The British Economy Was Stronger Than We Thought

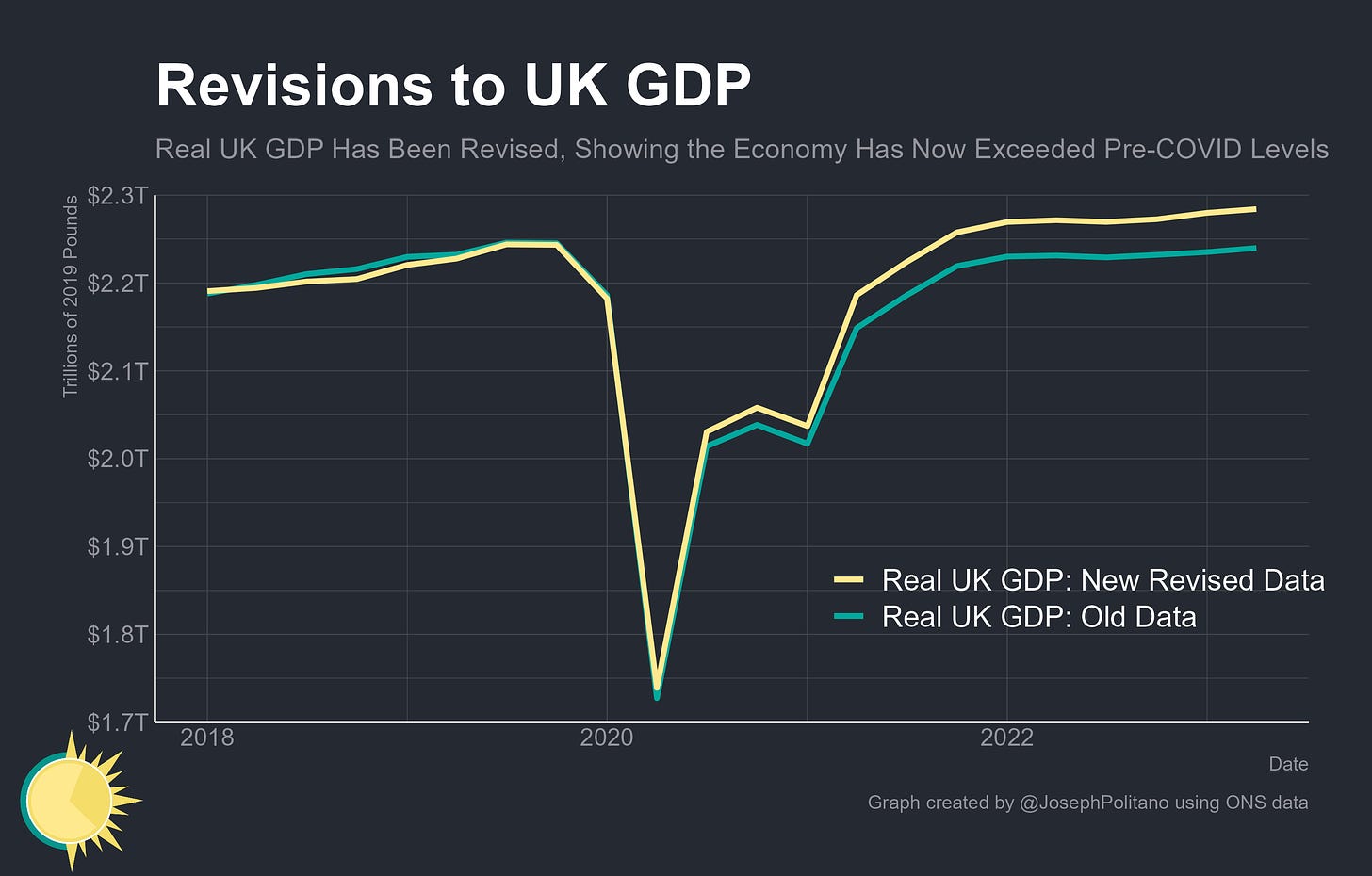

Revisions to British GDP Point to a Full Recovery From COVID in 2021—Despite A Larger Impact Of the Energy Crisis

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 35,000 people who read Apricitas weekly!

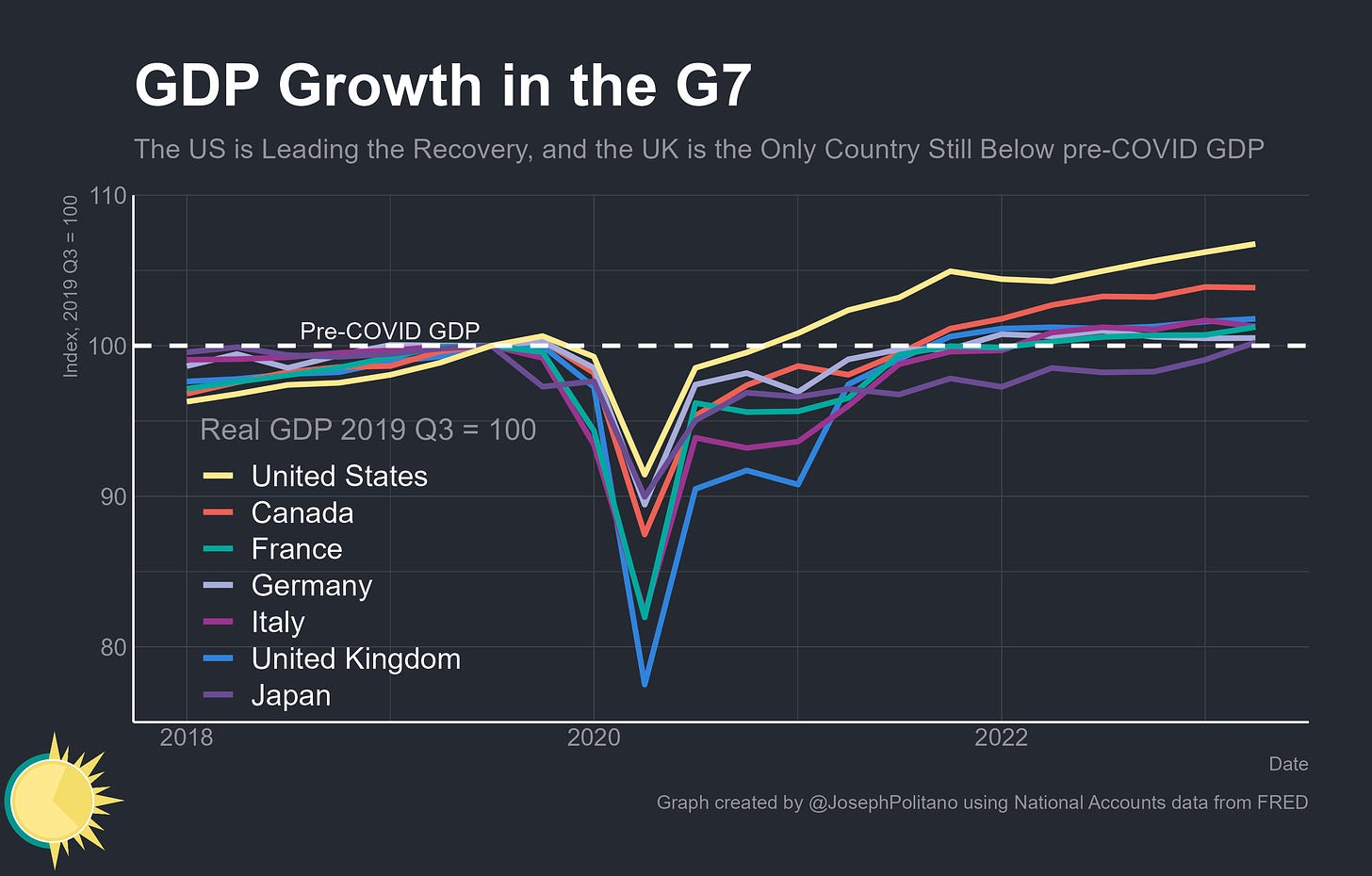

Sentiment about the British economy has been extremely low over the last few years—the country has been through an energy crisis, a massive cost of living crisis, a financial markets crisis, a healthcare crisis, several subsequent political crises, and much more. It didn’t help that British economic growth had seemed almost catastrophically weak, especially when compared to the US but even when measured against its continental European neighbors. The UK was one of just a small handful of major economies that had still not returned to 2019 output levels after nearly four years, and the extremely gloomy projections from the Bank of England (BoE) earlier this year foretold of a lost decade for the nation's growth.

However, last week the UK Office of National Statistics (ONS) updated its data based on details from Blue Book 2023—their annual national accounts—which included some methodological changes alongside large revisions to GDP based on the incorporation of new, comprehensive data. Most important is the addition of Supply-and-Use Tables (SUTs) for 2021—essentially, detailed data on the use of goods and services within the economy and their respective prices. The revisions suggest a radically different path for GDP than previously shown, where instead of UK economic output remaining stuck slightly below pre-pandemic levels, the British economy had actually completely recovered from the pandemic by the end of 2021 before slowing in 2022/2023.

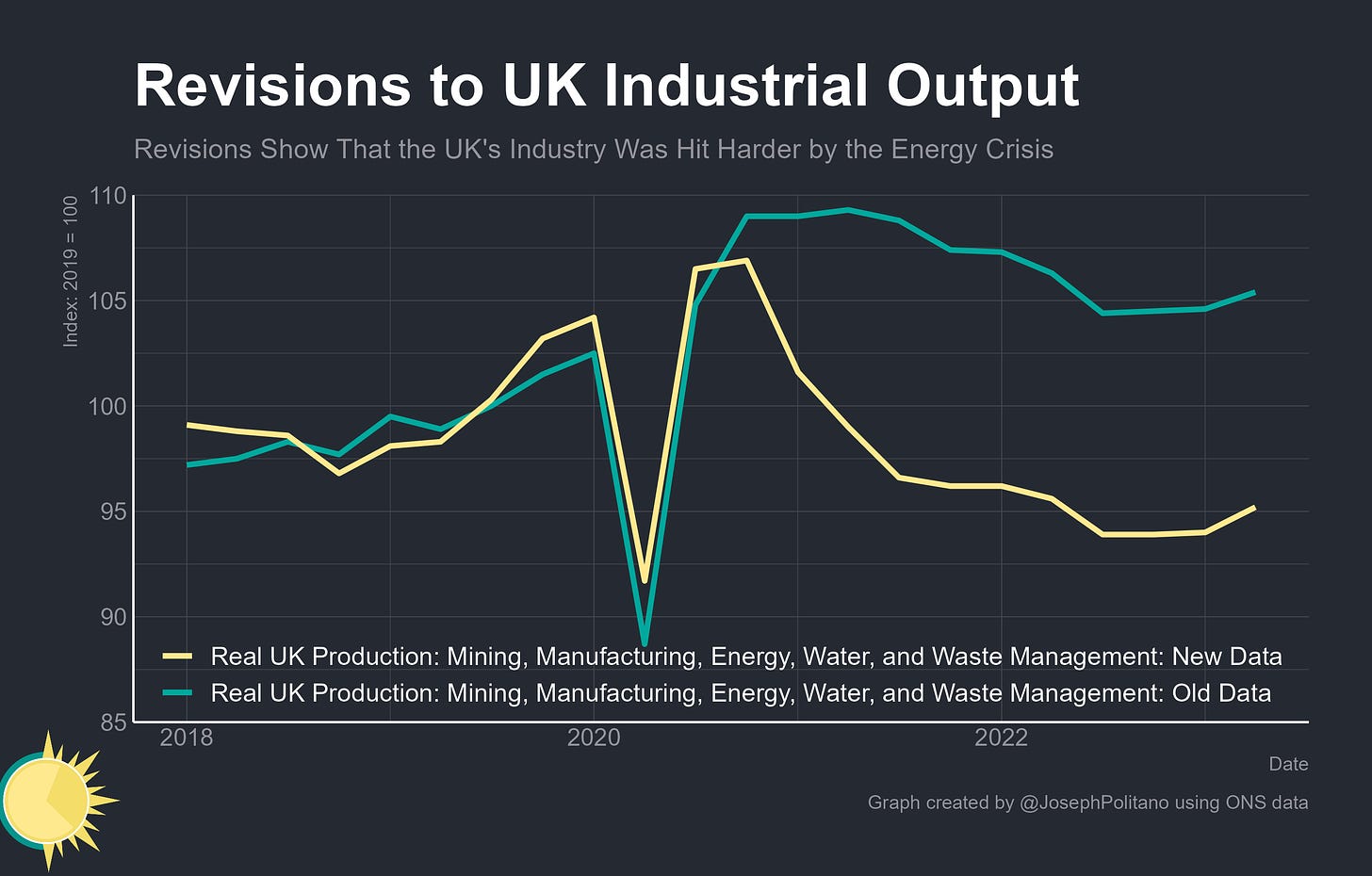

These revisions, alongside the improving global and UK-specific economic outlook, are good news for the nation’s economy—but they do not mean all is well in the British Isles. The boost in output measurements has only brought growth to the high end of the low European average, hasn’t changed the fact that UK GDP has barely grown since Russia’s invasion of Ukraine in early 2022, and only partially closed the large gap between recent UK and US growth. The new data also indicated a significantly larger impact of the energy crisis on British industry and did not erase the persistent weakness in real household consumption. Even post-revision, British GDP per capita remains ever so slightly below the pre-pandemic peak, and the UK is still the only G7 member whose employment rates have not recovered to 2019 levels. Perhaps the most optimistic signal for the UK, however, comes from the fact that real fixed investment has finally burst out from the slump it's been stuck in since the Brexit vote 7 years ago.

The NHS, Brexit, and The Energy Crisis

Measuring the economy is tricky at the best of times, and only gets more difficult when there are rapid shifts in the fundamental state of the economy. It’s therefore no accident that most of the major revisions to British GDP came from the areas most affected by the pandemic, supply-chain disruptions, and the recent energy crisis.

Net upward revisions were particularly strong in the services sector, with growth in output volumes being revised up 3.9% for 2021, and the single largest source of the upward revisions came from better measurements of prices and inventories across the retail and wholesale trade services sector. In particular, the real margins for goods distributors were increased significantly thanks to benchmarked data from the SUTs. Keep in mind that this measure reflects the services performed by retailers and wholesalers for the transportation, distribution, and sale of retail goods, not the direct final consumption of goods by British consumers, which did not see comparatively large revisions.

These updates to retail and wholesale data, alongside improvements to the methodological tracking of output moving via high-complexity global supply chains, also significantly upgraded estimates of British exports. Although growth is still struggling amidst the weakness of British industry and the ongoing effects of Brexit, revisions make it so exports actually peaked above 2019 levels in late 2022.

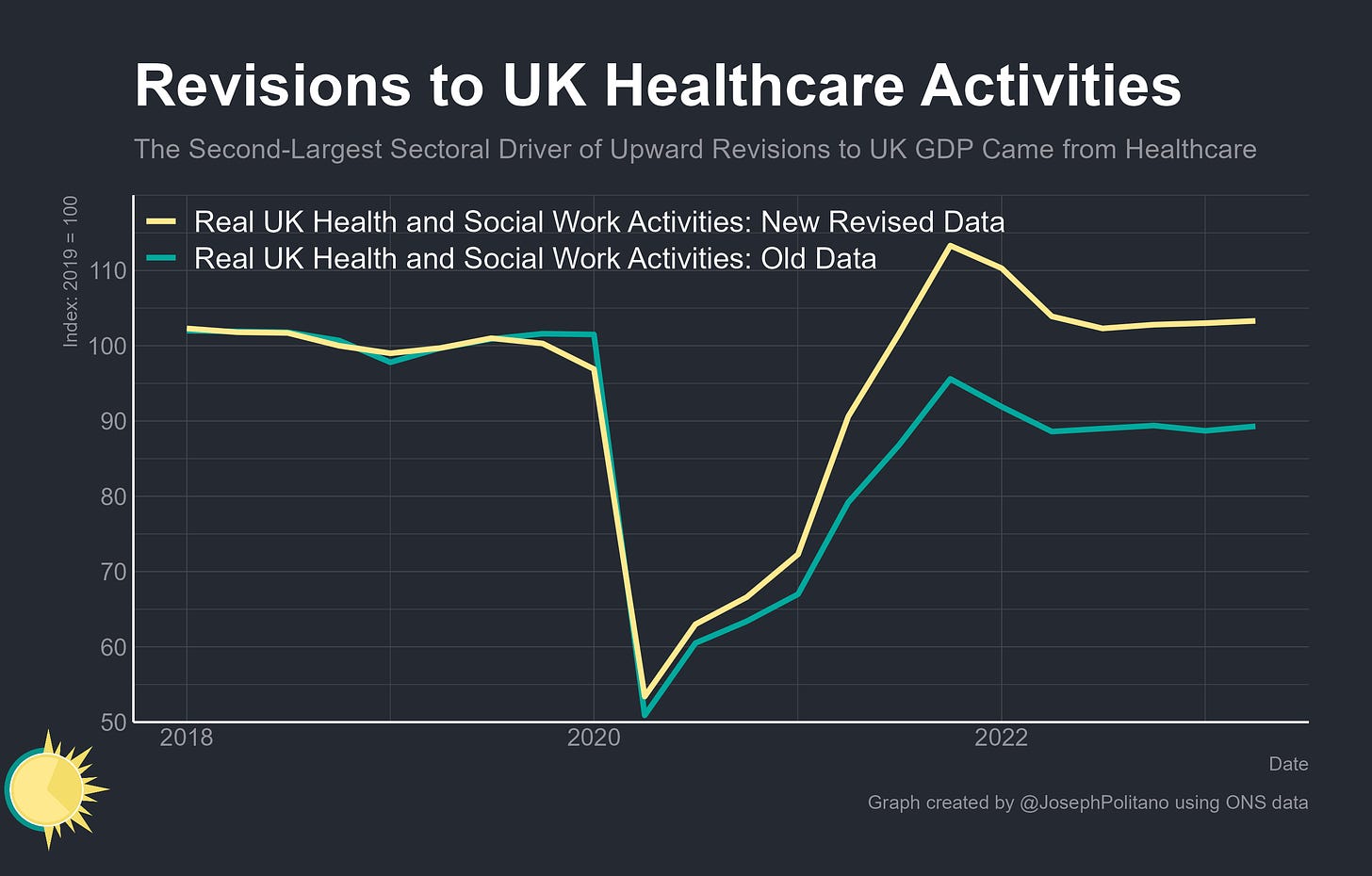

The ONS also heavily revised upward its estimates for healthcare and social services output growth in 2021, when vaccine deployments were rapidly ramping up and patients were more able to obtain non-emergency treatments. In particular, the revisions saw higher-than-previous growth in private-sector healthcare output and more productive use of intermediate inputs.

Yet in contrast with the large upward revisions to the UK’s service sector, the real output of British industry has been heavily revised downward, reflecting the confluence of supply chain issues and energy shortages that have plagued the sector across the last two years.

Keep reading with a 7-day free trial

Subscribe to Apricitas Economics to keep reading this post and get 7 days of free access to the full post archives.