Car Inflation is Back—Don't Panic!

Volatile Used Vehicle Prices are Rising Again—But this is Likely Temporary as the Chip Shortage is Alleviating and Underlying Supply Conditions are Improving

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 28,000 people who read Apricitas weekly!

In the two years following the initial onset of the pandemic, American used car prices rocketed up more than 50%—an increase larger than what was seen cumulatively over the prior three-and-a-half decades. The global semiconductor shortage and its massive supply shock to car manufacturing crushed the supply of new vehicles, leading to a collapse in the downstream inventory and availability of used cars. Price hikes following the supply shock had a significant impact on inflation, with vehicle prices being a major driver of aggregate movements in the consumer price index across 2021 and 2022.

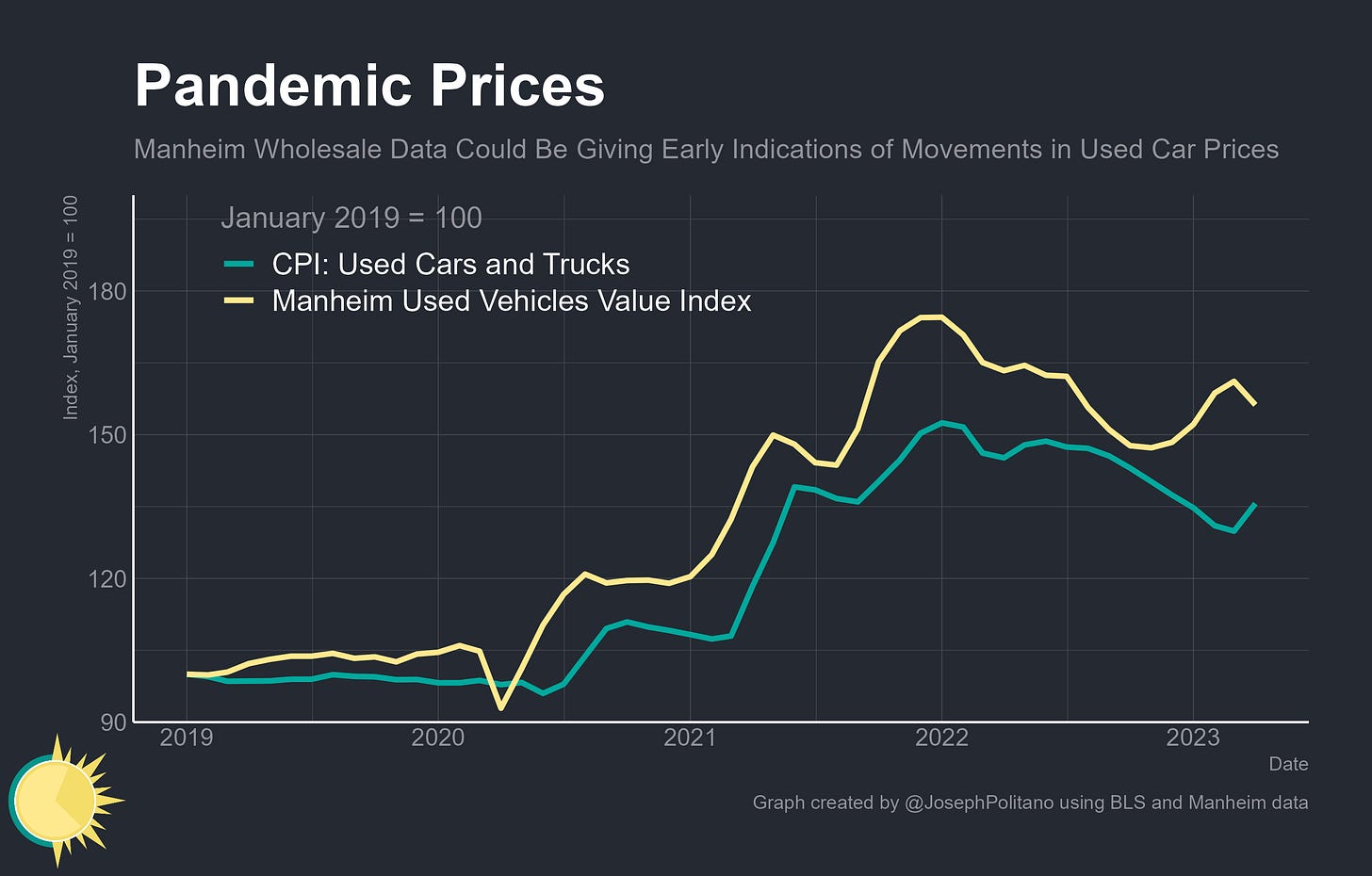

Yet it was well-known that used car prices were reflective of short-term rather than long-term market dynamics, and that they would fall as the semiconductor shortages eased, global car manufacturing rebounded, and overall supply improved. Throughout the latter half of 2022 and the early part of 2023 that is precisely what we saw—chip availability increased, car production partially recovered, and official used vehicle prices fell 15% from their early 2022 peaks, helping to tamp down inflationary pressures. However, that ended this month when prices for used cars and trucks popped up 4.4%—the first monthly increase in 10 months and the largest monthly increase since June 2021.

As I’ve flagged repeatedly over the last few months, the rebound in wholesale price indices suggested there would be a return of used car inflation—and this month’s increases in the CPI used vehicle indices show it is now officially back. These price increases are serious—coming from production slowdowns in late-2022 and a surge in demand in early-2023—and will likely weigh upward on inflation in the near future. Yet this is not a reason for panic—the rebound in used car prices has a lot to do with seasonal factors, price lags, and data quirks—and the bulk of the evidence is that stresses in global car supply chains continue to abate and that rate hikes from the Federal Reserve are increasingly constraining auto loan credit. Short-term bumps in used car prices will not stop the longer-term price declines as supply improves, but they will make the path of used car disinflation once again longer and rougher than previously expected.

Understanding Used Car Price Dynamics

Over the last several months, the Manheim used vehicle value index and other wholesale price indices have risen even as official used car prices fell, leading some to speculate that the direct link between the two had completely been broken. Dealerships were supposedly eating downward margin adjustments as the economy slowed (paying more for vehicles on the wholesale market and getting less back on the retail market) or the different structures and weights of the two indices were causing gaps to emerge. This month’s CPI report generally put those notions to bed—once again, official used car prices rebounded just a few months after the Manheim index did.

Indeed, the supposed broken link between wholesale and retail price movements came mostly down to the different seasonal adjustment factors used by the different data sets, as pointed out by inflation expert Omair Sharif. Looking at non-seasonally adjusted data, it’s clear official used vehicle price indices have moved closely in line with wholesale price indices with only a two-month lag. That likely means we have some pain ahead of us in upcoming inflation data—unadjusted wholesale prices increased 3.5% in March and another 0.1% in April. The next CPI print in particular could be brutal, as seasonal adjustment factors would expect a normal decrease of more than 1% in May compared to the 3.5% increase we saw in the March unadjusted wholesale data that will be passing through to CPI then. Since used cars and trucks compose almost 2.6% of the CPI spending basket, the total rebound from March lows could increase aggregate CPI levels by more than 0.2% alone (if official prices rise commensurate with recent moves in wholesale data).

What’s Driving The Rebound in Used Car Prices?

So why are prices rebounding? Unlike in the earlier episodes of used car inflation, sales levels are not declining amidst worsening shortages. Instead, we have seen a rebound in total car and truck sales over the last several months—with January and April being as close as we’ve gotten to normal pre-pandemic sales levels since the chip shortage began. Strong demand, especially during tax return season, has likely been the dominant contributor to the rebound in prices rather than further deteriorations in supply conditions.

However, that does not mean some declines in motor vehicle output haven’t contributed to the recent rebound in used car prices. Domestic motor vehicle production had been sliding for several months starting in October, reaching the lowest level in nine months just this March. It took four months between the low point of production and peak of used car prices in 2022, and it took five months between the peak of production in 2022 and the first increase in official used vehicle prices this year—it’s likely some of the jump in prices reflects more unanticipated scarcity in new car supplies. Thankfully, manufacturing output has recovered since then—April was the first month since 2020 in which the US assembled more motor vehicles than the 2019 average, though the jump in production was partially a seasonal adjustment quirk.

Indeed, the broader global picture is that the semiconductor shortage is easing and global car supply chains are improving. The most up-to-date and comprehensive data we have comes from European car manufacturers, and the share of them citing materials shortages for production slowdowns has fallen dramatically from the 80% levels recorded in 2022. US data, which comes out with a much longer lag, has moved in line with European data in the past, so we should expect to see similar improvements in the share of auto plants plagued by shortages. Preliminary data from the Manheim index saw a 0.9% unadjusted price decline in the first half of May, indicating the price rebound may already be behind us.

Supply conditions and output may still be highly volatile, but they are improving in a long-term sense—and that’s especially true in foreign markets like Europe and Japan that have been hit worse by the chip shortages. Dealership inventories remain historically low but are slowly rising, and combined with the rapid tightening of auto loan standards that should provide reassurance that recent price hikes do not represent the end of long-run used car disinflation.