Rivalry, Innovation, and Speedrunning

What Video Game Speedrunning Can Teach Us About Innovation Spillovers in the Public and Private Sectors

The views expressed in this blog are entirely my own and do not necessarily represent the views of the Bureau of Labor Statistics or the United States Government.

Portal, the groundbreaking 2007 first person puzzle platforming game, opens with a nearly minute long introduction where the player character Chell is locked inside a “relaxation vault.” It is a charming and witty introduction to the game and its main villain GLaDOS. It was also nothing short of the most annoying section of the game for professional speedrunners.

Speedrunning is, as the name suggest, the competitive sport of trying to beat a game as quickly as possible. Speedrunners compete in different categories, games, and rule sets, but whoever beats the game as fast as possible claims the world record. On older games where competition is fiercest, speedrunners know every nook and cranny of the game and regularly exploit its glitches and bugs to shave off precious seconds.

That’s what made the introduction to Portal so frustrating; there was no way to glitch through it. For nearly a full minute (of a game that can be beaten in less than 10 minutes) speedrunners were forced to patiently wait with nothing but a few useless props to keep them busy. Portal remains one of the most popular games in history, so the demand for speedruns was relatively high and the community looking for new glitches was large. After enough time, however, community members agreed that the “relaxation vault” was unskippable and simply decided to start speedruns at the end of the introduction and tack on an additional minute. When glitches were discovered, they required frame-perfect nearly inhuman precision to achieve, and even professionals required months of attempts to skip the vault just once.

That all changed on June 26th, 2021 when speedrunner xeonic discovered a way to skip the “relaxation vault” in its entirety. By shoving a radio prop against the spawn bed at just the right moment, the player can easily glitch through the vault doors by saving and loading the game repeatedly. This innovation was a revolution in Portal speedrunning—where players previously thought getting inbounds times under 9 minutes impossible, now it was within reach. Indeed, all of the top three times are now under 9 minutes.

Why am I telling you a story about Portal in a blog post about innovation? Well, because xeonic, despite completely changing the Portal speedrunning landscape, does not hold any of the top spots on the leaderboards. His best out of bounds speedrun is 9th and his best inbounds speedrun is 6th. After xeonic put in the hard work of discovering the skip he was passed up by players who mimicked his strategy without needing to figure out the intricacies of the vault. His innovation spilled over and he was passed up by his competitors.

The same thing happens, constantly, with competition and innovation in the economy. But where xeonic and his fellow speedrunners are mostly engaged in friendly competition as a hobby, in the economic world firms, individuals and countries are engaged in multibillion dollar battles over their innovations. Despite the strength of the patent system, it is innovation spillovers that dominate much of the innovative process. Firms in competition with each other therefore relentlessly pursue dispersing existing innovations, but are much less keen to invest in generating new innovations. As a result, aggregate demand is a critical driver of innovation diffusion and creation by forcing firms to be more productive and competitive using existing innovations while pursuing new innovations in search of first-mover advantage. In the real world as in the virtual, innovation is driven by competition and demand but is often manifests in technological spillovers that undercut firms’ incentives to innovate.

Competition and Demand in the Great Recession

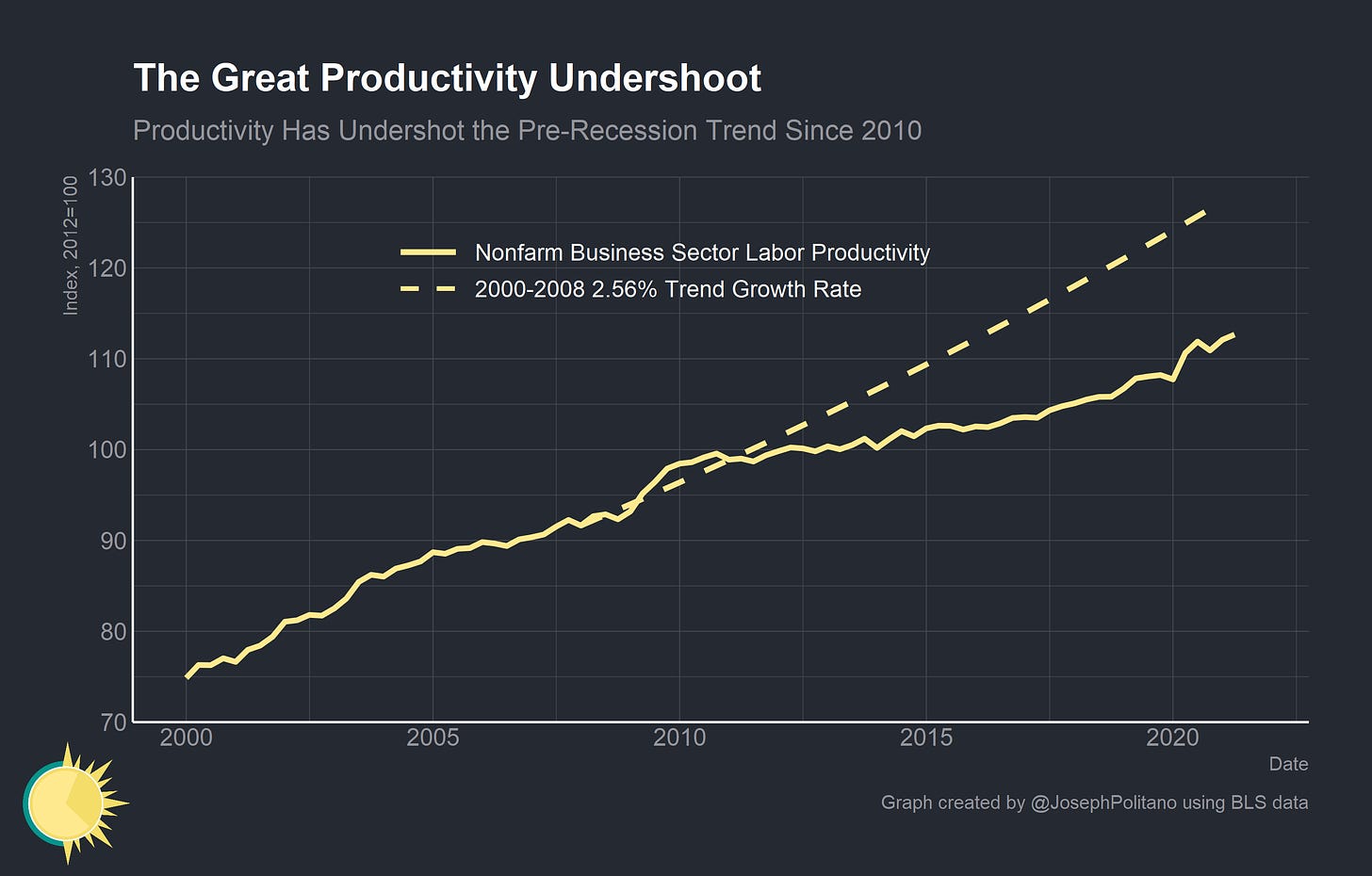

As shown in the above graph, nonfarm business sector labor productivity sank dramatically below its pre-crisis trend in the wake of the 2008 recession. It took a few years for the decline in labor productivity growth (which means a decrease in compensation growth) to show up in the data as low-income workers were more likely to be laid off at the start of the crisis. By 2012, however, it became clear that aggregate labor productivity was undershooting its potential.

What drove this decline in labor productivity growth? In short, the decline in aggregate demand. Tight monetary policy mixed with the financial crisis to cause a dramatic slump in demand and employment in 2008. The demand decline self-catalyzed through hysteresis (where a temporary drop in aggregate demand becomes permanent through elevated unemployment) because the Federal Reserve and federal government did not intervene enough to counteract the drop in aggregated demand. The result was a persistent undershoot of prior trend GDP growth.

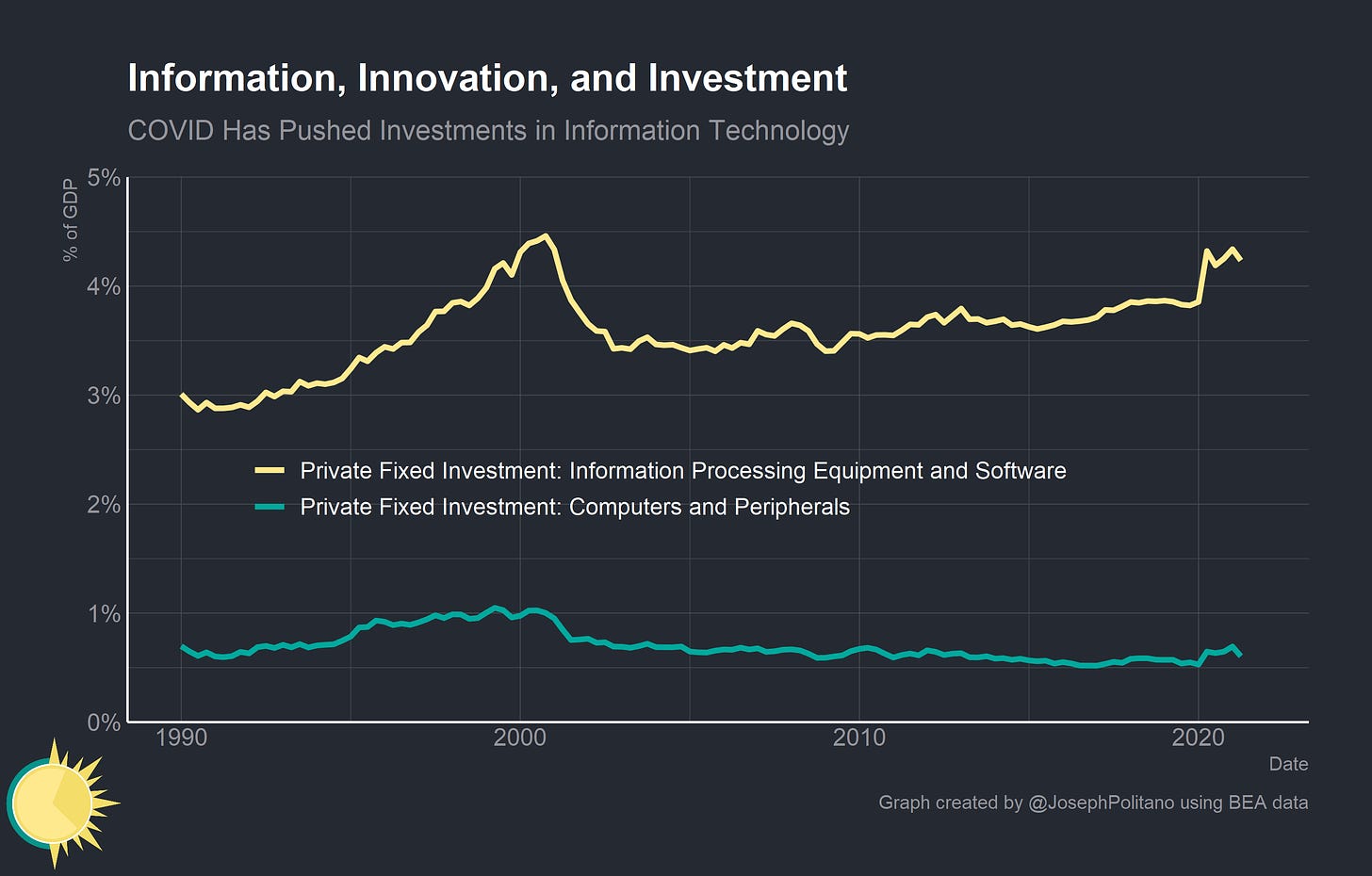

But why should a decline in aggregate production cause a decline in individual productivity? The answer lies primarily in the investment decisions of firms. The graph above shows that spending on Research & Development (R&D), both total and from the private sector, have a relatively stable relationship with GDP. What that means is that when GDP shrinks the private sector scales back its R&D investments, and the US public sector has refused to make up the slack. In fact, public spending has been steadily shrinking as a percentage of total R&D spending since the 1990s.

For a more literal example, look at firms’ investment in information processing and computers. Besides the massive investments in computing at the end of the 20th century and during the COVID-driven remote work period, spending on computer-related investments has been relatively stable as a share of GDP. That means the drop in nominal income growth during the Great Recession directly bled over into a drop in GDP and a drop in investments in productivity-increasing computer technology.

In short, firms invest most when they are swamped by current and future demand. When there are millions of unemployed people and demand remains low, there is little incentive for firms to invest in creating or deploying new innovations that would increase labor productivity and output. Firm level technology investment and wages are heavily related, as firms need aggregate demand to validate their sales in order to incentivize the productivity-increasing investments that boost output and wages. When aggregate demand falls, firms have little incentive to invest in expansion and technological improvements, and the lower investment in turn lowers aggregate demand and wage growth again. Without an intervention by monetary and fiscal authorities to bring aggregate demand back to trend, you can have the decade-long productivity undershoot that America has experienced since 2008. To return to our speedrunning example, if there is no demand from fans and players for new, faster speedruns then there is no reason to devise intricate time saving innovations.

Spillovers and Diffusion in the Computer Industry

The other critical dynamic is the diffusion of economic innovations through dynamic competition in the private sector. In the Portal example, speedrunners rapidly began implementing the new “relaxation vault” skip as soon as it was discovered and it almost immediately became necessary to perform the skip in order to achieve a world record time. Because of the intense competition among players, the technology of the skip rapidly diffused amongst speedrunners.

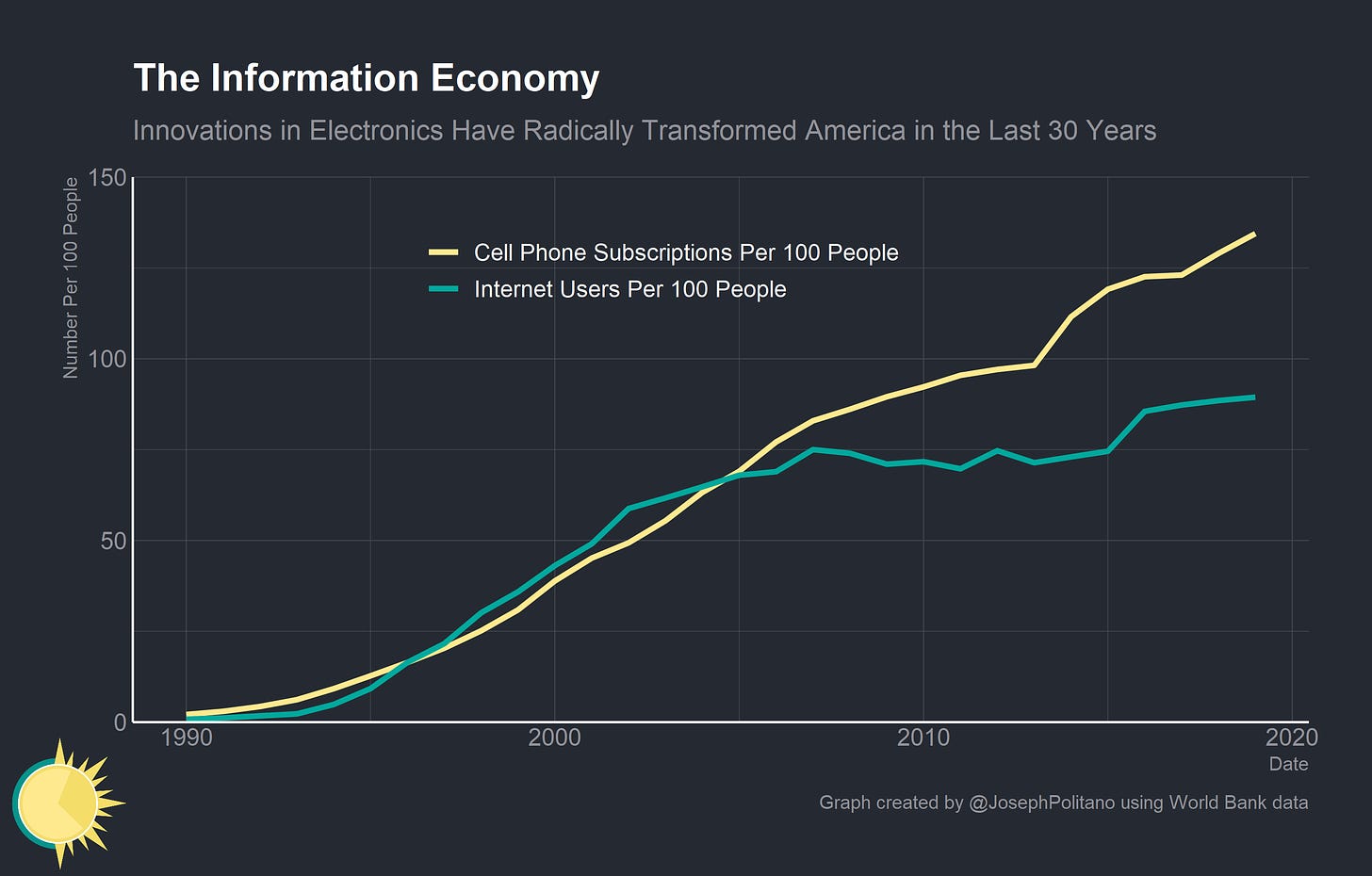

Corporations are exceptional at this kind of innovation diffusion, as they are in intense competition for consumers and are desperate not to be left behind by rival firms. The result is rapid deployment of innovations as soon as they become proven successes; just think of how many firms redesigned their cell phones to mirror the iPhone after its tremendous success. In the chart above you can see the rapid diffusion of cell phones and internet service throughout the United States. Between 1990 and 2010, the country went from having extremely few cell phones and no internet connections to the vast majority of Americans having access to both. This is in stark contrast to the limited competition within the Soviet system, which famously struggled to even connect the majority of its populace to landline telephones.

That same competition, however, also undercuts firms’ incentive to be the first-mover and therefore their incentive to invest in technological exploration. History is littered with firms that developed revolutionary advances in technology only to be rapidly lapped by their competitors and driven out of the market (Atari and Kodak, for example). Patents can work to counteract this by giving firms the exclusive rights to production of their innovations for a certain period of time, essentially incentivizing them to develop new technology by granting them a temporary monopoly. The most important innovations, however, are often un-patentable.

Take the iPhone example again. Apple had patents on a lot of the specific technology that composed the iPhone, but that did not prevent competitors from pouncing on some of the most important innovations (full touch screen display, an app store, integrated phone camera, etc). Nor was Apple the first to come up with much of the technology in the iPhone: touch screens were used before in a wide variety of portable electronics, as were cameras. In many ways, firms are iterating and refining upon previous innovations as much as they are developing new ones. Critical innovations are therefore non-patentable and spill over from the inventor to all of their competitors and the broader economy.

Here are some of the most blatant examples in recent memory; After the success of Snapchat’s “stories” feature virtually every competing social media site (including Facebook, Instagram, Twitter, and LinkedIn) simply copied the feature over to their sites. The picture filters and lenses that became popular on Snapchat rapidly became integrated into almost all videochat and image sharing websites. After the smash success of TikTok—which itself borrowed plenty of ideas from Vine—YouTube and Instagram both introduced competing short-form video features. All of these represent situations where innovation from corporations were rapidly copied by their competitors because patents were impossible.

In sectors where patents are mostly functional they represent one way to eliminate technological spillovers’ ability to undercut firms’ incentives to innovate. However, they are by no means the only option and are not always the best option. Challenge prizes present a compelling alternative; instead of being awarded a patent for developing a successful new drug, the original inventor would be awarded a large cash prize and any company could then legally produce the drug. The advantage of this is obvious—instead of making the first inventor into a temporary monopolist intent on pricing the drug as high as possible to recoup their costs the innovation is free to diffuse throughout the economy. There are, however, several disadvantages. For one, the institution administering the prize is required to precisely determine the value of a new technology before it is invented in order to properly incentivize research in that direction. Patents, on the other hand, are always as valuable as consumer demand for the patented product, allowing each firm to estimate the innovation’s value independently. For two, patents cover the “unknown unknown” innovations that prize makers can never plan for. Sometimes research in a new direction yields surprising results (Viagra was discovered by researchers at Pfizer looking into treatments for heart-related chest pains) and some degree of undirected exploratory research must be incentivized to discover innovations hidden in the unknown.

The last method to incentivize innovation is perhaps the most direct—government funded and administered R&D. As mentioned earlier, government’s share of R&D spending has been shrinking in recent years at just the time when we needed it most to counteract declines in productivity growth. Government subsidies to universities, think tanks, and other research institutions can directly incentivize the kind of broad exploratory innovation that the private sector is most likely to ignore due to spillover effects. On a more direct note, successful R&D from the US military often spills over to the private sector to great success, as was the case with ARPANET and microwave technology.

On the technological frontier, a “yes, and” approach is absolutely necessary. A mix of patents, prizes, subsidies, and government direct spending on R&D will be necessary to restore American productivity and innovation to its former glory. On a larger level, it is both impossible and undesirable to eliminate the fundamental structure of innovation spillovers. Iteration and improvements are necessary parts of technological improvements. As much as we tend to imagine technology as discrete inventions—the lightbulb, the telephone, the computer—in truth innovation is always merely a combination of old and new knowledge. Attempting to over-patent in order to incentivize innovation may actually have the opposite result as firms are forbidden from building on existing ideas in a timely fashion. To circle back to our speedrunning example, if xeonic was the only person allowed to perform his skip the Portal speedrun record time would surely be longer because the innovation was not allowed to spill over.

Conclusions

Demand, spillovers, and incentives are by no means the only factors affecting the pace of innovation, though they are all critical. Agglomeration, essentially the spillover effects of the concentration of industry and production in urban areas, is another critical impediment to American innovation. In short, the lack of housing construction in cities like San Francisco is harming the economy and preventing innovation by limiting the amount of people with access to unique high-tech spaces in Silicon Valley. Racism and other structural economic exclusion also directly hampers innovation—in a seminal paper Dr. Lisa Cook demonstrated that lynchings, riots, and segregation laws had direct negative effects on the creation of patents from African-American inventors. Ending these structural inequalities would also expand the range of American innovators and work to restore productivity growth.

More than anything, it is important to recognize that innovation is a continuous system-level process as much at is is a discrete individual-level one. Innovation spillovers mean that virtually everyone from engineer to user to developer contributes to and benefits from the innovative process. Without user feedback or pressure from competing developers and engineers, there would be no reason to continuously push forward the innovative process. Critically, without system-level aggregate demand growth there is less incentive for firms to invest or innovate at all, meaning employment and investment outcomes are inextricably linked. Most importantly, since innovation is a continuous process it is the speed of innovation that matters most. Once we start to think of innovation as a system-level issue, we can begin to address the system-level causes of our current low productivity growth.

If you like what you read, consider subscribing to get free economics news and analysis delivered to your inbox every Saturday!

Reminds me of two videos I saw recently:

The Fosbury Flop in high jump:

https://www.youtube.com/watch?v=CZsH46Ek2ao

"Rolling" in NES Tetris:

https://www.youtube.com/watch?v=n-BZ5-Q48lE

So cool to watch this diffusion play out in such a wide range of competitions!