Charting the Largest Tariff Hike in Modern History

Measuring the Size & Impact of Trump's Newly-Imposed Global Tariffs

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 60,000 people who read Apricitas!

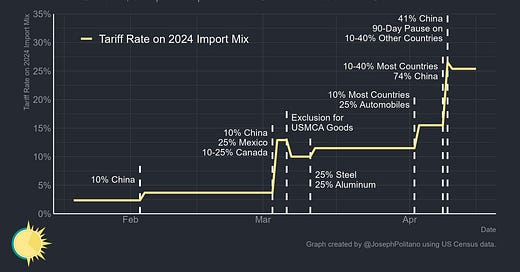

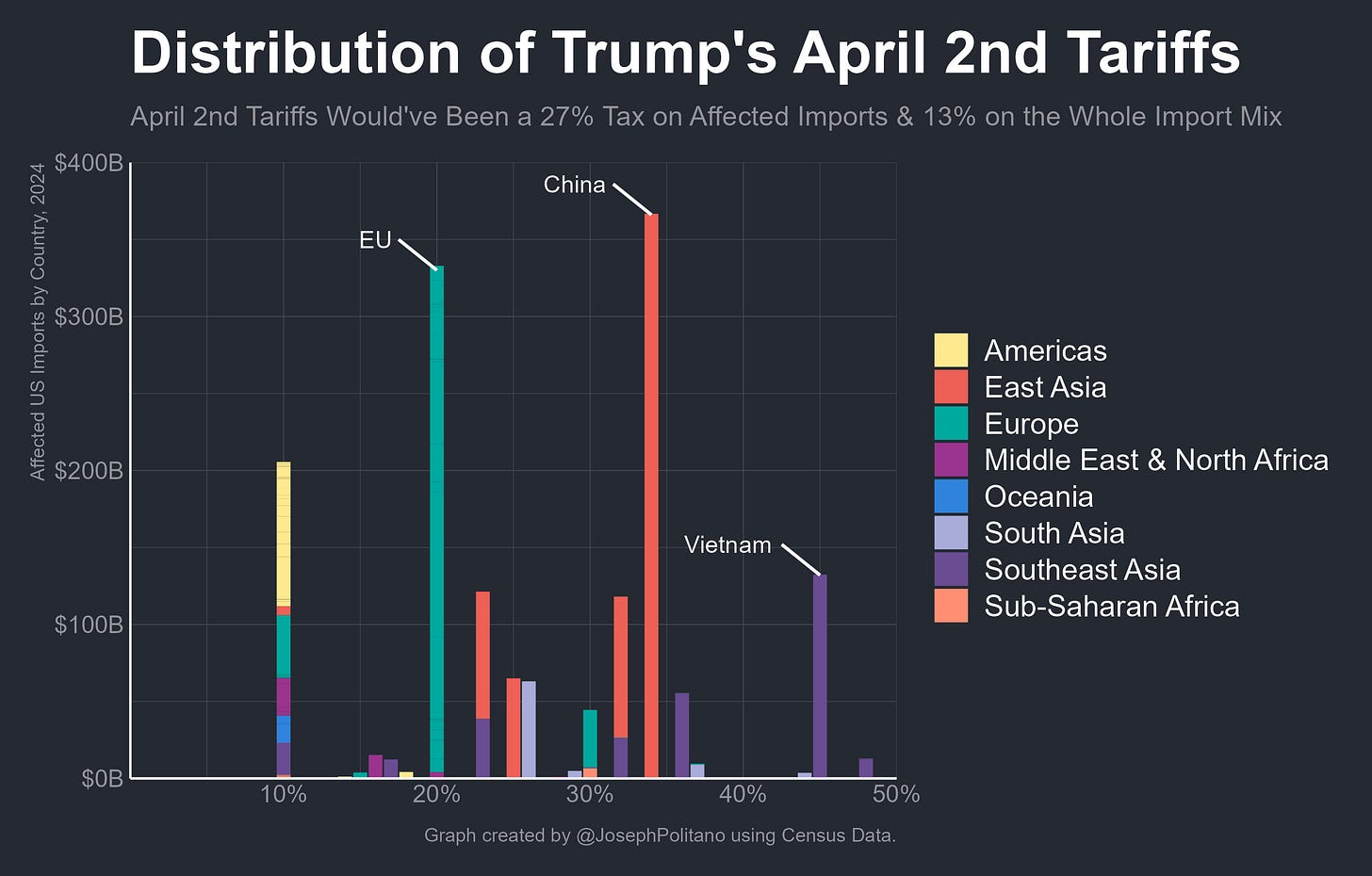

Last week, Donald Trump announced the largest tariff package in modern American history—a 10% universal baseline tariff on imports from every country except Canada & Mexico plus additional country-specific tariffs that go as high as 40%. The 10% tariffs went into effect last Saturday, making for the largest single-day tariff hike in modern US history and bringing effective tariff rates to the highest level in nearly a century. Those additional country-level tariffs came into force three days ago, completely shattering the record set just a few days before, but were immediately paused when financial markets puked in response to their implementation.

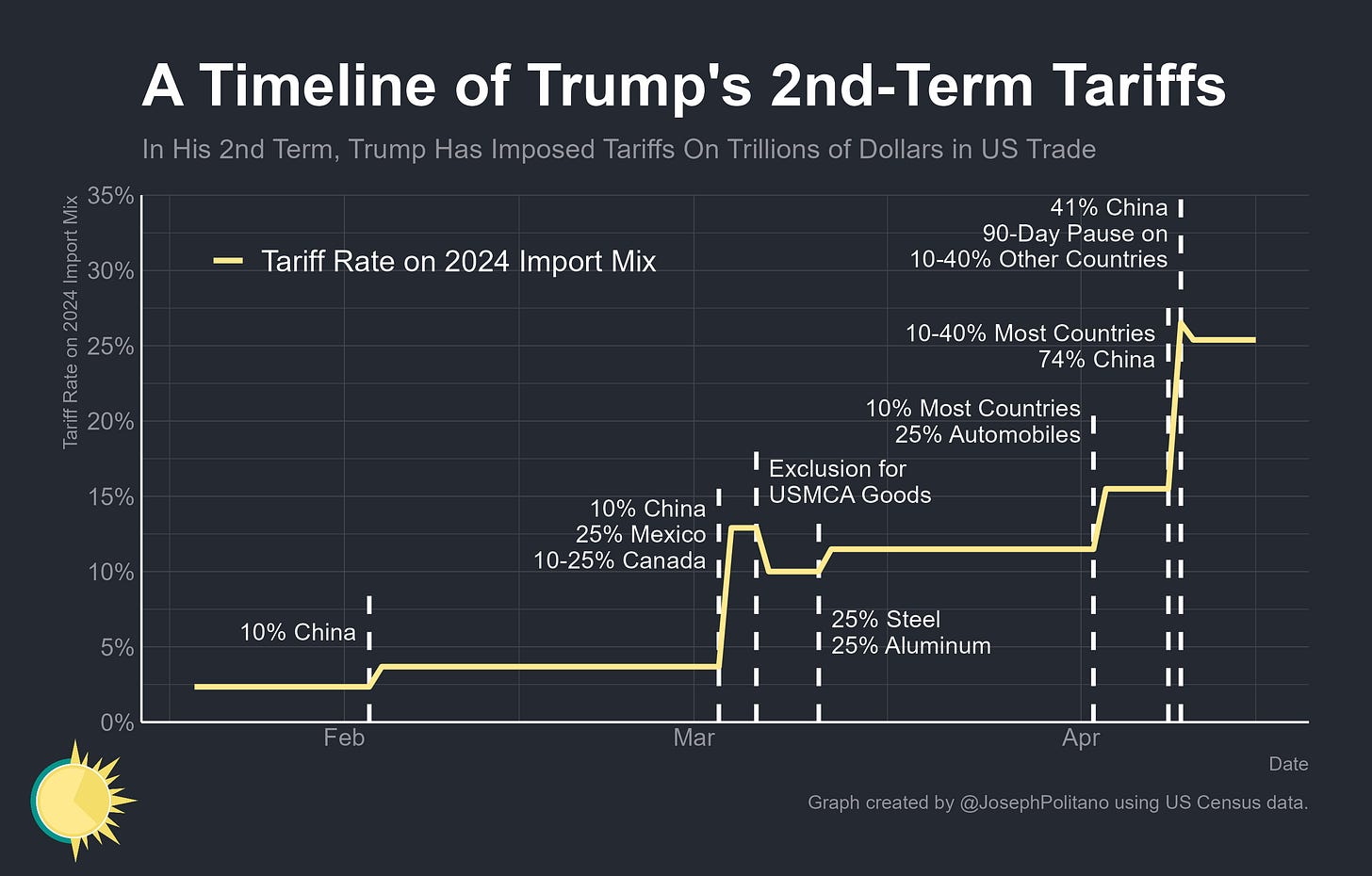

Trump claimed those now-paused country-level tariffs were “reciprocal” and that the US is only hitting back at other nations’ tariffs and trade barriers, but that was a blatant lie—the numbers justifying these tariffs were fabricated from calculations based on the US bilateral goods trade deficit. Free-trade zealot Switzerland got a higher “reciprocal” tariff than heavy-tariff-user Argentina simply because America’s trade deficit with Switzerland is larger than with Argentina. More importantly, several of the largest American trading partners got hit with massive tariffs—Vietnam got 46%, Taiwan got 32%, South Korea got 25%, Japan got 24%, and the EU got 20%—before the pause went into effect. Imports from China, already hit by 20% universal tariffs plus the preexisting tariffs from Trump’s first-term trade war, got an additional 34% tariff.

That wasn’t the end of it—tariffs on China went up an additional 91% beyond the April 2nd tariff announcement after two successive rounds of retaliation, reaching 145% on most goods. This is the end of most direct trade between the world’s two largest economies—outside of the categories facing only 20% tariffs, it would almost always be more economical to source from any other country, produce domestically, or simply not buy goods outright than try to pay tariffs this high. In total, America has just blockaded itself from all overseas trade and completely severed the majority of US-China economic links in the single largest negative shock to global supply chains since the early pandemic.

Contextualizing the Tariff

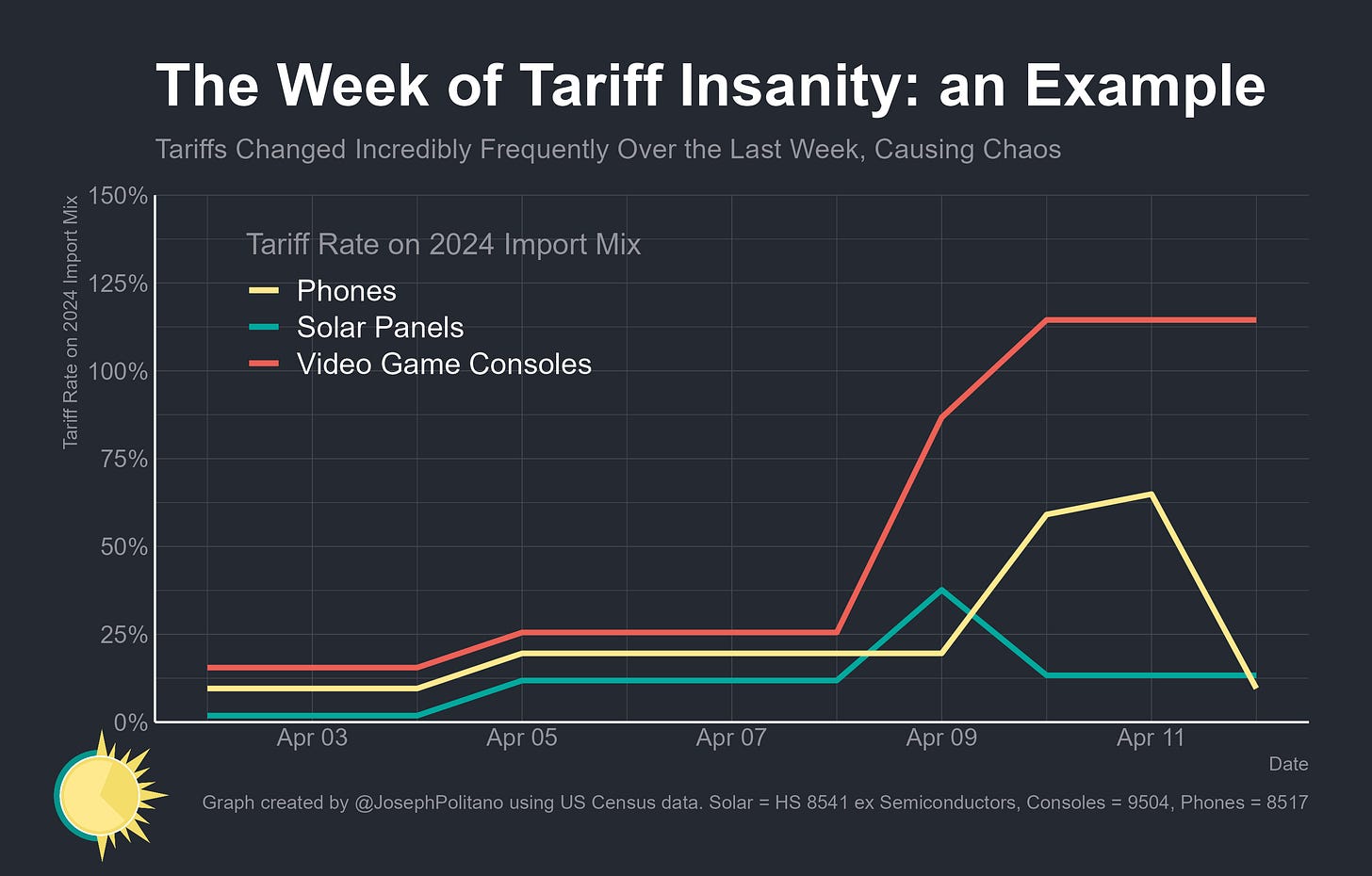

It should go without saying that this is an insane way to run the world’s largest economy. Imagine being a US solar panel importer, panicking because most of your goods come from Southeast Asian nations like Vietnam and Thailand threatened with insane tariffs. After April 2nd, you rush out to import as much as you can before a 36% effective tariff increase takes effect April 9th, only to have the tariffs reduced by 26% the next day. Or imagine being an electronics retailer, already facing tariffs of 16% on imported game consoles that mostly come from China. You brace for an expected 32% tariff increase based on the April 2nd tariff rates, instead receive a 61% tariff hike because China tariffs were increased further, and then receive another 27% tariff hike the next day even when most other imports saw tariff relief. Or imagine being that same electronics retailer, panicking about the effects of tariffs on your cell phone imports, watching tariffs accelerate up to 65% amid the China trade war, only for the White House to quietly publish an addendum yesterday exempting smartphones, computers, and parts from all of the tariffs imposed since April 2nd.

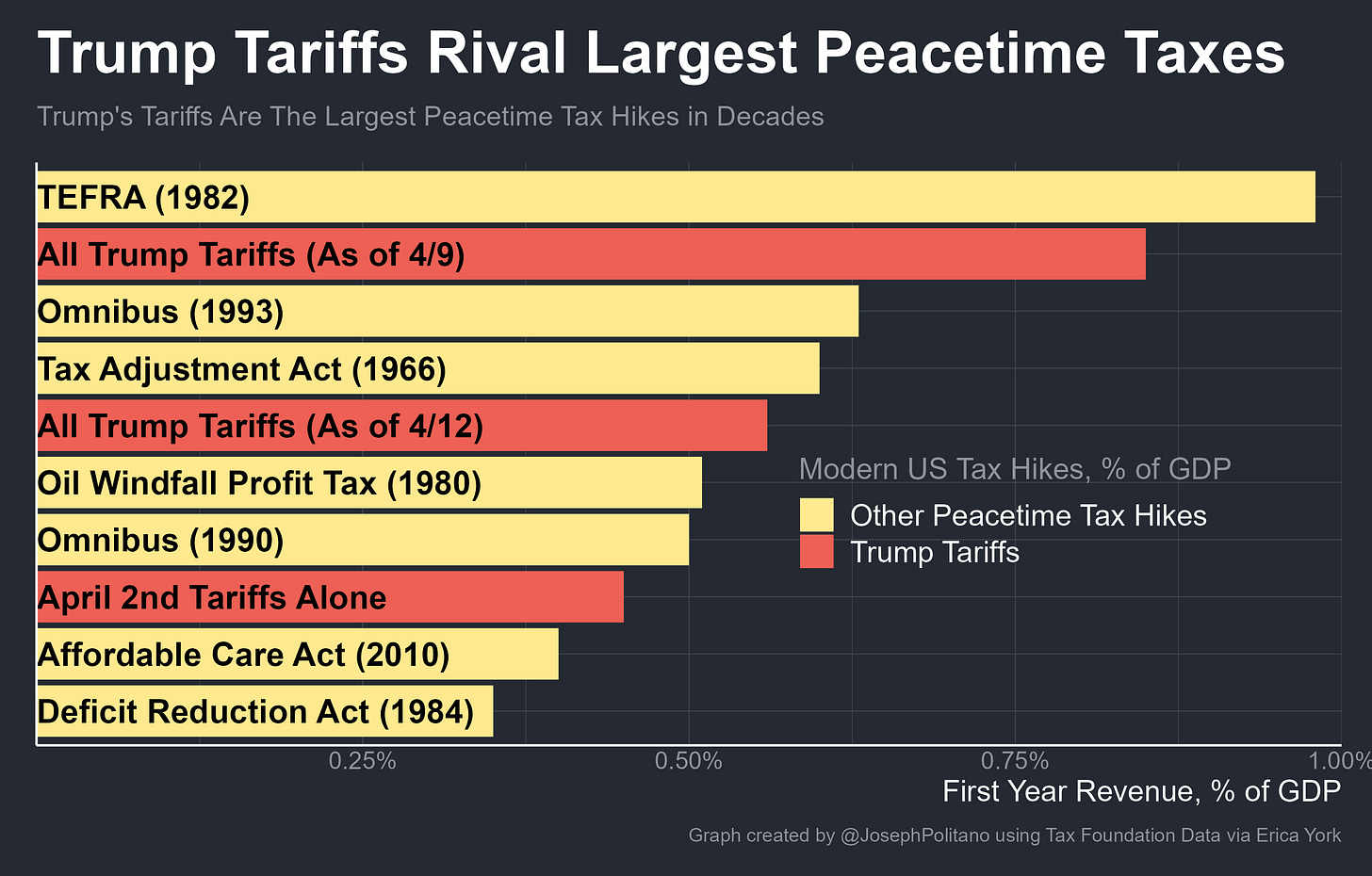

Yet it’s also just worth mentioning the sheer size of Trump’s tariff hikes in fiscal terms—they are among the largest peacetime tax hikes in American history. Analysis from the Tax Foundation estimates that total tariffs will increase federal revenues by about 0.56% of US GDP if sustained, and the April 2nd announcement alone would have increased revenues by 0.45%. For context, the passage of the Affordable Care Act in 2010 caused a smaller net increase in tax revenues than Trump did last week. If a more sensible tax like a VAT or income tax was implemented with similar scale, suddenness, and volatility, it would still be a major shock to the macroeconomy—but Trump has manifested this entirely through an unprecedented increase in some of the most economically distortive taxes in existence. Plus, these revenue estimates understate the impact of the tariff hikes—taxes on Chinese imports are now so large that the US will collect vanishingly little revenue from them given the likely total collapse in trade volumes.

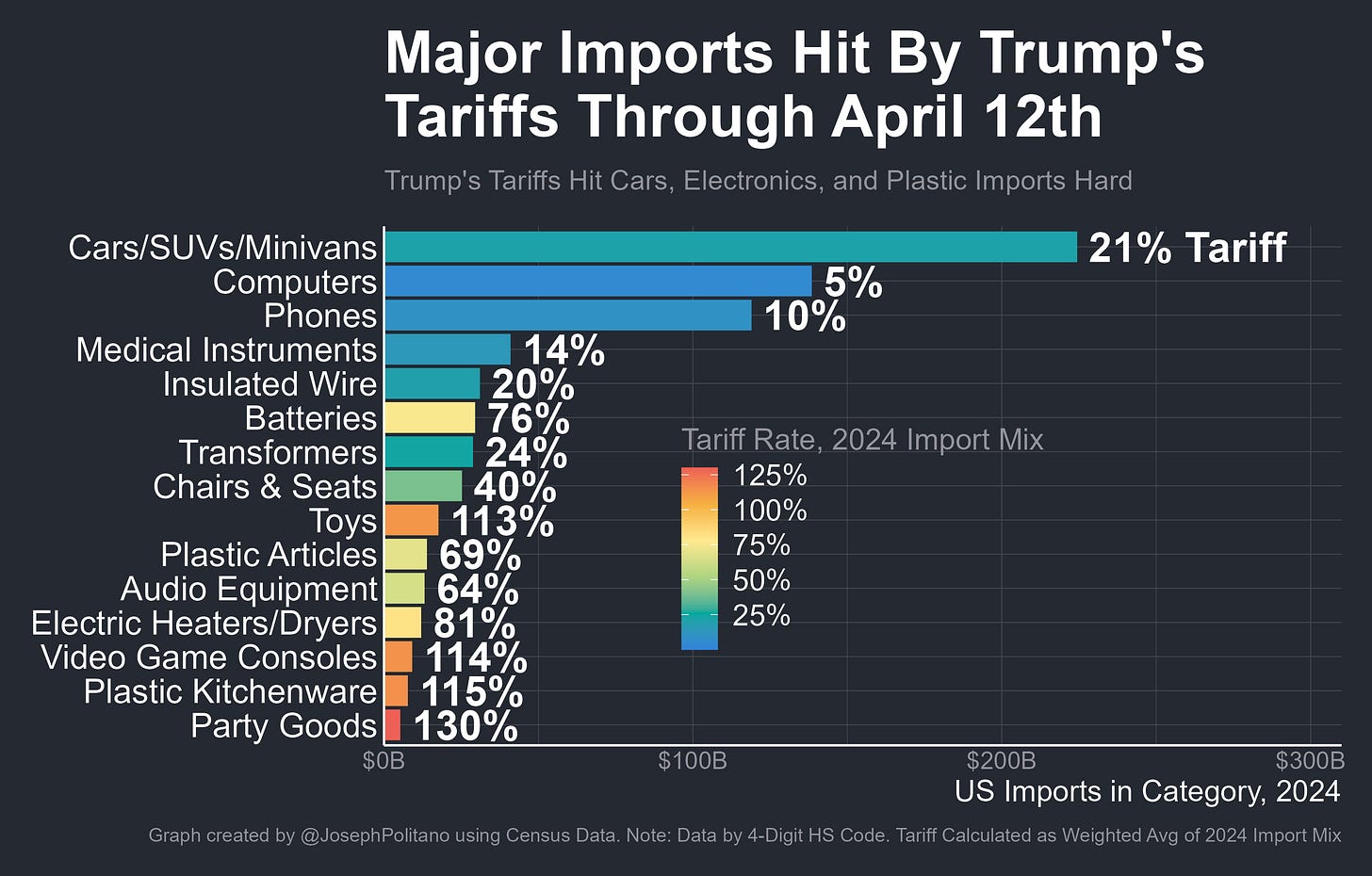

The cumulative impacts of all of Trump’s tariff moves thus far has been an unprecedented rise in the cost for many foreign-made goods. Motor vehicles, America’s single-largest manufactured import, currently face a 21% effective tariff rate once exemptions for US content are taken into account. Electronics like batteries, game consoles, audio equipment, and more now face massive tariff rates, given their concentration in China. In fact, many goods—toys, plastic kitchenware, party supplies, etc—are so concentrated in China that they now suddenly face functional tariffs in excess of 100%, which will cause chaos for their supply chains.

Meanwhile, the 10% tariffs hit bananas, cacao, palm oil, and dozens of other raw agricultural products that simply don’t grow in American climates, hurting food manufacturers and grocery shoppers. They hit dozens of raw inputs, parts, and components that feed US factories, hurting American manufacturing output. They hit most of the capital goods, construction materials, and equipment necessary for reindustrialization, making it harder to build factories, data centers, or housing in America. The unending tariff uncertainty continues to worsen consumer confidence and business expectations.

This whole episode is a continuing, unnecessary economic disaster—why use a fake formula? Why hit small countries like Vanuatu and Lesotho? Why exempt gold and laptops but not tropical agricultural staples like coffee and bananas? Why give only a few days’ warning between announcement and implementation? Why unilaterally break all of America’s free trade agreements? Why pursue tariffs this large to even begin with? US financial markets have fallen in response to both the direct negative economic effects of these taxes and the now-obvious degradation of US governing institutions.

Trump, for his part, is far from done raising tariffs—he is already lining up more universal tariffs on pharmaceuticals, lumber, semiconductors, critical minerals, and additional goods that were exempted from this round of tariffs. After 90 days, he could reimplement some or all of the now-paused tariffs just as he did against Canada and Mexico earlier this year. Plus, he could accelerate the trade war against the EU and Canada by responding to their retaliatory tariffs. The day after reducing tariffs on most countries, he was back to threatening Mexico with tariffs again. America is already at the highest tariff rate in more than a century, and the chaos is unlikely to end.

You published it! Yes!!

Great charts! Can you share what software you’re using? Thanks again for sharing.