Financial Conditions Are Tight, But Maybe Easing

Monetary Policy is Still Tight as the Fed Fights Inflation, But New Data Suggests Some Financial Conditions Might Be Easing Amidst Improved Economic Forecasts

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 22,000 people who read Apricitas weekly!

Otherwise, liking or sharing is the best way to support my work. Thank you!

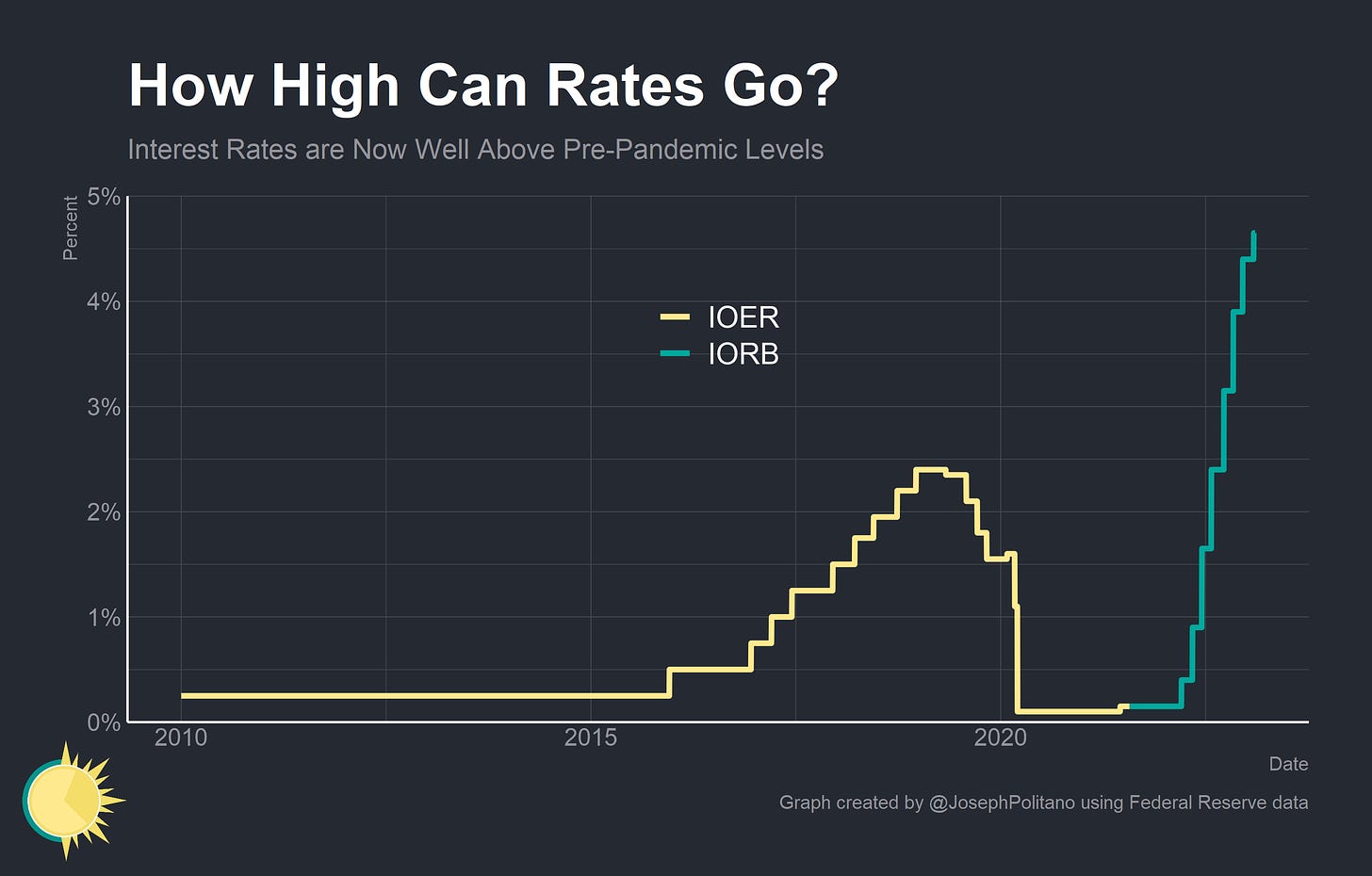

It has been eleven months since the Federal Reserve began aggressively raising interest rates in an effort to combat rapidly-rising inflation, and a broad range of financial conditions have tightened significantly since then. Compared to 2021, it is more difficult for major companies to issue bonds or raise capital, for small businesses to borrow money or finance expansion, and for households to get a credit card loan or a mortgage. The Federal Reserve believes that tight financial conditions continue to be necessary in order to slow economic activity and bring down inflation, but in recent months smaller rate hikes and improvements in the economic outlook have arguably caused financial conditions to ease.

Equities are up, mortgage rates are down, high-yield corporate bond spreads are decreasing, market volatility has fallen, and indices of financial conditions have eased over the last 3 to 4 months. Those improvements have come as a result of stronger recent economic data alongside a rosier economic outlook—but critically, the Fed doesn’t yet view recent financial easing as a threat to their ability to fight inflation. Chair Powell said that the Fed’s “focus is not on short-term moves, but on sustained changes to broader financial conditions,” when asked directly about data showing improved financial conditions at last week’s press conference, though he did caution that policy wasn’t yet “sufficiently restrictive.”

However, it’s worth noting that financial conditions remain tight compared to normal levels, that recession risks are still elevated, and that some data shows an ongoing tightening of financial conditions rather than easing. Ultimately, whether conditions worsen or improve from here depends largely on whether today’s expected path of interest rates is sufficient to contain inflation without a recession.

Why Financial Conditions Are Still Tight

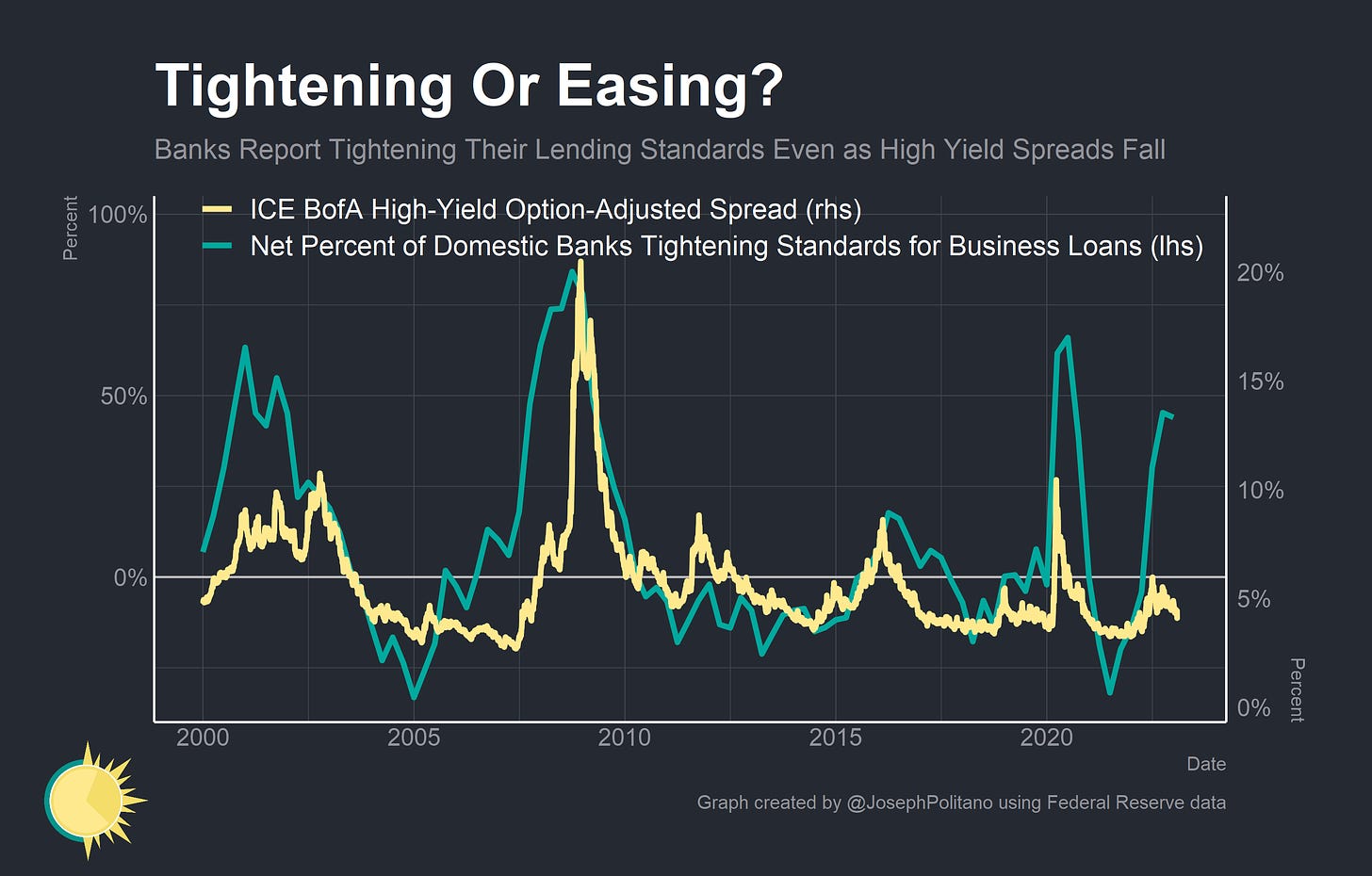

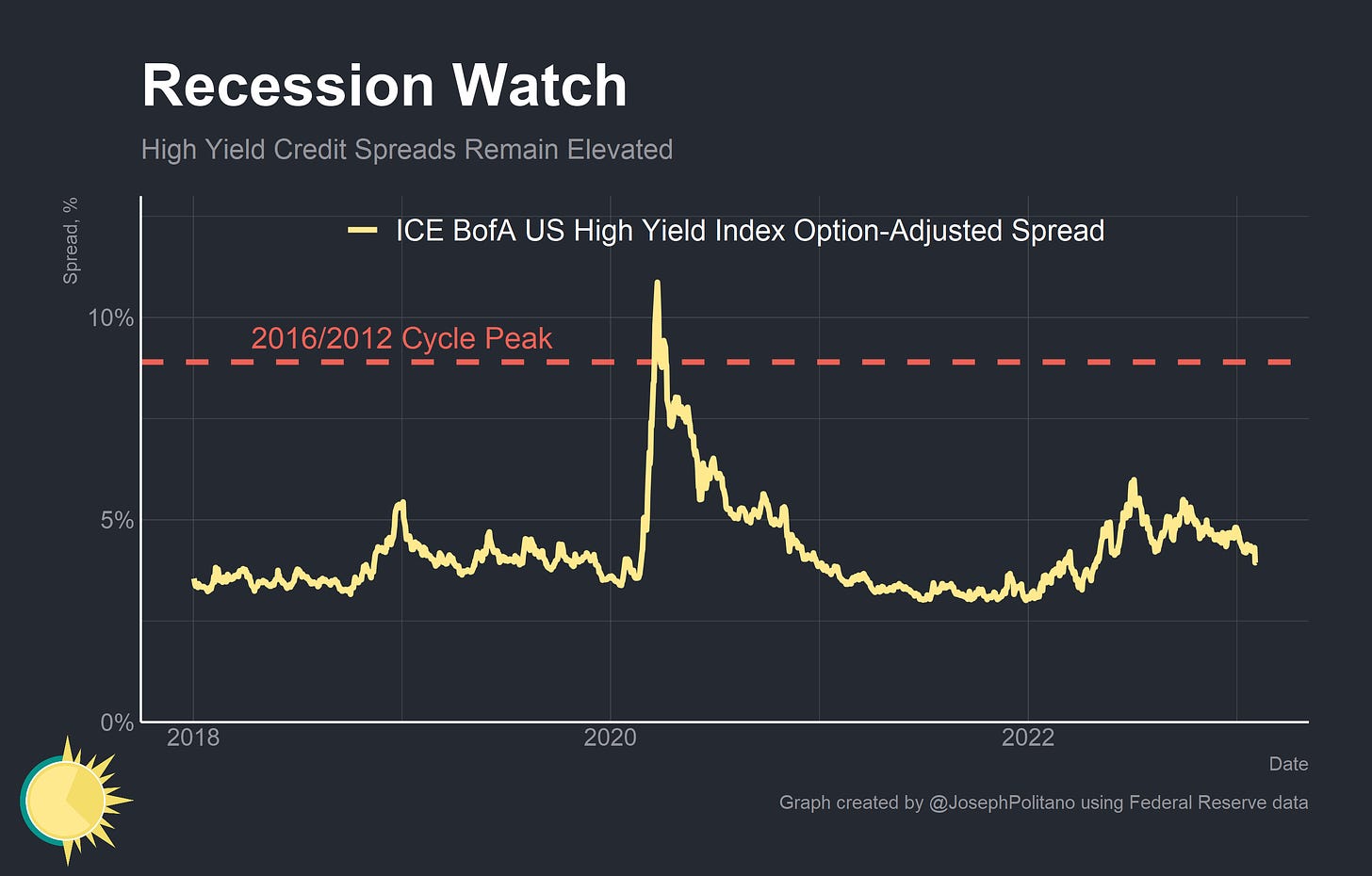

Bank of America’s measure of high-yield corporate bond spreads, which reflect default risk and the cost of borrowing for the riskiest major companies, has fallen 200 basis points from its July high as the economic outlook has improved. At the same time, however, the Senior Loan Officer Opinion Survey of major banks indicates rapid ongoing tightening of credit standards and increases in credit spreads for business loans. So are businesses finding it easier or harder to borrow nowadays?

First, it’s important to note that while credit spreads have been decreasing they still remain much higher than in 2021 and somewhat higher than during most of the 2018/2019 economic slowdown. In other words, market pricing still indicates that businesses are facing tight financial conditions. Today, banks may just be catching up to prior movements in markets.

But another big difference comes down to markets’ vs banks’ view of the rapidly-shifting economic outlook—of the banks that indicated a change in their credit standards in the Q1 2023 SLOOS, 100% tightened and cited the worsening outlook as a somewhat or very important reason. The Dallas Fed’s Banking Conditions Survey tells a similar story: banks expect nonperforming loans to increase and see massive falls in loan demand and general business activity, both currently and in the future.

Keep reading with a 7-day free trial

Subscribe to Apricitas Economics to keep reading this post and get 7 days of free access to the full post archives.