The Multifamily Supply Surge—and Credit Crunch

US Multifamily Housing Completions are at 50-Year Highs, But Tighter Credit Has Significantly Reduced Starts & Permits

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 40,000 people who read Apricitas weekly!

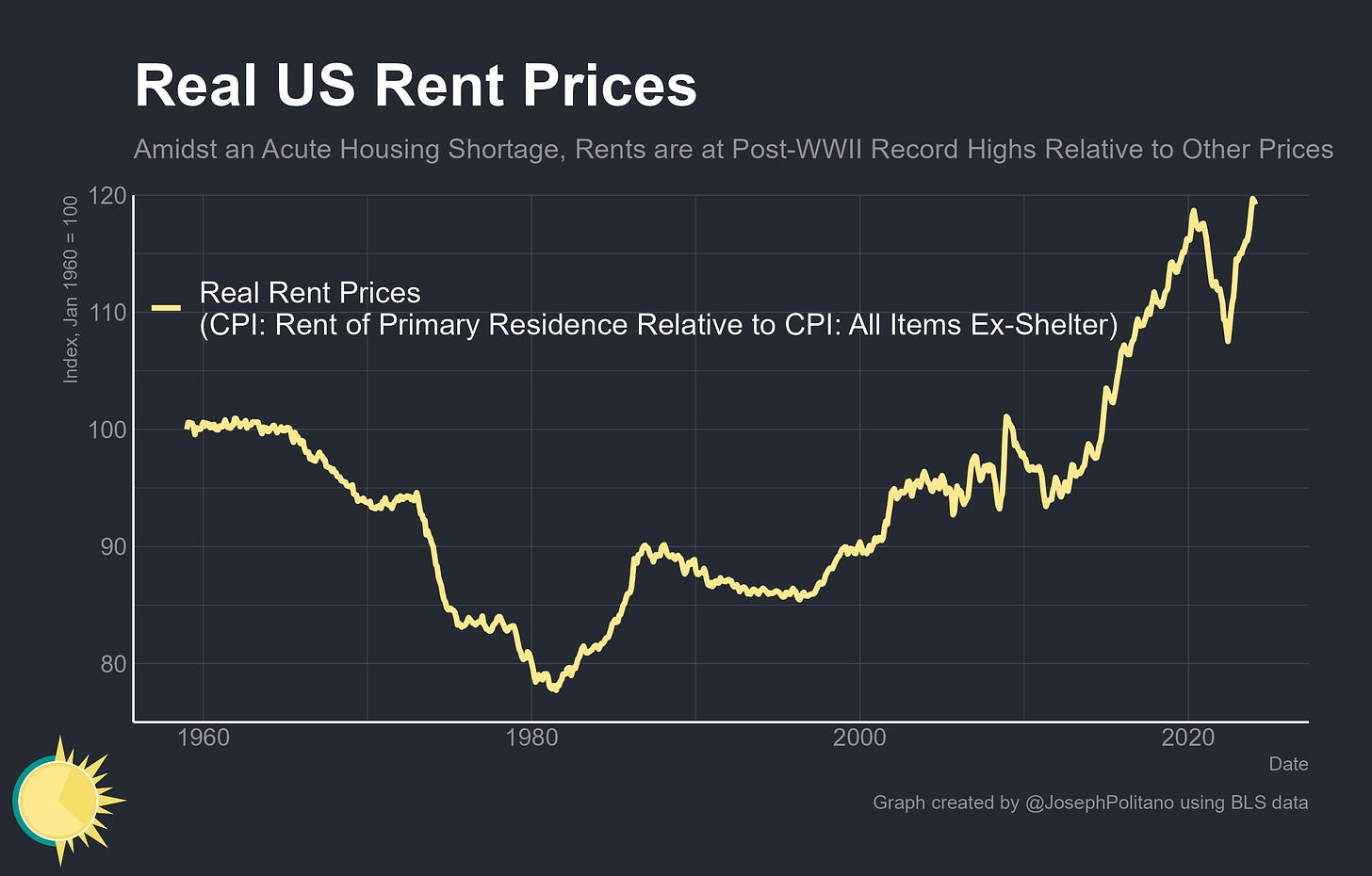

America has a massive housing shortage—the country has built millions of homes fewer than necessary over the last decade and a half, which has driven real home prices and rents well above their long-term average. That shortage, combined with the tightening of mortgage lending standards post-2008 and economic changes that recentered growth around major urban areas, also shifted demand previously channeled into suburban single-family construction into new apartment buildings.

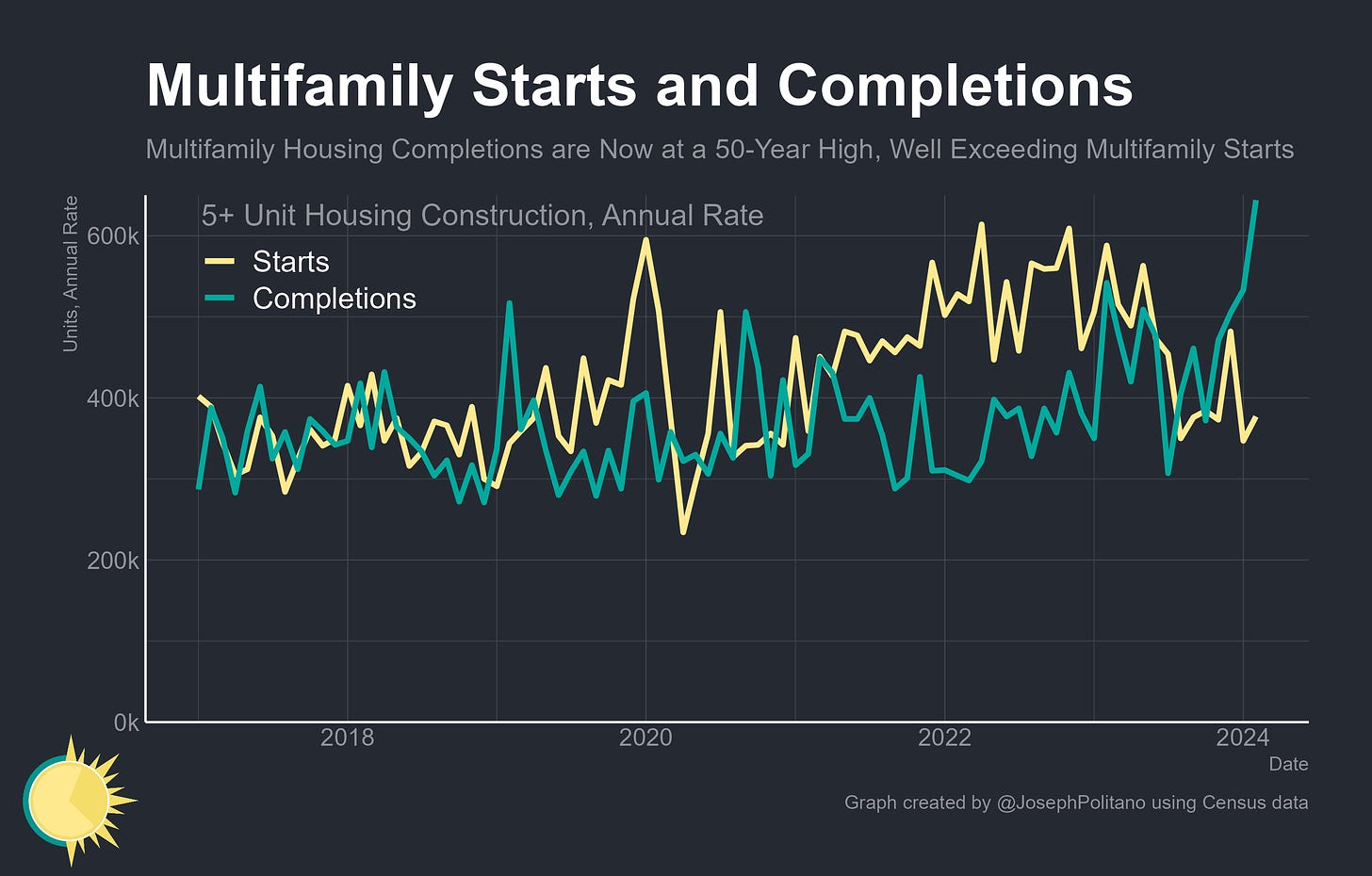

In 2021, the US permitted 568k apartment units, the highest level since 1986, and then set another modern high by permitting 636k in 2022. Real fixed investment in multifamily construction climbed more than 30% between 2019 and 2023, easily surpassing the pre-Great Recession peak. Today, those projects started in 2021/2022 are finally paying dividends as new units come online—apartment completions hit a 50-year high in February, approaching a rate of 650k per year.

That surge in completions, combined with a slowdown in income and employment growth, is helping to steadily cool US rental inflation. Indices of newly signed rental prices from Zillow and ApartmentList both show prices increasing at a slower rate than the pre-pandemic norm and well below their 2022 peaks. That is actually a somewhat unusual situation—in the short term, the kind of tighter monetary policy we’ve seen over the last few years can increase measured housing inflation by driving would-be buyers into the rental market and cutting the production of new housing units. Yet while higher mortgage rates have certainly suppressed US homebuyer activity, they have not yet reduced the supply of newly-completed rental units.

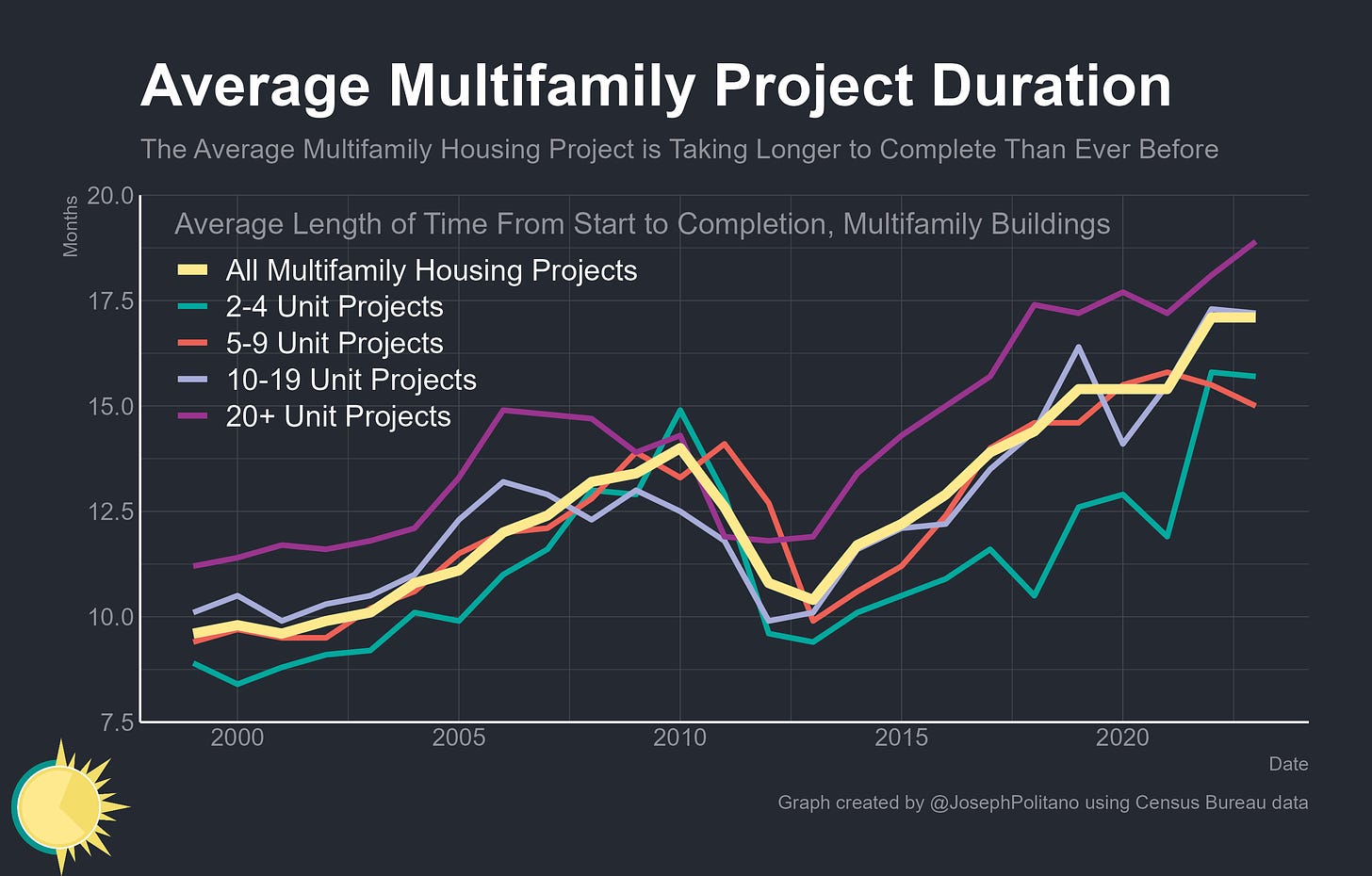

Part of the reason why is that US housing construction projects have been taking longer to complete over time, a trend compounded by the supply-chain snarls seen throughout the pandemic. The average multifamily project completed in 2023 took more than 17 months to build, up from 15.4 months in 2020 and less than 10 months at the turn of the millennium. Longer construction times have effectively increased the lag between the credit conditions for homebuilders and the number of units actually delivered to market—in effect, many of last year’s completions began under the monetary policy of late 2021 and early 2022.

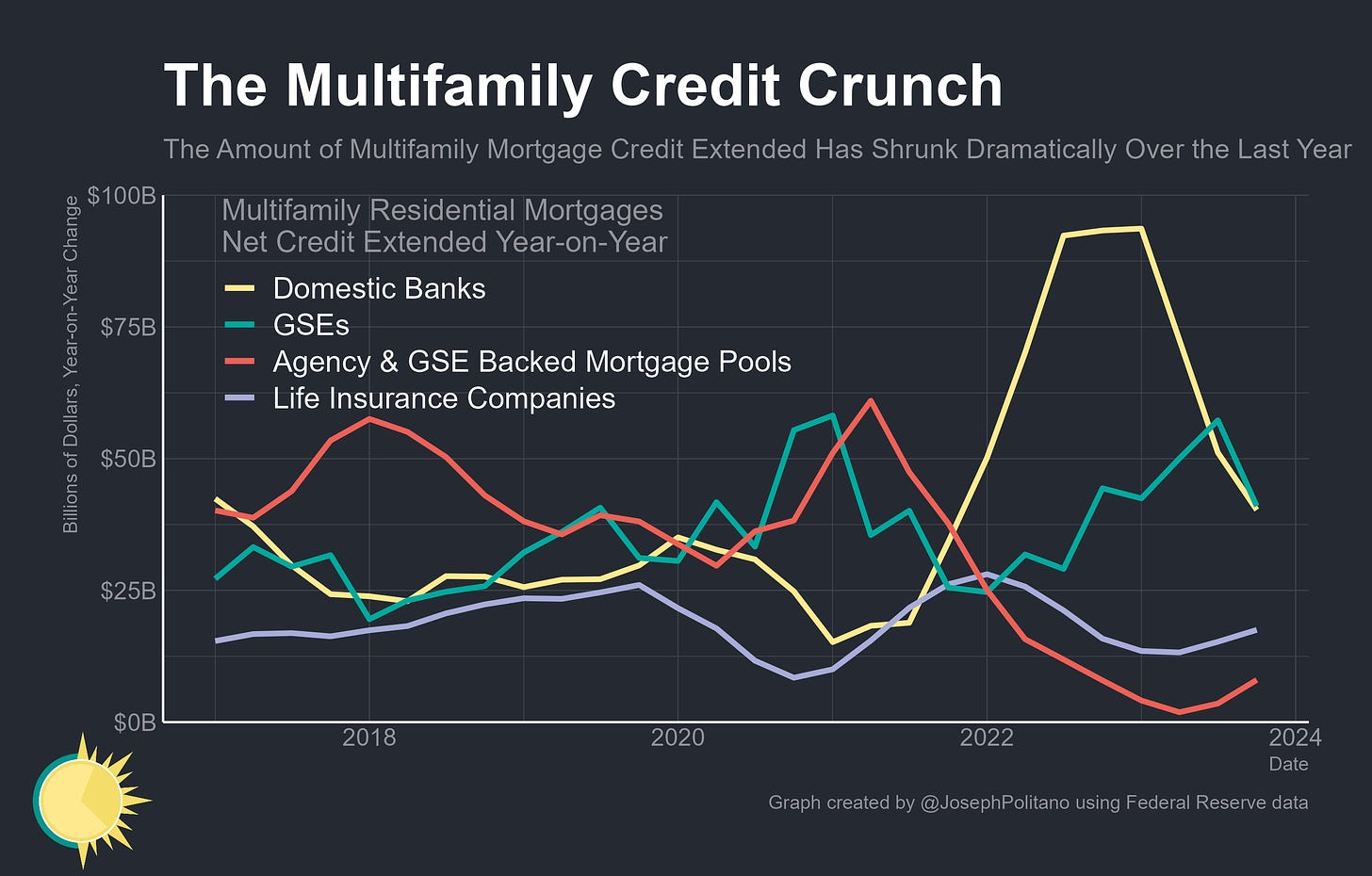

Yet make no mistake, more restrictive monetary policy has already caused a credit crunch in the apartment sector even though it has yet to impact completions. Net lending to the multifamily construction industry has fallen significantly over the last year, with financial institutions rapidly tightening their lending standards for real estate projects. The slowdown in net bank lending has been particularly acute, cooling from a pace of roughly $90B per year all the way down to less than $40B—and delinquencies, while still low by historical standards, are now rising.

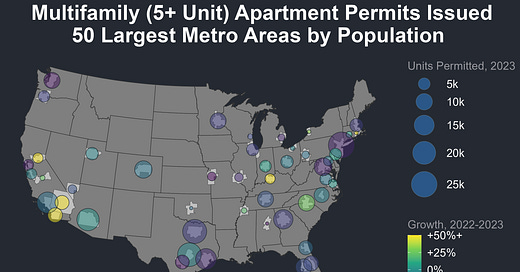

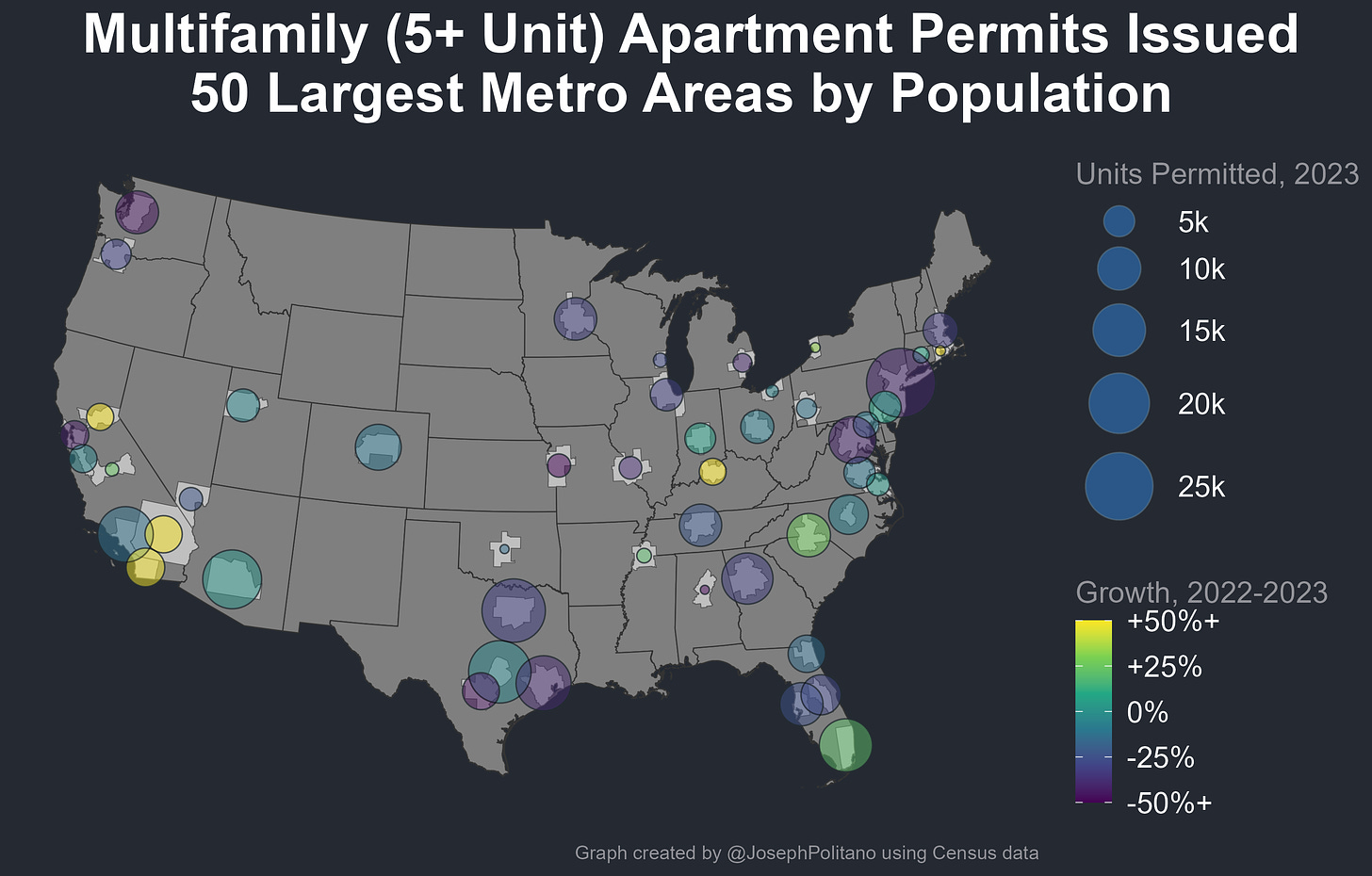

Tighter credit and slowing rent growth significantly reduced multifamily starts and permitting activity throughout the US last year. Among America’s largest metropolitan areas, multifamily apartment permits dropped 45% in Seattle, 44% in San Francisco, 42% in DC, 41% in New York, 39% in Houston, 33% in Boston, 32% in Atlanta, and 32% in Chicago between 2022 and 2023. Some major construction centers (like Austin, Phoenix, and Raleigh) have seen permitting activity hold steady and some others (like Miami, Charlotte, and secondary cities throughout California) have even seen permitting increase—yet the overall trend is one where apartment permitting has declined all the way back to pre-COVID levels. There is still a pipeline of nearly 1M apartment units currently under construction that should keep completions high for the time being, but absent a pickup in starts soon new apartment supply could fall significantly next year.

Breaking Down The Supply Surge & Credit Crunch

Keep reading with a 7-day free trial

Subscribe to Apricitas Economics to keep reading this post and get 7 days of free access to the full post archives.