Tepid Optimism for a Soft Landing

Fed Forecasts No Longer Imply a Massive Recession is Necessary to Stop Inflation

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 29,000 people who read Apricitas weekly!

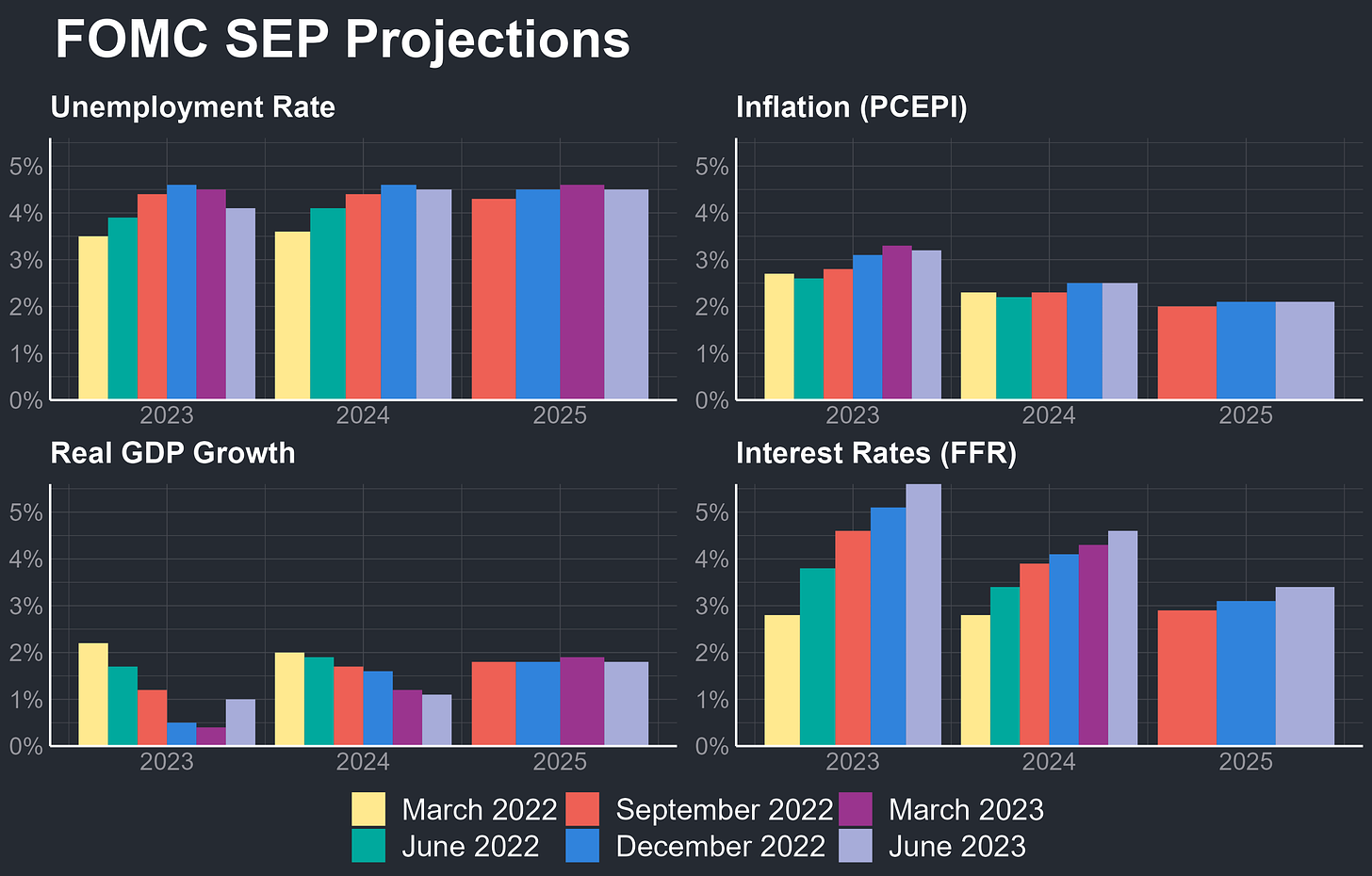

For the last nine months, economic projections from the Federal Reserve have implied that a rapid recession would be necessary to stop excess inflation “under appropriate monetary policy.” The unemployment rate was expected to increase by 1% in under a year—something that has never occurred outside of a recession in modern US history—and GDP growth was expected to stay extremely low even as inflation remained problematically high. However, as the Fed decided to skip a rate hike yesterday, it finally sounded a more optimistic tone. The median Federal Open Market Committee (FOMC) member expects unemployment to “only” rise to 4.1% this year, for GDP growth to remain a positive-but-low 1%, and for headline inflation to come in slightly lower than expected.

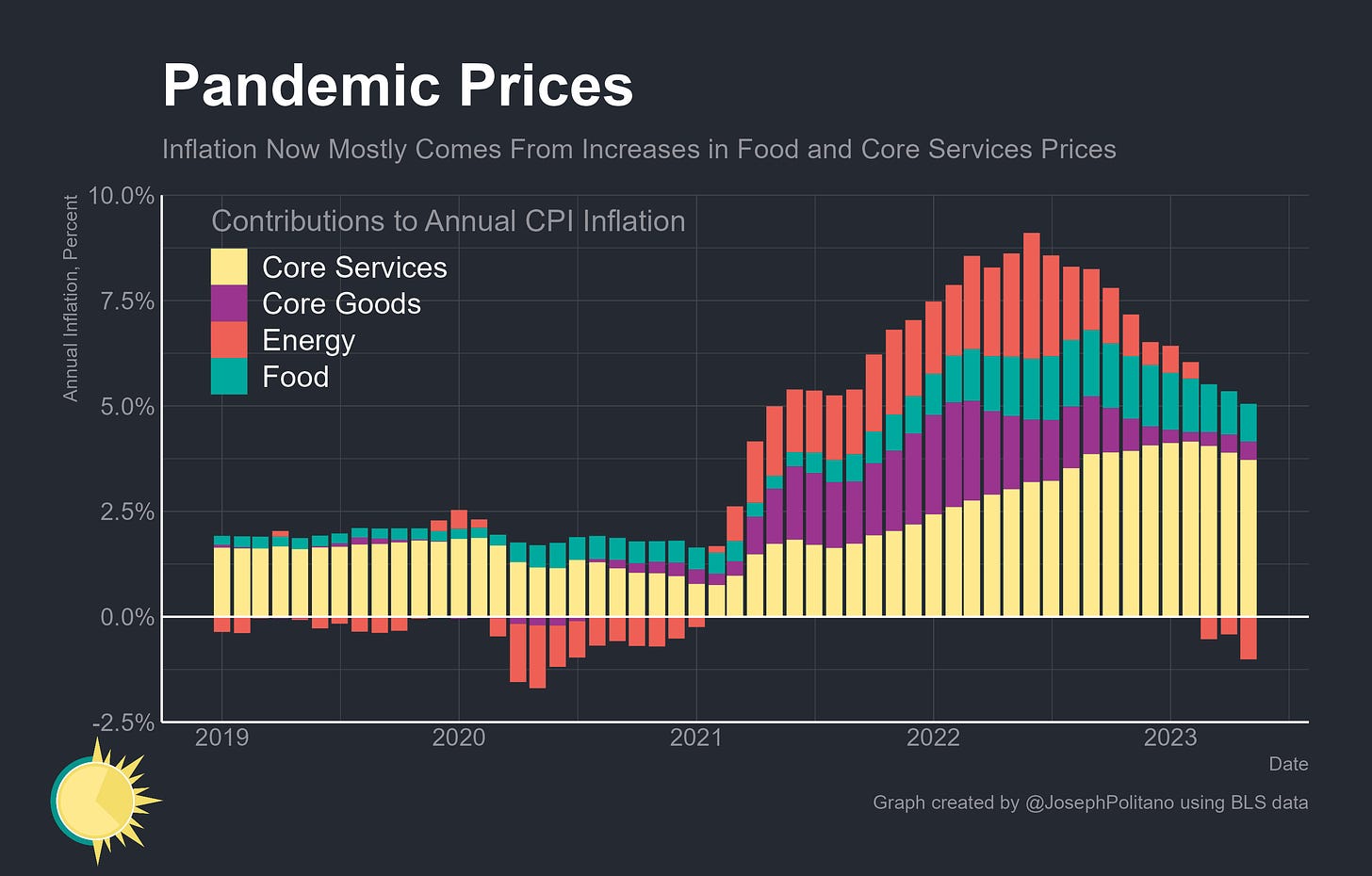

That’s partly because of renewed optimism on the short-term inflation outlook. The headline year-on-year growth in the consumer price index (CPI) came in at only 4% in May, the lowest level since March 2021, and core inflation excluding food and energy came in at 5.3%, the lowest level since November 2021. Arguably, the biggest cause for optimism is that monthly growth in core services inflation, the most cyclically-sensitive aspect of inflation, has taken a significant step downwards over the last three months. That does not mean the Fed believes its job is done in fighting inflation, with it forecasting core PCE inflation to remain at a high 3.9% this year and rates needing to continue rising to a peak of 5.6%. Nor does it mean the Fed believes disinflation will be painless, as its forecast of unemployment rising 1% over two years is still anomalous outside of recessions. Still, its current economic projections suggest a scenario closer to a soft landing than a hard landing.

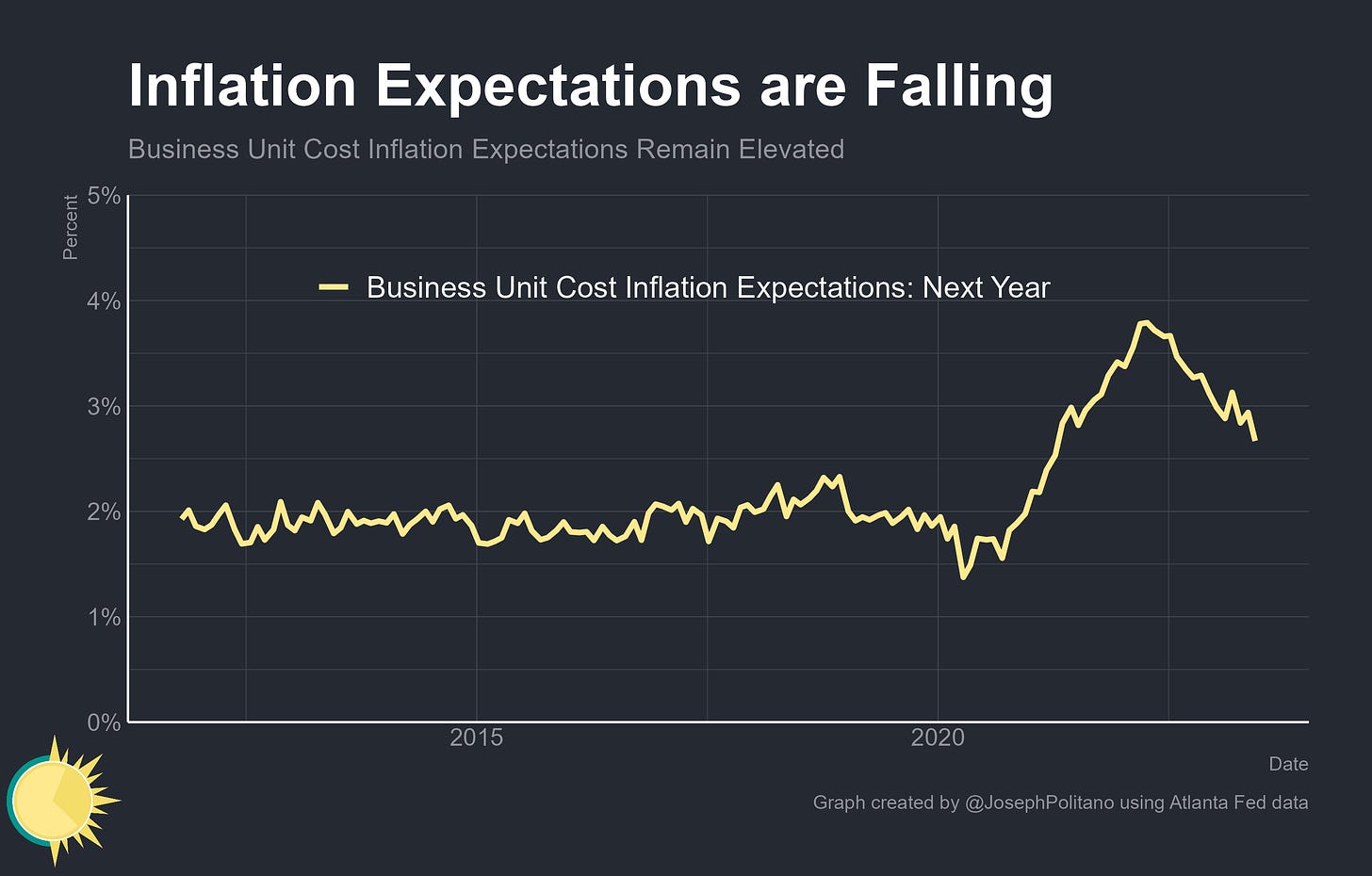

Businesses, too, are steadily becoming convinced that the worst of the inflationary episode is behind us. The Atlanta Fed survey of firms’ own unit-cost inflation expectations, one of the most robust ways of measuring business-side cost forecasts, shows year-ahead price growth expectations falling to 2.7% and longer-term expectations falling to 3%, both the lowest levels in two years.

“The labor market, I think, has surprised many, if not all analysts over the last couple of years with its extraordinary resilience…it's really the engine, it seems, that is driving the economy”

Fed Chair Jerome Powell, June 14th FOMC Meeting Press Conference

The ongoing resilience of the labor market in the face of rate hikes has supported economic growth and higher rates even as inflation slows, and the recent decline in firm inflation expectations has importantly not come alongside slowing hiring plans as it did throughout much of 2022. Given that a soft landing requires inflation to normalize with minimal employment sacrifices, this is good news. Indeed, broad sets of economic expectations are now improving, with the manufacturing sector’s outlook rebounding, household inflation expectations falling, and consumer confidence coming off last year’s lows. Since headline inflation looks likely to hit a low of below 3.5% in next month’s CPI report for the simple fact that food and energy inflation peaked this time last year, and given how much of household sentiment and household inflation expectations are anchored to frequently-purchased food and energy goods, further improvements in consumer economic outlook can be expected. The US economy is not out of the woods yet, but tepid optimism for a soft landing is definitely on the rise.

Today’s Inflation Outlook

Keep reading with a 7-day free trial

Subscribe to Apricitas Economics to keep reading this post and get 7 days of free access to the full post archives.