Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 19,000 people who read Apricitas weekly!

Otherwise, liking or sharing is the best way to support my work. Thank you!

Amidst generationally high inflation, rising interest rates, and elevated recession risks, the economic outlook is more uncertain than ever. The bulk of the macroeconomy now hinges on how fast inflation retreats and how much economic pain is required to get inflation back down to normal, and variance in likely outcomes around both growth and inflation remains extremely high.

Within that framework, it’s worth thinking of the possibilities for next year in terms of three broad outcomes (though obviously, this is more of a spectrum than a set of strictly separate results)—a hard landing where inflation only comes down after a recession, a soft landing where growth slows but remains positive as inflation dissipates, and no landing where inflation remains above the Federal Reserve’s 2% target despite significant rate hikes.

The good news is that the odds of a recession in the next year have likely decreased significantly since its peak earlier this summer as inflation data has improved and energy shortages have abated. The bad news is that a significant economic slowdown in the relatively near future essentially remains the base case among both professional forecasters and the Federal Reserve. Few expect the roaring growth of the initial post-2020 recovery to continue much further or for inflation to abate entirely painlessly—the question is primarily about how much damage the economy will sustain rather than if it can get by unscathed. But without further ado, here are 10 charts on the data and themes that dominate the 2023 economic outlook.

What to Expect When You’re Expecting (Inflation)

If inflation is the focal point of today’s macroeconomic uncertainty, then inflation forecasts are the best place to analyze the macroeconomic outlook from. After an extremely turbulent year, market-based measures of inflation expectations derived from inflation-linked Treasury bonds have fallen dramatically from their highs early this year. In fact, inflation expectations for the next 5 years and the following 5 years have fallen slightly below a level approximately consistent with the Fed’s 2% inflation target. While some of that is undoubtedly driven by the recent falls in oil prices, the drop in longer-run inflation expectations in particular indicates growing concern about the chances of a “hard landing” that induces a sustained period of below-trend growth.

Shorter-term market-based measures of inflation expectations have also declined dramatically and stabilized at levels approximately in line with the Fed’s inflation target. ICE’s US Dollar Inflation Expectations Index, which incorporates data from inflation-linked swap markets and Treasury markets, estimates that inflation expectations for the next 12 months are now a touch below 2.25%. Expectations for the following 5 years remain at similar levels.

Businesses, however, still need some convincing—their unit-cost inflation expectations are rapidly declining but remain significantly elevated compared to pre-pandemic levels. This fits in line with ongoing complaints from manufacturing firms about materials shortages, labor shortages, and logistics constraints—in other words, the COVID supply-chain snares have not left us yet. These own-firm-unit-cost inflation expectations are also usually more accurate than other survey-based inflation forecasts, so it is worrying that they remain comparatively high. However, Federal Reserve officials have committed to raising rates until inflation comes down and inflation expectations are re-anchored, so the bigger question is arguably “how high will rates have to go to get inflation down?”

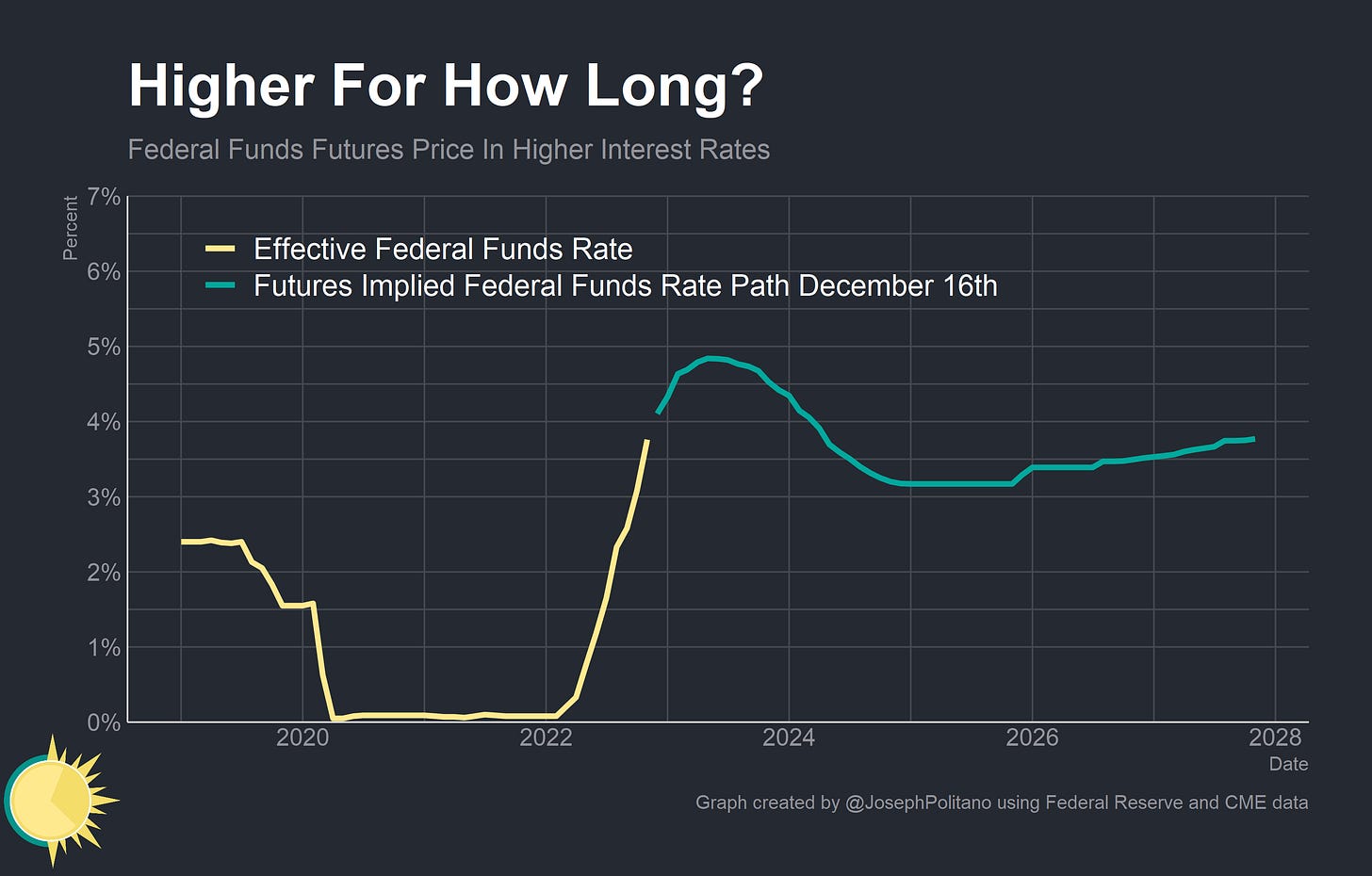

Higher For How Long?

Right now, futures markets are forecasting a peak interest rate of slightly below 5%, followed by significant cuts in the second half of 2023 and the first half of 2024 that would bring rates back down to about 3%. The net effect of this is a very inverted yield curve with high real short-term interest rates—ICE also estimates that the real 1-year interest rate currently sits at nearly 2.6%, which would be on par with the peak pre-Great Recession level of 5-year real interest rates. However, it’s worth noting that interest rate volatility is still extremely high and that forecasts are shifting constantly.

The extreme inversion of the yield curve also indicates the highly restrictive stance of monetary policy—both the 2yr/10yr and 3month/10yr yield curves are now deeply in negative territory. While yield curve inversions are not perfect recession indicators, they are an important sign that markets expect significant rate cuts from the Federal Reserve in the near future—something that usually coincides with a recession. Combined with deteriorating forecasts for real output growth, it paints a picture of highly restrictive monetary policy with elevated recession risks.

The Growth Gap

Indeed, real GDP projections from both professional forecasters and the Federal Reserve have been on a continued decline as both groups now expect extremely low growth over the coming year. The median real GDP growth estimate from professional forecasters sat at 1% when they were surveyed in November, and the median forecast from Federal Reserve officials now sits at a measly 0.5%.

Business expectations are not much better—the outlook for future business conditions is declining in Federal Reserve surveys of both manufacturers and service-sector firms. In aggregate, revenue expectations are holding up but employment expectations are rapidly deteriorating—likely indicating high inflation expectations amidst lower real growth expectations. At the moment, expectations seem closer to stagnation or slight deterioration rather than an outright recession, but they remain gloomy nonetheless.

The Other Energy Transition

The oil market will be another key area to watch out for in the coming year, especially as the US transitions from emptying the Strategic Petroleum Reserve to refilling it. The US used SPR releases to buffer against the Russian oil shock this year, but marginal oil supply will now be handed back over to the private sector in 2023—and the most recent forecasts from the Energy Information Administration expect US crude oil production to remain below pre-pandemic levels and below this year’s net-of-SPR-release-highs for the entirety of 2023.

Right now, crude oil prices have sunk to the top end of the range of the SPR’s refill target (though EIA’s forecasts don’t yet show this, a sign of how swift and volatile commodity markets have been) and the administration is officially signing contracts to begin buying up crude. Expect the SPR target refill range to act as a bit of a floor on oil prices for the time being—but volatility remains the name of the game, and the uncertainty around energy prices is likely to remain a fixture of the macro environment going into 2023.

The Most-Anticipated Recession Ever

This is arguably the most anticipated recession in modern American history, with the vast majority of companies, households, and policymakers having a negative economic outlook and preparing for the worst. That’s with good reason—I’ve been harping on this for a while, but the Federal Reserve’s own forecasts call for a recessionary increase in the unemployment rate over the next year in order to quell inflationary pressures.

Subscribing to the hard (or at least hard-ish) landing scenario is the only option that is not fighting the Fed—if you believe that a substantial real economic slowdown is required to stop inflation, or that the Fed is committed to inducing a substantial real economic slowdown, then you believe significant economic pain is coming. The hard landing scenario essentially says the Fed won’t stop until the fight on inflation is won, regardless of the damage required.

The soft landing scenario requires believing that either inflation will return to normal immaculately—without significant economic pain—or that the monetary tightening in place is already sufficient to alleviate pricing pressures. It also requires believing that the Fed will back off soon, or that the real economy will prove more resilient to rate hikes than expected. This is doubting the Fed’s stated reaction function a bit—to buy the soft landing scenario you buy that the Fed pivots at the right moment to get inflation down without causing a recession.

The no-landing scenario, by contrast, posits that inflation is more structural than widely accepted and either will not be alleviated by monetary tightening or that the Federal Reserve is not willing to accept the economic pain necessary to stop inflation. Again this scenario doubts the Fed’s stated reaction function, but in a different way—to believe no landing is coming you must believe the Fed lacks the tools or the resolve to stop today’s bout of inflation.

Either way, the best forecasts likely have to include substantially more uncertainty than is widely appreciated. The variance in outcomes—both between and within soft/hard/no-landing scenarios—is extremely high, and forecasting during the pandemic has been extremely hard. Going back to look at forecasts from last year, it is difficult to find anyone who predicted the combination of Russian-invasion-induced supply-shocks and Chinese-COVID-zero-induced demand shocks that so radically shaped the US economy over the last year. How many people in December 2022 forecasted two-quarters of negative GDP growth coupled with positive employment and manufacturing output growth? One thing about 2023 is for sure—uncertainty promises to be high, and the global economy promises to keep being weird.

Joseph created a great wagon wheel of charts that, together, help gather an organize the chaos of day-to-day economic updates. Thanks (as usual) for organizing my uncertainty!

Inflation is a monetary phenomenon. Why do you not even mention money supply, IOER, or NGDP? If we contain NGDP, we contain inflation. Containing NGDP means containing monetary variables, as amplified by fiscal policy. It's pretty simple. I understand if you think this framework is bogus, but why not take the time to refute it?