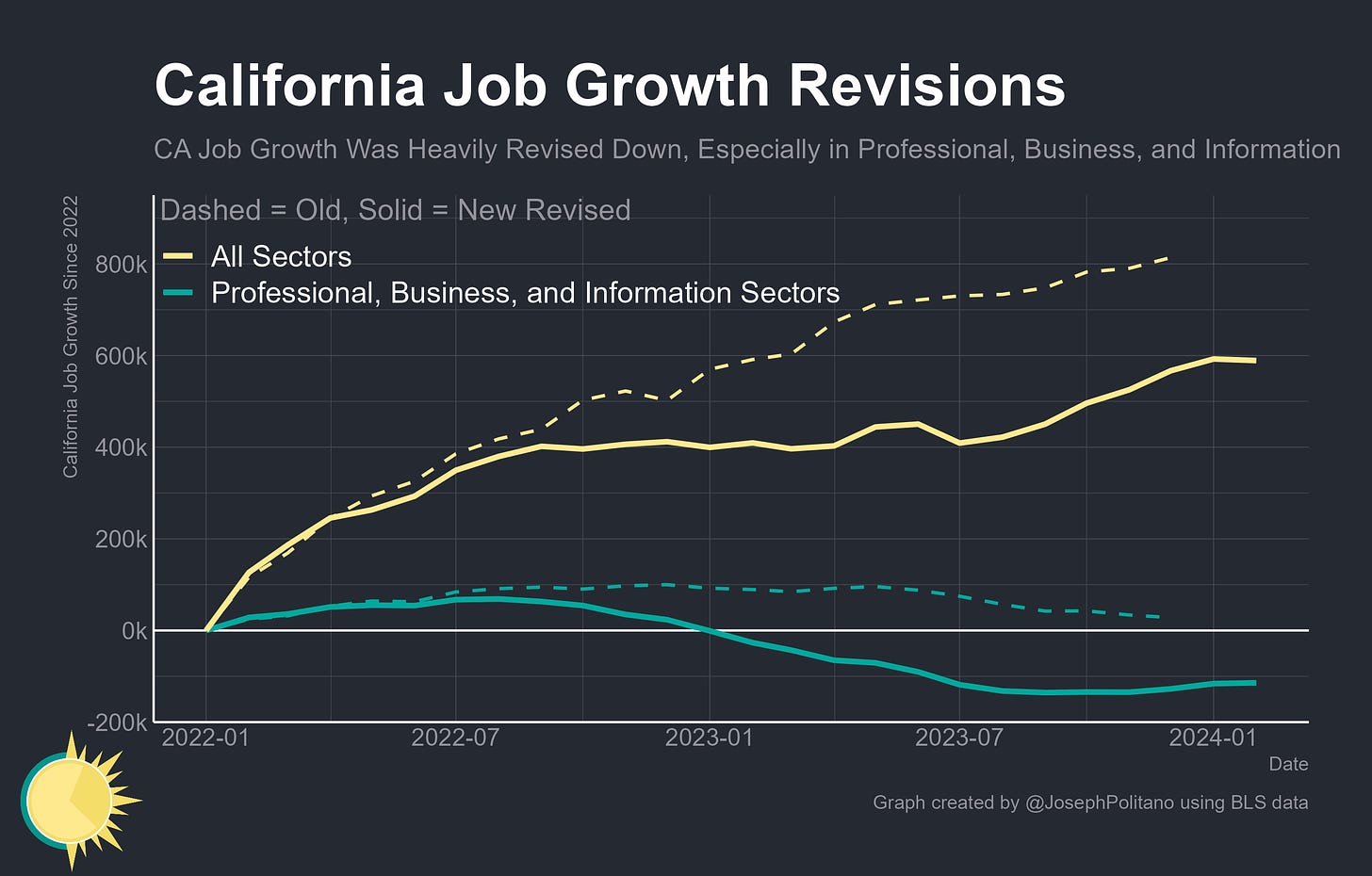

The extent of the job losses in California’s tech sector wasn’t fully apparent until the recent release of new official data on state-level job growth. Every year, the Bureau of Labor Statistics revises its regional jobs data using more comprehensive information sources as part of its regular data benchmarking processes—yet this year’s revisions to state-level payroll data were especially pronounced in California. Old numbers saw the state add 814k jobs from the start of 2022 to the end of 2023, but revised numbers reduced that figure by 247k. That was the single-largest gross downward revision of any state, and the third-largest downward revision as a percent of total payrolls (behind only Massachusetts and DC).

The downward revisions to California job growth were also even more pronounced in tech-related industries. Most tech jobs—like software publishing, web hosting, computing infrastructure, data processing, streaming, and social media—fall under the greater umbrella of the “information” sector, while a couple other subsectors—like computer systems design and custom computer programming—fall under professional & business services. In those information and professional/business services sectors that encompass tech-related employment, California job growth was originally estimated at 28k but revised downward by 156k. Payrolls were revised down by 11.6% in computing infrastructure & data processing, 9.5% in web search portals & related, and 5.1% in computer systems design & related.

Those revisions solidified the fact that California was losing ground as a share of US employment across wide swathes of the tech industry. At best, the state remains at roughly its pre-pandemic share of nationwide employment in some subsectors like computing infrastructure, streaming services, and social networks. However, California’s share of jobs in other subsectors like software publishing and computer system design has fallen to some of the lowest levels on record—and in web search, it has fallen to the lowest level in more than a decade.

The drop in California tech employment over the last year has been especially pronounced within Silicon Valley—the San Francisco metro area has lost 16,100 jobs in the information sector over the last year, while the San Jose metro area has lost 7,700. In percentage terms, those are the largest drops in information employment that the Bay Area has experienced since the dot-com bust and the 2001 recession. Outside of the information sector, both the San Francisco and San Jose metro areas added a small number of jobs over the last year, but the loss of tech jobs was enough to more than completely offset job growth across other parts of the economy.

That still leaves an obvious question: where are California tech jobs going? Right now, that’s hard to answer with a high degree of precision—full 2023 detailed state-level jobs data has yet to be released, and many tech subsectors’ data was broken by a change in industry classifications in 2022. However, we can get a general idea by looking at the overall information sector and then excluding sub-industries like movies and telecoms. By this metric, Texas added 25k info tech jobs from the start of the pandemic to Q3 2023 while Washington state added 22k and Florida added 20k. Meanwhile, California added only 16k and New York added only 14k. In percentage terms, that means Florida’s info tech payrolls grew 27%, Texas’ grew 24%, Washington’s grew 18%, New York’s grew 8%, and California’s grew a meager 5%. Other states with notable info tech job growth include New Jersey (+11k, +28%), Tennesse (+10k, +43%), North Carolina (+9k, +19%), Georgia (+8k, +14%), and Pennsylvania (+8k, +15%).

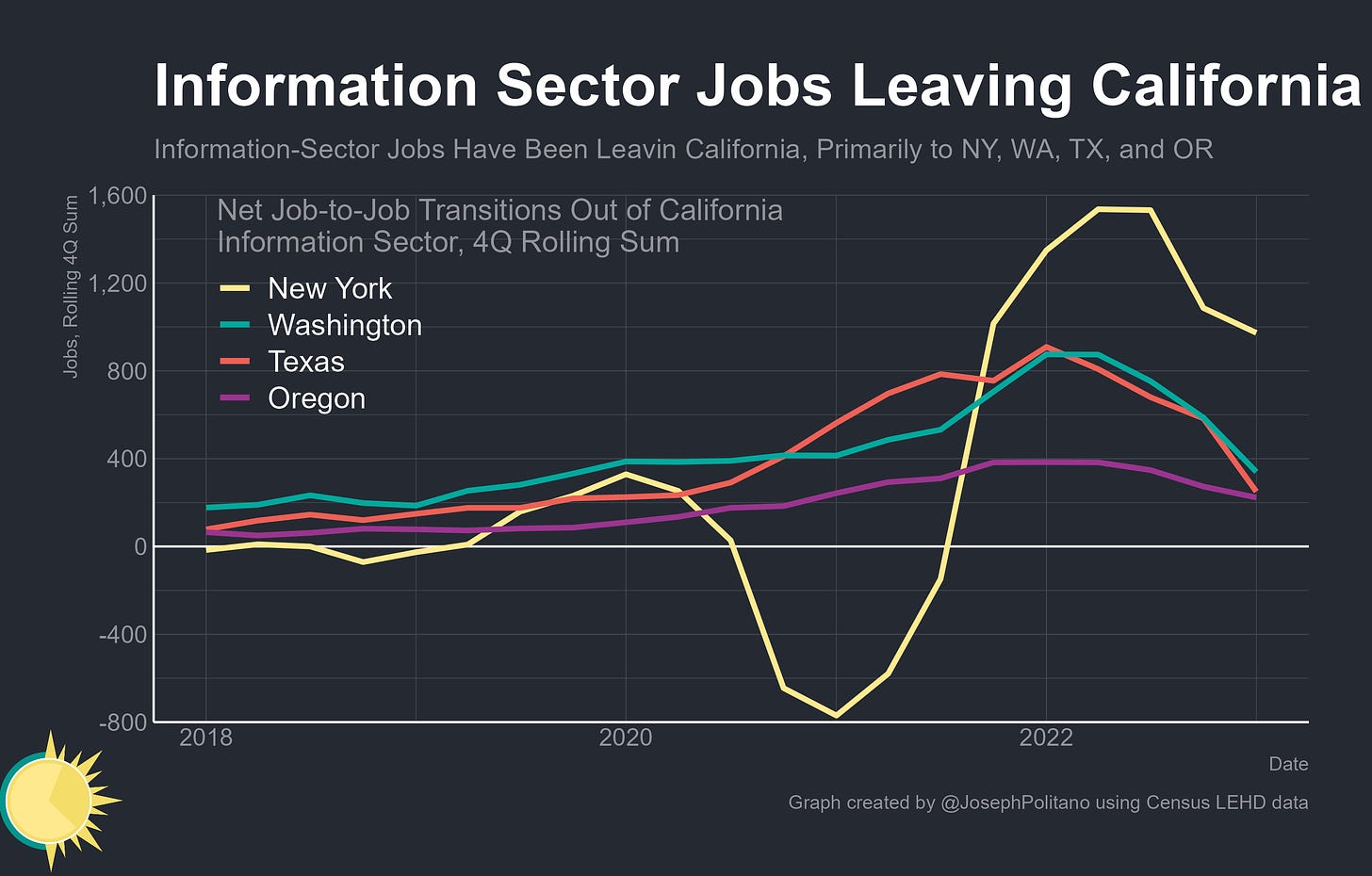

Using longitudinal Census data on net interstate job-to-job transitions in the information sector, we can also get an idea of where California tech workers specifically are moving, rather than just which states are adding the most tech jobs. Since the start of the pandemic, Texas has been the single-largest destination for net outmigration of California information-sector workers, followed by Washington, New York, and then Oregon—with Nevada, Tennesse, Colorado, Arizona, and Florida also meriting honorable mention. The raw amount of outmigration peaked in mid-2022 and has decelerated since the start of the tech-cession—yet this reflects the large nationwide decrease in tech hiring and job churn rather than California stabilizing its employment share in the industry.

What it Means for the Golden State

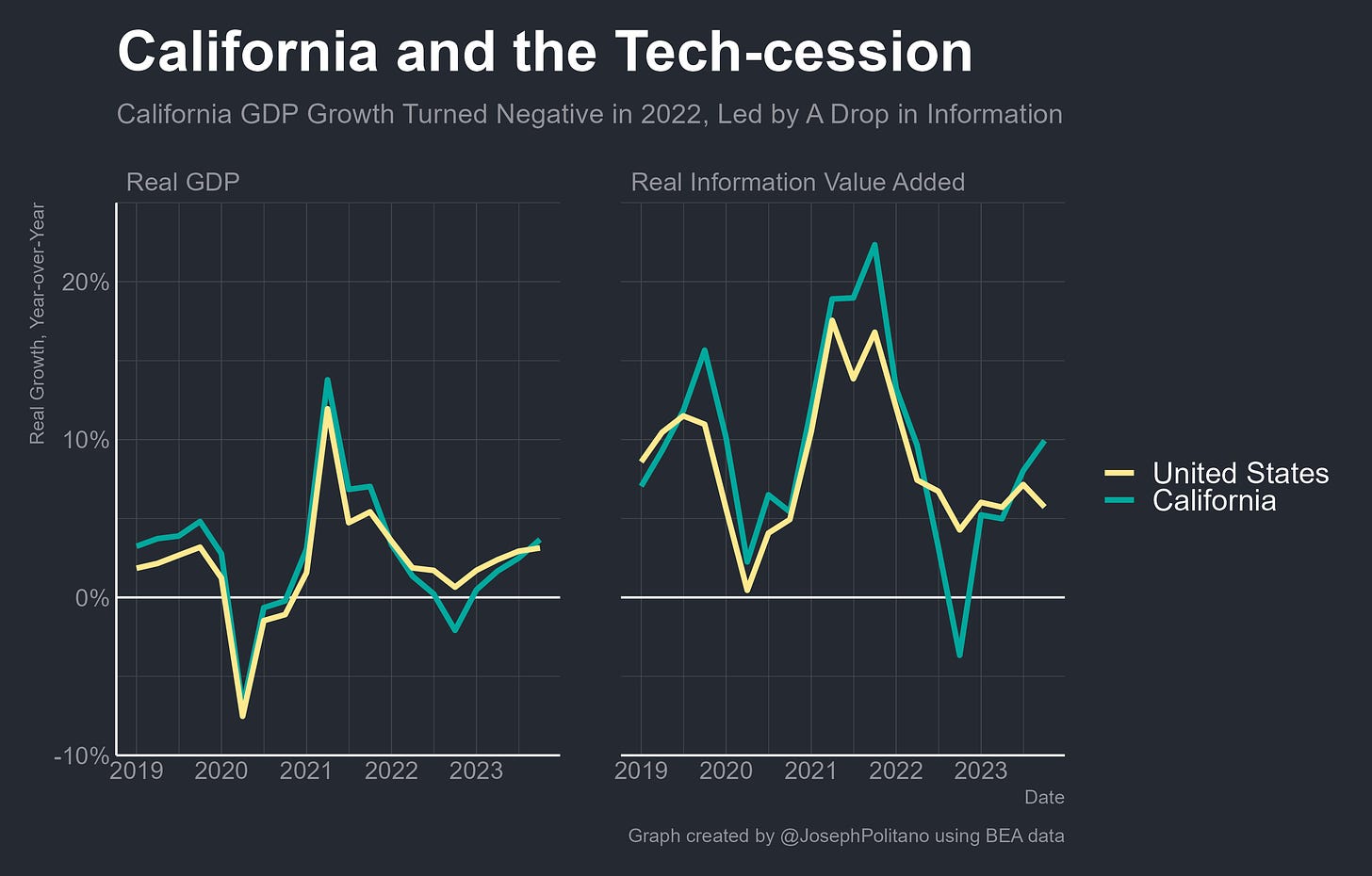

What has the loss of so many tech jobs meant for California? First, there was a broad economic slowdown—the state’s GDP fell 2.1% through 2022, the second-biggest drop of any state over that period, driven by a massive deceleration across the information sector. That allowed states like Texas to overtake California in the post-pandemic GDP recovery, creating a gap that California still hasn’t been able to close despite its economic rebound in 2023.

Shifts in tech jobs out of the Bay Area and California broadly have also significantly impacted the state’s housing market. Rent price growth in San Francisco (and Los Angeles) tended to be much higher than the national average throughout the latter half of the 2010s, but has come in well below the national average since the start of the pandemic as remote work enabled many to move for cheaper housing elsewhere in the US. SF-area rent prices have also cooled significantly over the last year as the region lost tech jobs, increasing by more than three percentage points less than the national average. These shifts have affected home prices, too—by Zillow’s estimate, home values within the city of San Francisco proper are at their lowest levels since 2017, down more than 17% from their mid-2022 peaks, while California statewide home price growth has trailed the national average since mid-2022, falling 0.5% while nationwide prices grew 2.5%.

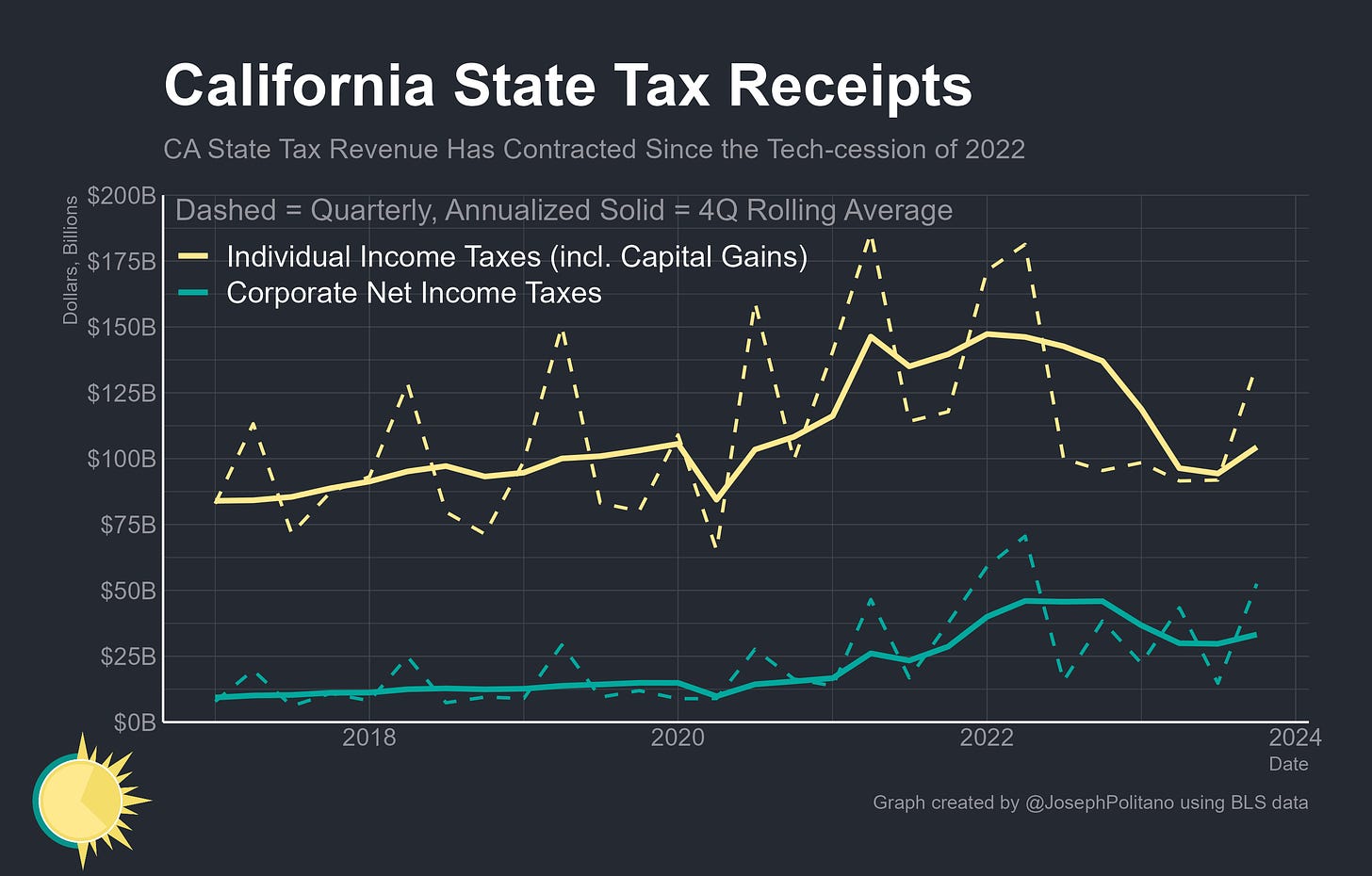

Perhaps most importantly, California losing tech jobs also significantly hurts the state’s public finances, which have grown heavily dependent on Silicon Valley. Witholdings on regular equity compensation at major publicly traded tech companies were responsible for 7% of the state’s total income tax revenues in 2021, and that’s before discussing the volatile initial public offerings that can each put billions into the state’s coffers. California’s calendar-year income tax revenues dropped $34B between 2022 and 2023 as the tech-cession has raged, with corporate net income tax revenues also falling $13B. Facing significant consecutive annual budget deficits this year, California has had to tap into its financial reserves while cutting or delaying various state spending projects on infrastructure, education, healthcare, and climate. In the short term, the state can hope for a further rebound in tech and a reopening of the IPO window, but to the extent the US tech industry is now structurally less concentrated in California it will mean less future potential revenue—forcing the state to raise tax rates or pare back spending on investment, social services, and more.

Conclusions

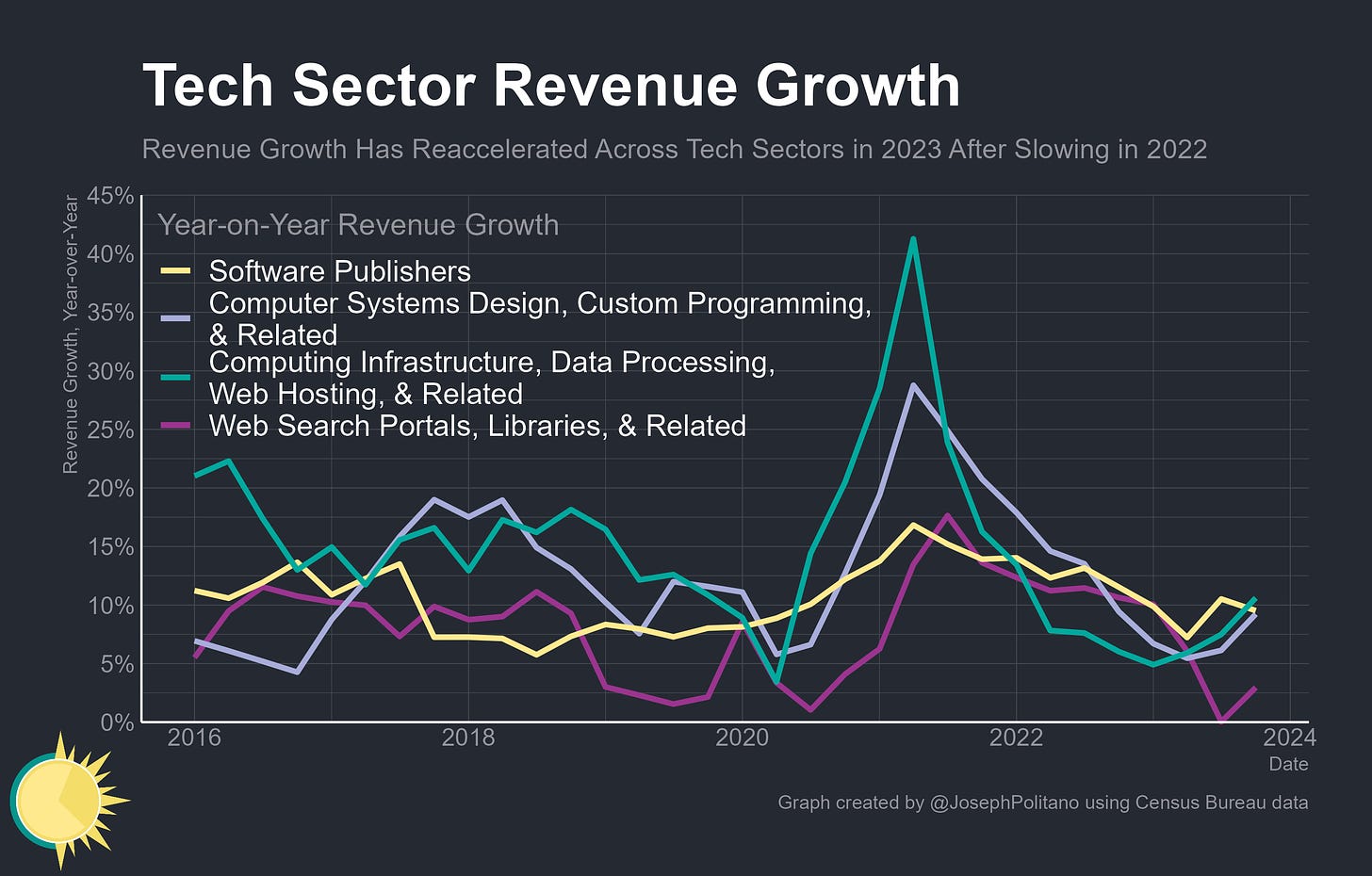

However, California may indeed have some short-term tech rebound to look forward to, as much of the US tech sector has now moved past the slowdown of 2022. Revenue growth among computing infrastructure providers & data processors, software publishers, computer systems designers, and web search portals have all recovered from their post-pandemic lows.

Physical investment within the tech industry is also skyrocketing to keep up with increasing demands for computing power, especially those of the booming artificial intelligence industry. The net property, plant, and equipment held by US information technology firms has shot up by more than $70B over the last year, a dramatic acceleration that was by far the largest increase on record. All of that has put some more life into Cali’s tech industry—in a highly symbolic victory, OpenAI recently signed the largest post-pandemic downtown San Francisco office lease, surpassing the size of a lease signed just months earlier by competing AI firm Anthropic. California income tax withholdings posted strong gains in February and March and are now running slightly ahead of expectations despite trailing budget projections at the very start of the year, propelled forward by strong stock performance at companies like NVIDIA, Meta, and more.

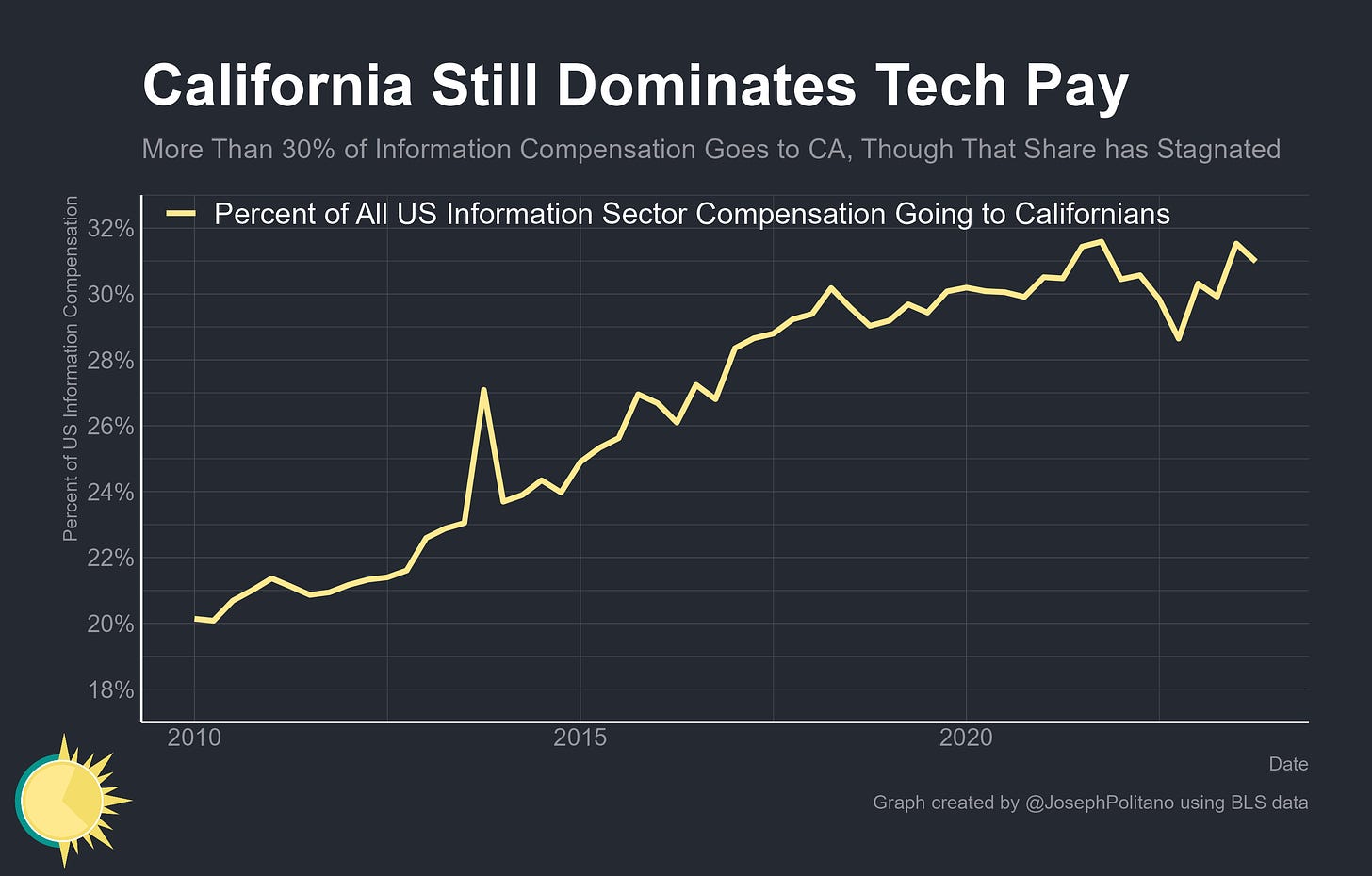

Indeed, despite losing significant amounts of tech jobs to other states, California still retains a massive advantage at the high end of the industry—while making up only 18% of nationwide employment in the information sector, Californians receive a whopping 31% of the industry’s total compensation. In 2022, the average Californian in the software publishing industry took home $247k including stock options and bonuses, while the average non-Californian earned only $176k. Those dynamics are a central part of how cumulative GDP growth in California has been 9.9% since the start of COVID, ahead of the nationwide average of 8.9%, despite job growth in the Golden State being 1.8% against a US average of 3.8% over the same period.

California’s long-standing problem is not that its economy is failing or lacks dynamism—rather, it’s that the state refuses to accommodate everyone in its economic success. Opportunity hoarding, particularly via exclusionary restrictions on housing construction designed to protect the value of homeowner’s properties, places harsh limits on how many jobs California can add regardless of how much the state’s economy grows. The pandemic remote work boom was the first time when the kind of well-educated high-income workers who compose the backbone of the tech industry left California in large numbers, but rising housing costs were already driving low and middle-income residents out of California for decades beforehand.

Texas has built half a million more homes than California since the start of the pandemic, and metro Austin has built 100k more homes than the entire Bay Area despite being a fraction of the size. Should it be any wonder, then, why California is losing tech jobs to Texas?

Attempts at opportunity hoarding have now led to opportunity loss—San Francisco will never be able to go back and allow the housing units that were so ravenously in demand when the city’s downtown and its tech industry were at the zenith of its power, making it just that much harder for the still-extremely-expensive-city to compete for startups and tech talent going forward. For California, policy failures have significantly weakened the state’s grip on the world’s most valuable industry cluster—perhaps permanently.

Nice overview of the trends. Personally, I think this is the beginning of a major shift in the geographical location of digital technology jobs.

I don’t think the booming investment will do much for California directly. I’m quite certain that’s mainly data centers and while Silicon Valley is a key market, most of the development is outside of California. I’m sure there are knock on effects — obviously people have to design the software and services that run on the data center server, but that’s second order.