Car Markets at the End of the Chip Shortage

The Years-Long Semiconductor Shortage That Hampered Global Car Production is Over. What Now?

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 36,000 people who read Apricitas weekly!

For nearly three straight years, America has been dealing with an acute shortage of semiconductors that has had catastrophic effects on motor vehicle production. Between March 2020 and today, the United States has produced roughly 4.75 million fewer vehicles than would be expected in the absence of the pandemic, contributing to a massive spike in costs for consumers—prices for used vehicles were up more than 55% at their peak, more than the cumulative increases seen in the preceding 35 years, and prices for new vehicles rose nearly 22%. Yet this quintessential example of inflationary COVID-era supply issues has now ended—just this month US manufacturers stopped citing a shortage of semiconductors for the first time since late 2020.

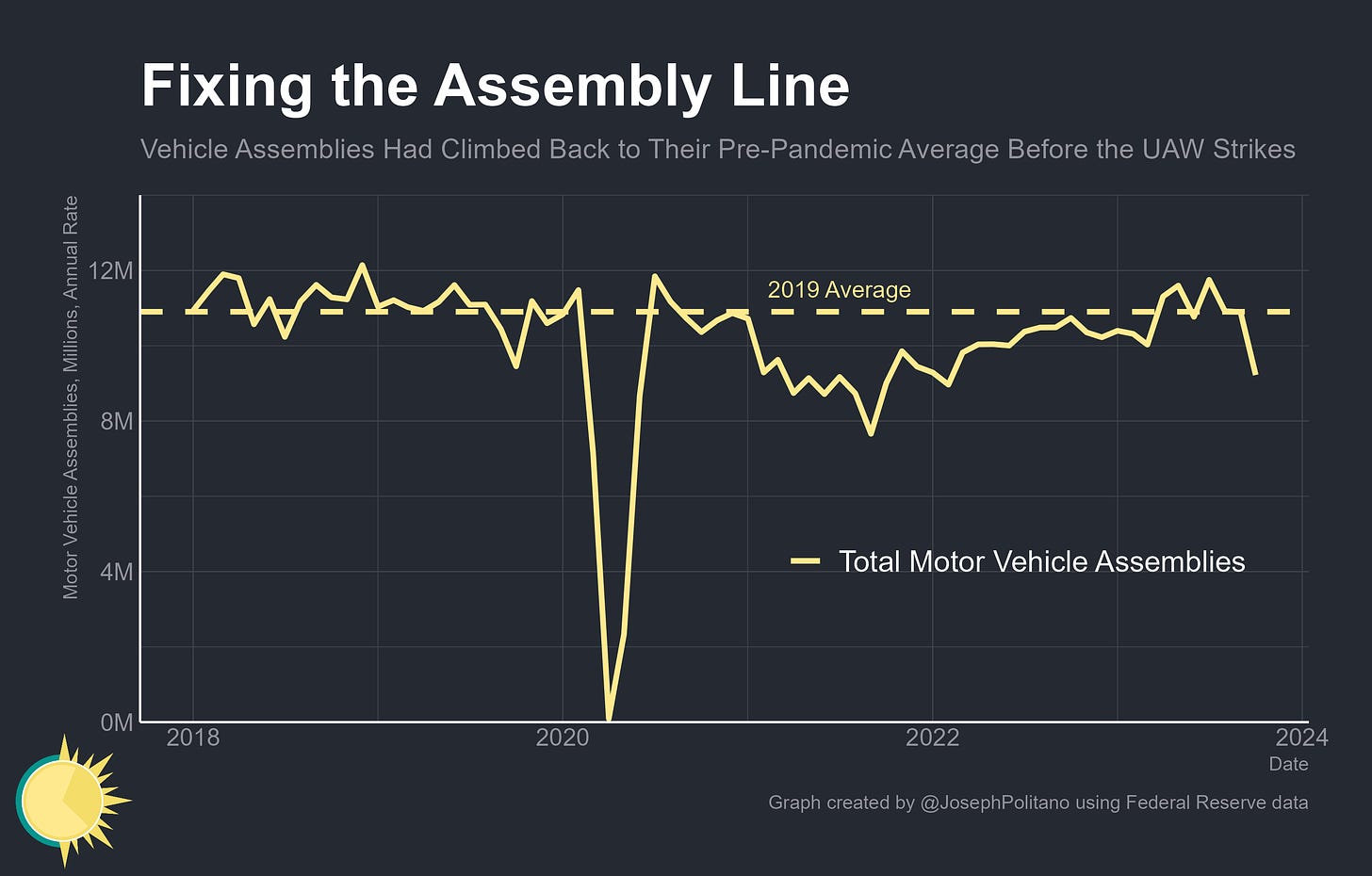

The resolution of the chip shortage and easing of other supply-side constraints had allowed domestic vehicle production to finally normalize around pre-COVID levels for most of this year, before a recent subsequent hit from the now-resolved strikes by United Auto Workers (UAW). In October, American carmakers produced roughly 25k fewer automobiles and 89k fewer light trucks (pickups, SUVs, minivans, etc) than in the same month last year due in large part to strike activity.

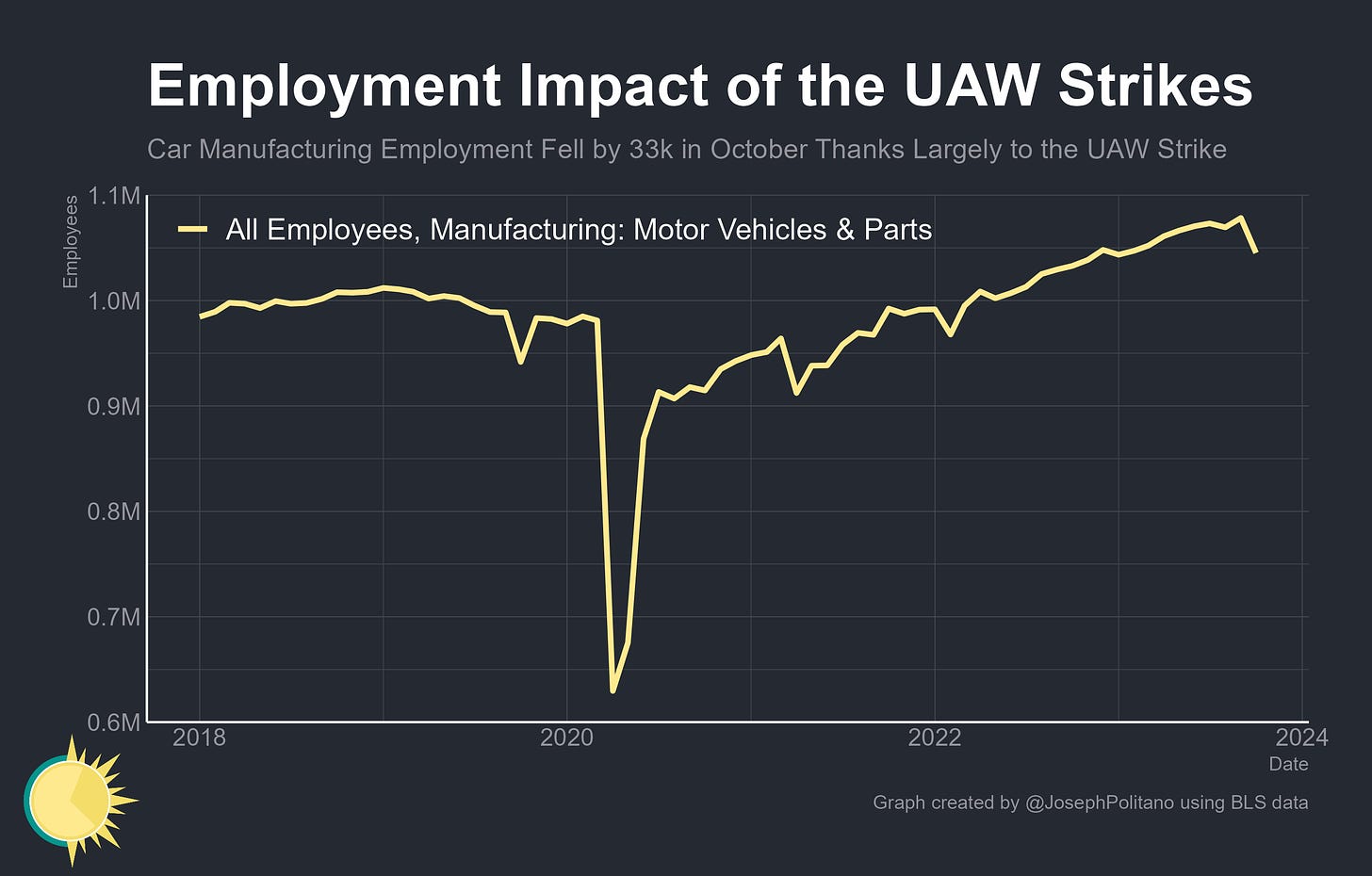

That strike saw tens of thousands of workers participating at different times throughout the month, leading to official payroll employment in motor vehicles and parts manufacturing declining by more than 33k, of which 25k were directly striking as of the data’s reference period. However, the swift resolution of the strike by the end of October should allow for a rebound in output over the next couple of months.

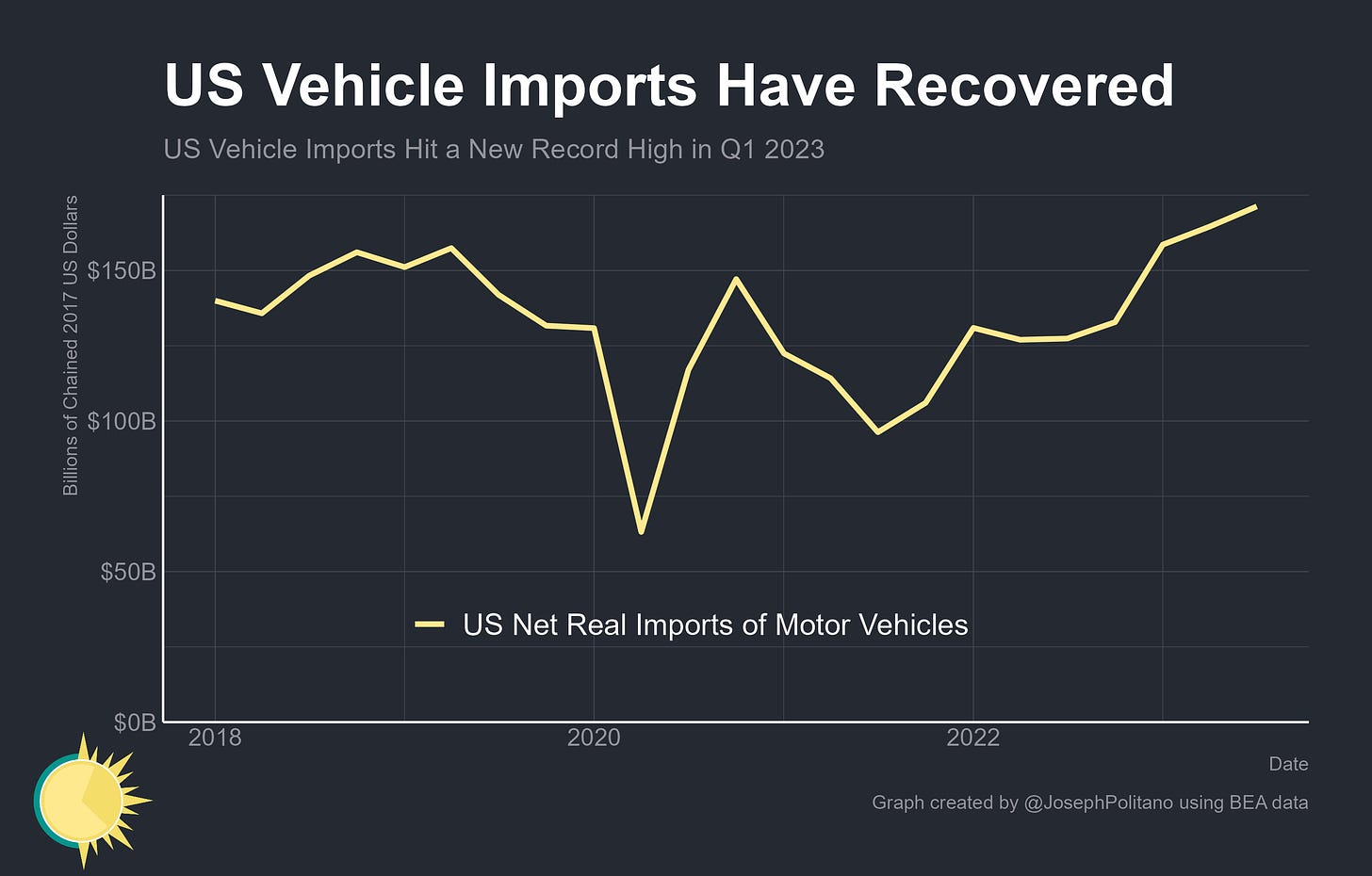

More broadly, it is not just US car production that has recovered from the chip shortage—most of America's major vehicle trade partners have now seen their output catch up with or exceed pre-COVID levels. Production in Mexico, Canada, South Korea, Japan, and (to a lesser extent) the EU has climbed to some of the highest levels since the start of 2021, in many cases reaching or exceeding pre-pandemic levels.

The improvement in global output has enabled Americans to more easily access foreign-made autos—US net real imports of motor vehicles have climbed to a new record high, growing by more than a third over the last year. These supply-side improvements, combined with weakening demand as a result of tighter financial conditions, are putting downward pressure on American vehicle prices.

Demand-Side Reductions

Keep reading with a 7-day free trial

Subscribe to Apricitas Economics to keep reading this post and get 7 days of free access to the full post archives.