The Disinflationary Process Continues

Headline US Inflation Keeps Cooling Down, and Core Inflation is Finally Showing Some Positive Signs

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 26,000 people who read Apricitas weekly!

Otherwise, liking or sharing is the best way to support my work. Thank you!

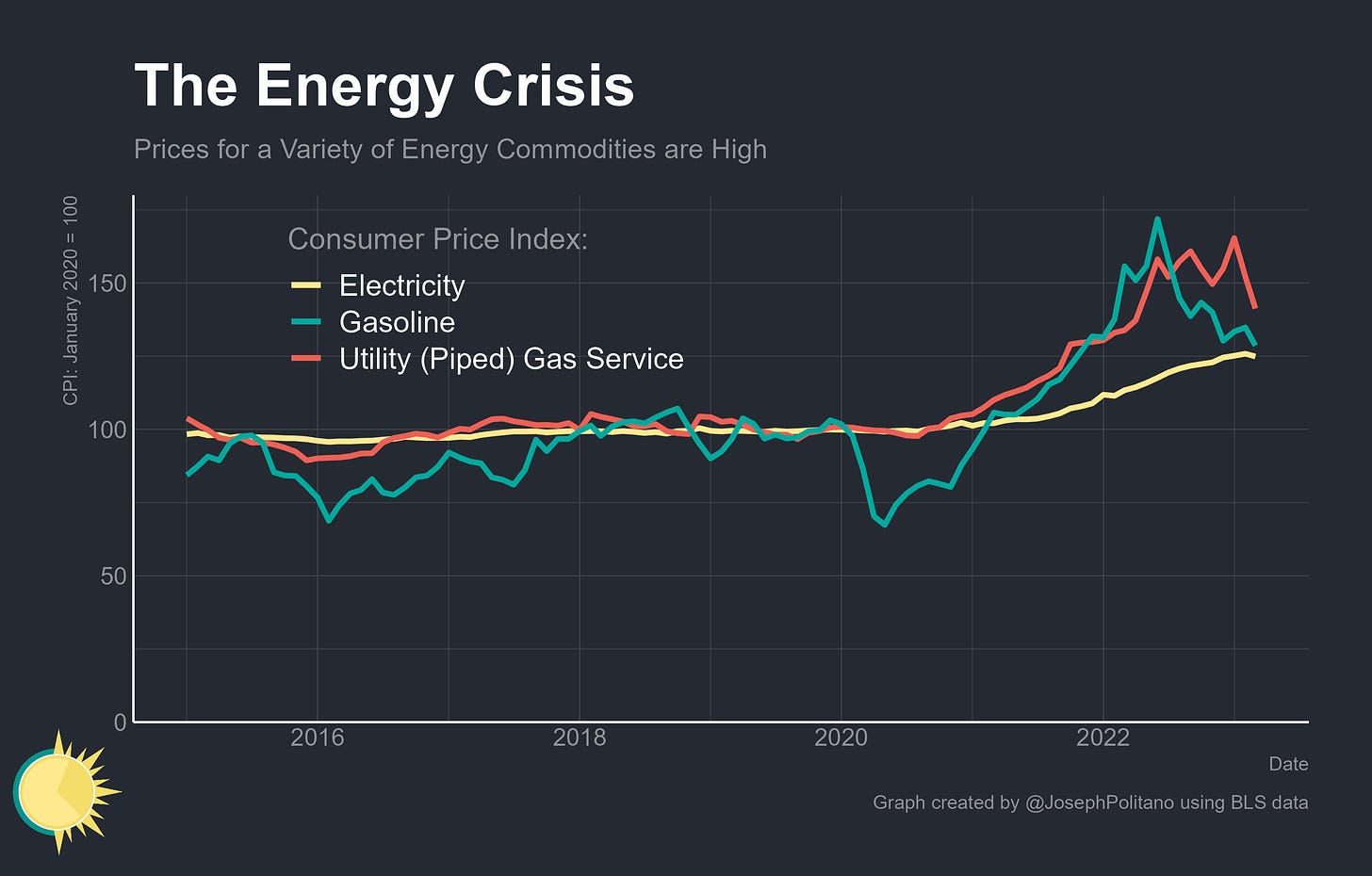

US inflation continues to cool down; year-on-year growth in the consumer price index has shrunk from a peak of 9.1% in June 2022 to just below 5% today. For the first time since January of 2021, energy is cheaper than it was last year thanks in large part to the fall in energy prices since their initial runup caused by the Russian invasion of Ukraine. Prices for core manufactured goods have also stabilized as supply chains improve, with falls in used car prices nearly fully offsetting rises in other goods.

Food inflation appears to be cooling as well—for the first time since November 2020, prices for at-home food items actually declined over the last month. Eggs, milk, meat, fruits, and vegetables all got cheaper in March as the dislocations in agricultural markets continued to fade, and falling prices for inputs like fertilizer suggests more stabilization could be on the way. If it continues, that should provide a headwind to inflation in restaurants and other food services businesses going forward.

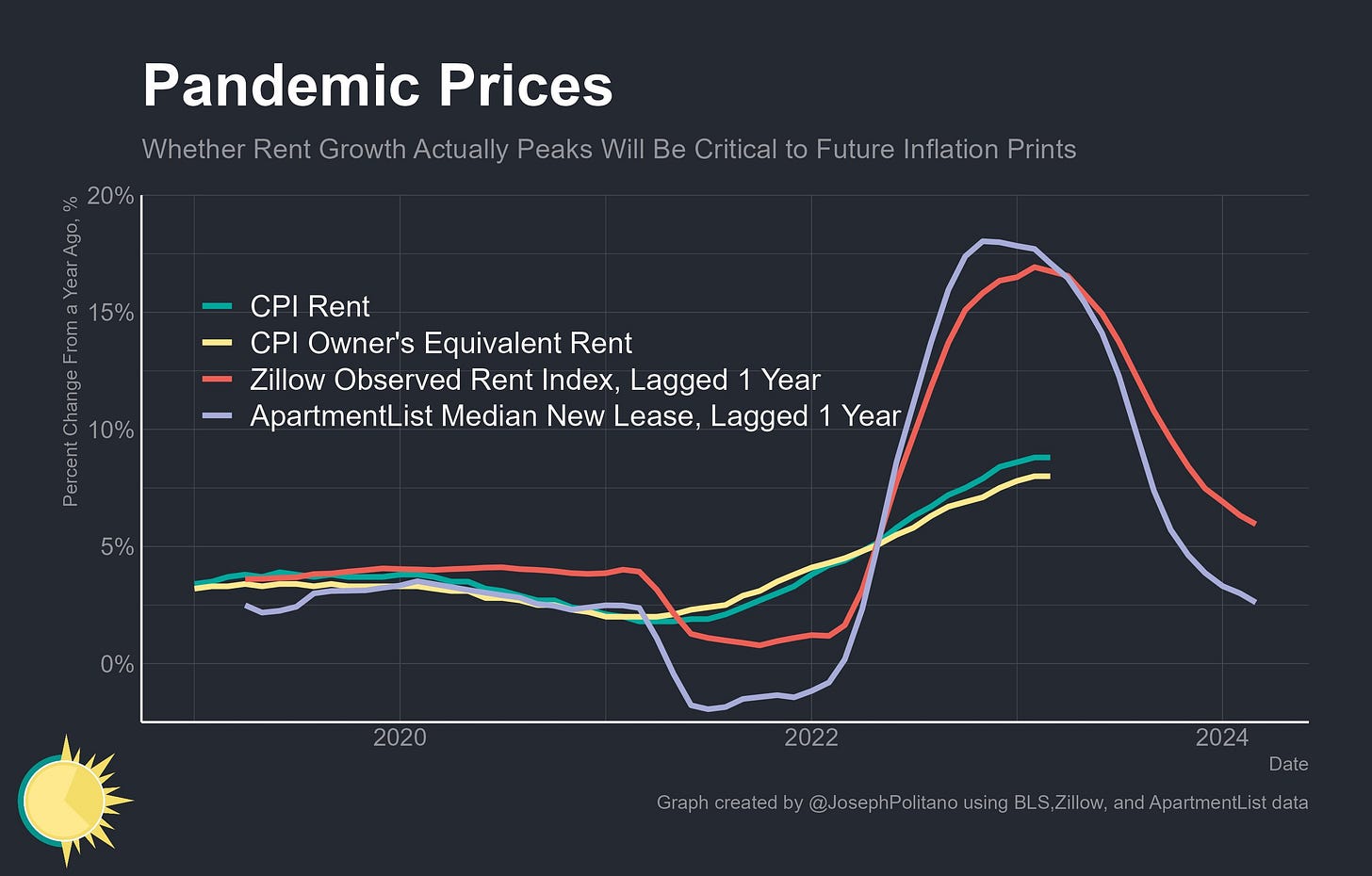

Inflation in core services—the kind of cyclical prices for housing and labor-intensive services that are most influenced by monetary policy—is also showing some positive signs. Annual core services inflation declined for the first time since August 2021 thanks in large part to a cooler print from housing prices. Indeed, we might be near or past peak rental inflation, as data from new leases over the last year suggests more normalization is on the way for official rent inflation. Inflation in core services ex-housing, which the Federal Reserve believes best reflects labor-cost-driven price pressures, remains high but may start cooling as declining wage growth passes through to prices.

At the February FOMC meeting, Jerome Powell said that “the disinflationary process has begun”—and since then the process has continued, albeit bumpily and slower than previously anticipated. Inflation itself has continued to fall, near-term business inflation expectations have continued moderating, wage growth has decelerated, and credit conditions have tightened (especially in the wake of Silicon Valley Bank's failure). There's still nowhere near enough progress to consider excess inflation vanquished—indeed, Fed staff members now believe it will require a “mild recession” this year to achieve that outcome—but the effects of tighter monetary policy on inflation are finally being felt in a big way.

Cooling Core Inflation

Broadly speaking, monetary policy has the most direct effect on prices for rents and other core services through its influence over aggregate nominal consumer income and spending. These cyclical prices made up a small share of the early-pandemic-era inflationary surge compared to idiosyncratic shocks to food, goods, and energy prices, but today increases in cyclical core services prices make up the bulk of CPI inflation.

Most of the recent decline in inflation has likewise represented the fading of idiosyncratic shocks to aggregate supply—core goods inflation cooling as supply chains improve, energy prices declining as oil market dislocations fade, and food prices stabilizing after the Russian invasion of Ukraine. Monthly headline inflation was essentially entirely propped up by rising prices for housing and other services, for which there has been relatively little relief for most of the last 12 months.

However, this month’s CPI report showed some long-awaited signs of improvement in core services inflation. Year-on-year housing inflation appears to be at or near peak levels—growth in new lease prices, which tends to lead official housing inflation data by one year, peaked around this time in 2022.

Indeed, March saw the lowest one-month increase in the housing rental subcomponents of the CPI in a year, with growth dipping below 0.5%. If that continues, year-on-year growth in headline and core inflation can meaningfully decline over the next few months—housing prices alone make up 1/3 of the CPI basket, practically as much as food and core goods combined. New lease prices will also likely feel marginally less upward pressure in the near future as wage growth, employment gains, and household formation all decelerate (though for the time being remain above pre-pandemic norms), which will pass through to CPI housing metrics over the next year.

Nonhousing services inflation, too, is cooling off thanks in large part to how the CPI measures medical care services prices. Outside of medical care services, however, there has been much less relief—inflation in personal care services and recreational services, which are among the most labor-intensive services in the CPI, has remained at or near modern highs over the past several months. Still, wage and gross labor income growth continue to decelerate, with quarterly growth in average hourly earnings in particular declining to levels consistent with pre-pandemic peaks. To the extent these prices are wage-cost-driven, they should cool more going forward.

Fading Supply Shocks

Still, it’s worth remembering that the bulk of the disinflation America has seen so far has come from improvements in supply factors as supply chains heal and dislocations from the Russian invasion of Ukraine fade. Energy prices, which at peak were more than enough to push inflation above the Fed’s 2% target on their own, are now pulling inflation downwards for the first time in years.

In fact, US electricity prices fell for the first time since January 2022 last month as the effects of significant declines in natural gas prices, among other factors, pull power costs downward. Utility gas bills have also plummeted as natural gas prices fall, hitting the lowest levels since April of last year. Gasoline prices have also fallen 12% over the last twelve months and crude oil prices have fallen 15% as the initial impacts of Russia’s invasion of Ukraine on oil markets fade, all of which will pass through to other components of inflation as costs decline for many businesses.

Prices for used motor vehicles also continued to decline as the effects of supply-chain improvements passed through to the auto market, but it’s unlikely we’ll see much relief on this front in the near future. American vehicle production remains below pre-pandemic norms even as supply chains improve, and wholesale used car prices have been rising substantially over the last few months. Declines in dealership markups for used vehicles might explain some of the recent divergence between wholesale and retail prices, but it’s unlikely that significant further relief can come from margin adjustment alone.

Meanwhile, food price inflation also continues to decline as the disruptions in global agricultural markets from Russia’s invasion of Ukraine fade. Inflation in the meats & eggs and fruits & vegetables categories sit at the lowest level in more than a year, and price growth in the dairy and cereals categories has also declined substantially.

That food disinflation should help stabilize restaurant prices, which have been skyrocketing over the last two years. Prices for full-service meals, in general, can provide a good gauge of headline inflation as restaurant inputs are a wide cross-section of labor, rent, food, transportation, and energy prices and food service tends to be a very competitive industry with many market players. So far, restaurant inflation is high but down from prior peaks—prices have increased 8% over the last year and 3.5% over the last 6 months.

Great (Inflation) Expectations

Markets and businesses, critically, expect disinflation to continue in the near future, although they still see inflation remaining above the Fed’s 2% target for a while. The Atlanta Fed’s business inflation expectations survey, which asks businesses to forecast movements in their own unit costs, shows forecasted price increases hitting the lowest levels since mid-2021. This measure is more robust and predictive than the consumer inflation expectations metrics that have spiked up again in recent months.

Short-run market-based inflation forecasts also see disinflation in the pipeline, though they have become less optimistic than at the start of the year. ICE’s US Dollar Inflation Expectations Index, which derives inflation expectations from a variety of financial market data, sees CPI inflation slowing to just above 3% by year-end. That’s a substantial increase above the less-than-2.5% expected at the start of the year, but still would represent a significant slowing of inflation.

Plus, longer-run market-based inflation expectations remain extremely well anchored. Breakeven inflation rates derived from treasury bonds remain at the low end of levels consistent with 2% target inflation for both the 5-year and 5-year, 5-year forward (i.e. the 5-year period starting in 2028) time horizons. In other words, markets remain confident that the Fed will be able to reign in price growth, even if the disinflationary process will still take some time.

New to the newsletter and really enjoying it. Thanks and great insight!!

Great post Joey! Love your newsletter.