Don't Call it a Pivot

Federal Reserve Officials Are Getting Even More Bearish on the Economic Outlook

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 19,000 people who read Apricitas weekly!

Otherwise, liking or sharing is the best way to support my work. Thank you!

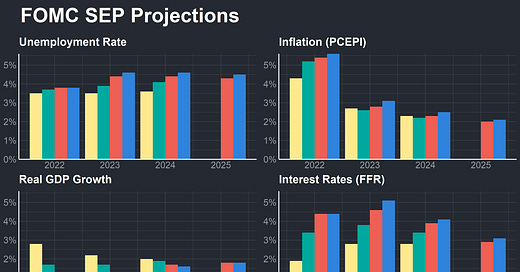

After four consecutive 0.75% interest rate hikes, Federal Reserve officials settled on a 0.50% hike at their meeting yesterday to round out a historic year of monetary tightening. But don’t mistake the hiking slowdown for a pivot—Fed officials have only gotten more bearish on the economic outlook in the time since their last meeting. Compared to projections from September, the median FOMC official now expects higher interest rates, higher unemployment, lower GDP growth, and higher headline inflation over the next three years. Critically, the Fed’s labor market forecasts—which show a nearly-1% increase in the unemployment rate—have never occurred outside of a recession in modern American history.

"I don't think [FOMC Projections] would qualify as a recession because it has positive growth…it's not going to feel like a boom, it will feel like slow growth"

Jerome Powell, FOMC Press Conference, December 14th

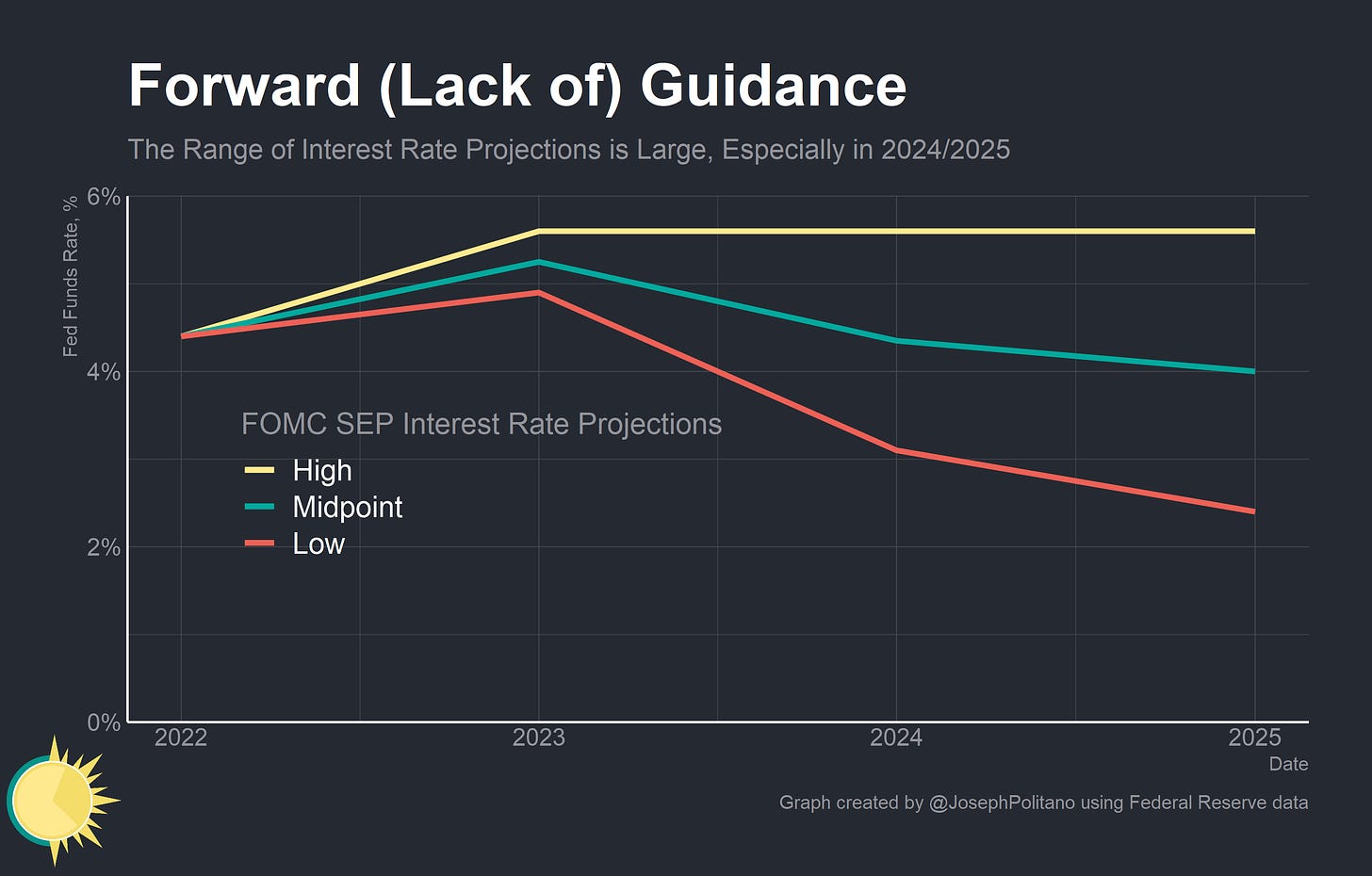

Federal Reserve officials are also increasingly uncertain about the economic outlook and the forward path of monetary policy—as evidenced by the wide range of projections for interest rates in the near future. For 2025, the lowest “dot plot” projection for interest rates from an FOMC member came in at a meager 2.4% while the highest projection came in at a staggering 5.6%. The midpoint of projections still represents a more-than-1% decline in interest rates from 2023 to 2025, though—indicating that rate cuts are expected sometime in the future amidst significant real economic pain and the decline in inflation. Differing opinions on whether the necessary path of monetary tightening will constitute a recession likely explain a large chunk of the widening gap between different members’ rate projections, but one thing remains clear—the fight against inflation remains the Federal Reserve’s single-minded focus, and they are not yet willing to compromise on policy efforts to tame inflation even amidst highly elevated uncertainty and recession risks.

“I don't think anyone knows whether we're going to have a recession or not. And if we do, whether it's going to be a deep one or not, it's just, it's not knowable.”

Rates and Levels

“I wouldn't see us considering rate cuts until the committee is confident that inflation is moving down to 2% in a sustained way”

In particular, Federal Reserve officials continued talking down the possibility of preemptive rate cuts in 2023 and stressed that they would not consider such actions until they were confident of their success in stabilizing inflation. Powell continues to make comparisons to the 1970s to explain that declaring victory over inflation prematurely can have serious negative consequences. As a result, interest rate futures markets have stopped pricing in aggregate rate cuts over the next calendar year—although they do expect some cuts at the end of the year to partially offset hikes at the start of the year, and markets expect significant rate cuts in 2024 at this point.

Medium-run real and nominal interest rates have been declining a bit from their peaks two months ago, indicating both a restabilization of inflation expectations and a slight loosening of financial conditions. Chair Powell seemed to push back just a little bit against this recent shift—but stressed that they don’t overanalyze short-term moves and were more broadly focused on the large negative shift in financial conditions since the start of this year. It fits into the one major way that the Fed’s thinking has seemingly shifted in recent months: they are less concerned with maximizing the speed of rate hikes themselves and more concerned with determining how long policy will have to stay restrictive.

The State of Financial Conditions

Keep reading with a 7-day free trial

Subscribe to Apricitas Economics to keep reading this post and get 7 days of free access to the full post archives.