The State of America's Labor Market

Employment is Mostly Holding Up, but Key Sectors are Shrinking or Slowing, and Gaps in the Data Remain

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 19,000 people who read Apricitas weekly!

Otherwise, liking or sharing is the best way to support my work. Thank you!

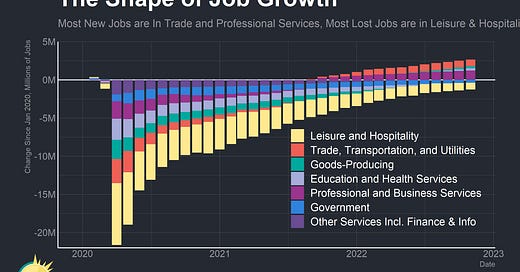

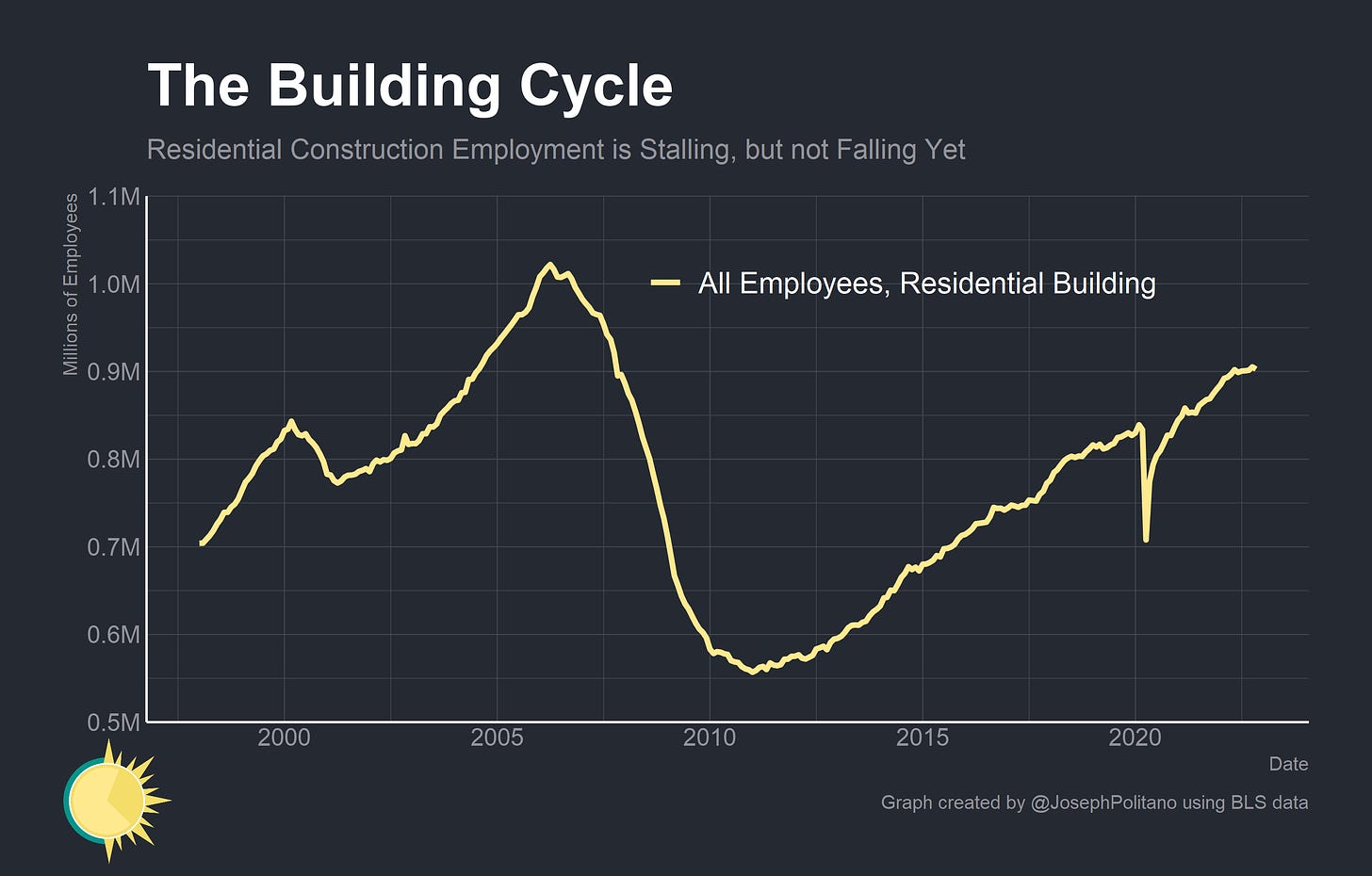

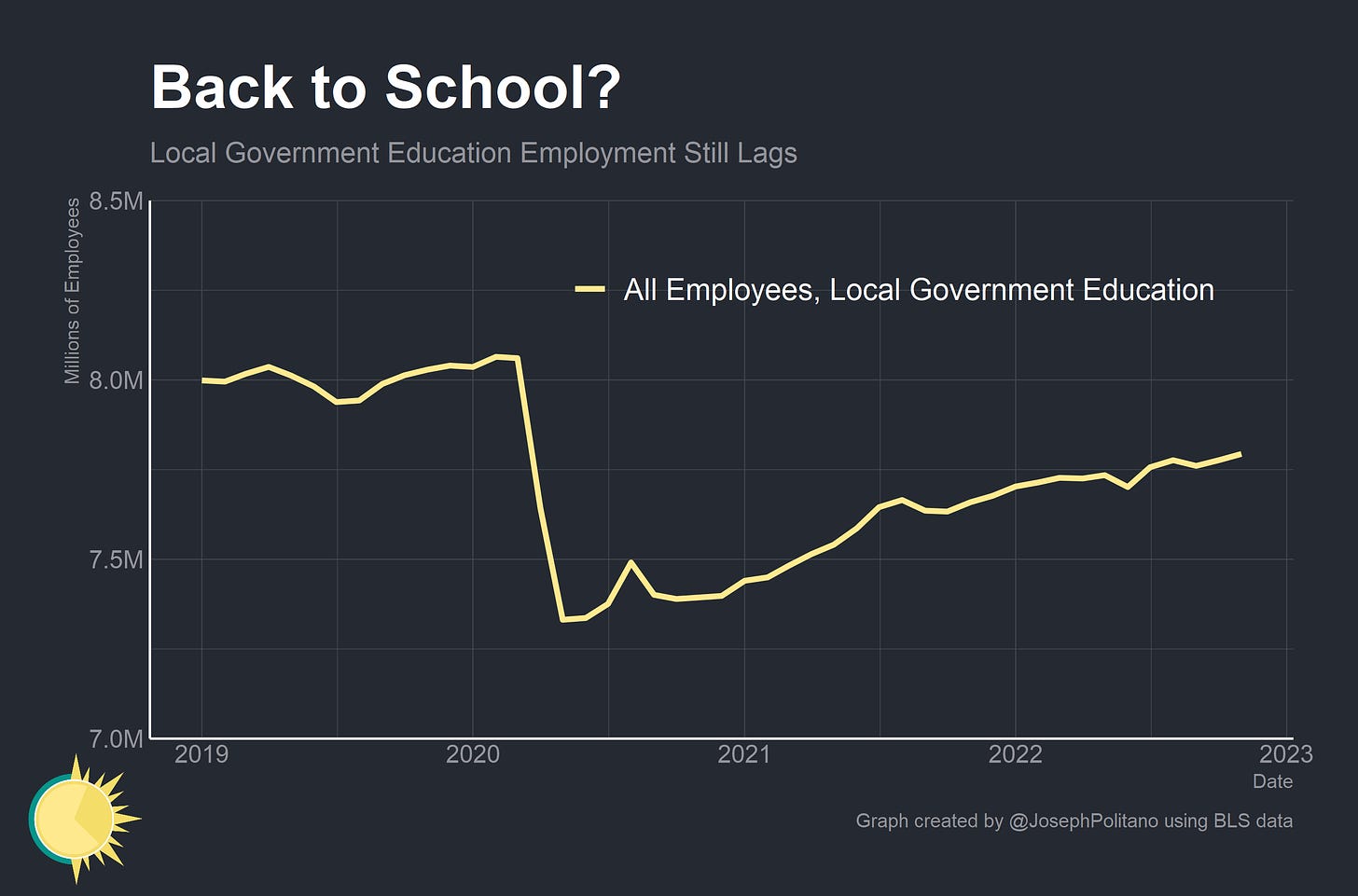

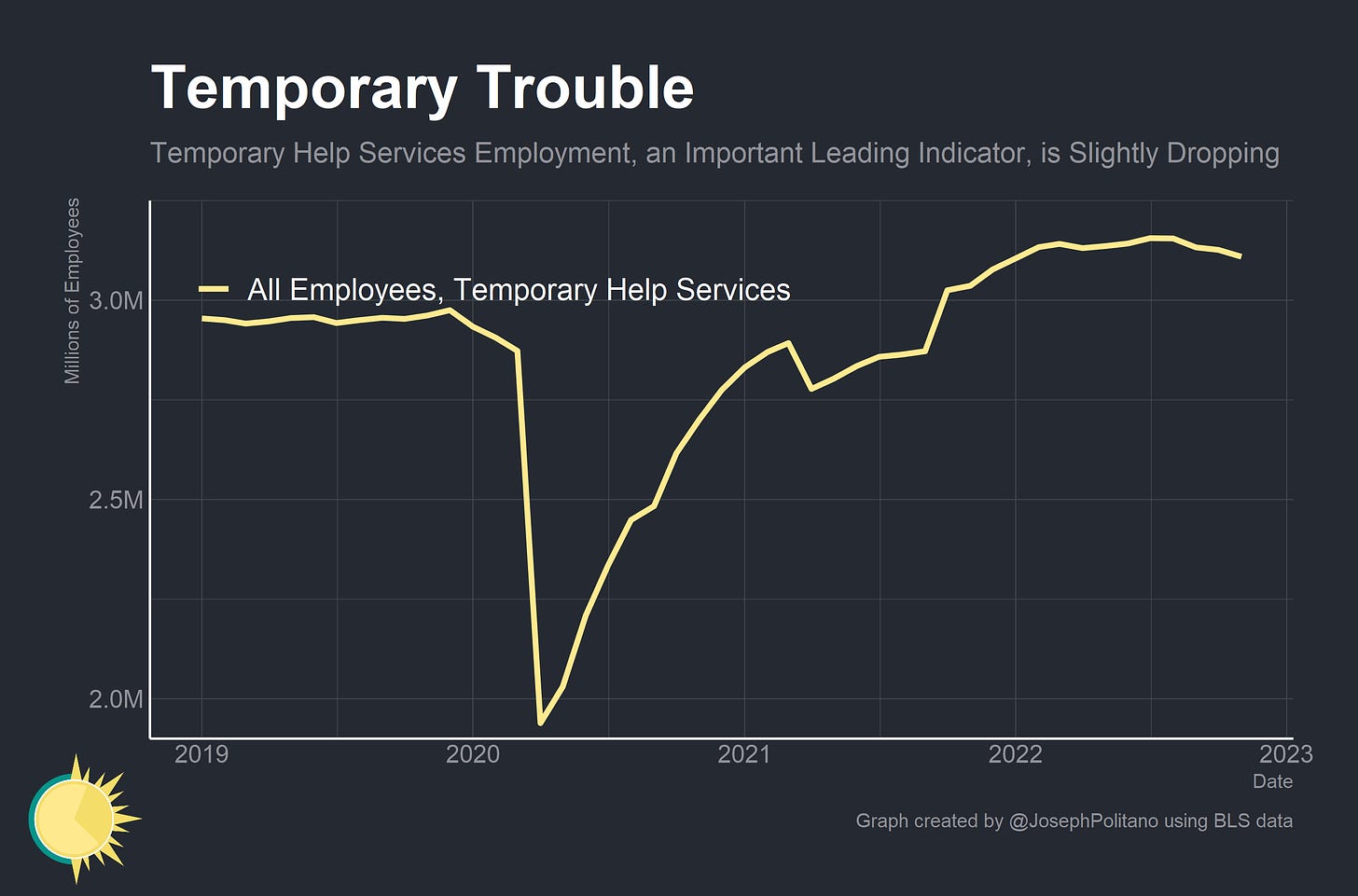

Since the start of this year, a slowdown in the broader economy has been accompanied by comparatively strong payroll growth. However, the aggregate strength belies some weakness in key sectors as the effects of interest rate hikes work their way through the economy. Residential construction employment has stagnated as mortgage rates rise and housing starts fall. Truck transportation and warehouse employment are both declining as the pandemic-driven goods boom wanes. Employment in local government education—America’s K-12 school system—has still not recovered to pre-pandemic levels. And even employment growth in major sectors like professional and business services has seemingly slowed. Watching these key sectors will be critical to spotting leading signs of possible deterioration in America’s employment situation and evaluating recession risks for the upcoming year.

In addition, key questions about the data itself remain going into the new year. Surveys of households are still showing much weaker employment growth than surveys of businesses, and the path of wage growth is still unclear amidst shifts in stock options, signing bonuses, and other irregular payments. That leaves big questions on the pace of aggregate wage growth—and therefore the future path of inflation.

Where the Labor Market is Slowing

Job growth over the last year has been fairly robust and broad-based as all major industries continued to recover from the recession. In particular, major gains have come from education & health services (which mostly reflects hiring at hospitals, nursing homes, and residential care facilities) and leisure & hospitality (which mostly reflects job growth in food service and in-person entertainment).

Most industries have now returned to their pre-pandemic employment levels, with a few notable exceptions. Leisure and hospitality is the big laggard as reductions in in-person entertainment spending, shifts in food consumption behavior to delivery, and fierce competition on wages move workers out of the industry. On the flip side, employment in professional & business services has more than fully recovered as the industry’s long growth trend continued through the pandemic—accelerated by the proliferation of remote work. Trade, transportation, and utilities employment has also exceeded its pre-pandemic employment level, its pre-pandemic growth trend supercharged by increased spending on consumer goods and household delivery.

However, the story is not all sunny. Employment in some key goods-related sectors is now stagnating or shrinking as consumption habits slowly rebalance away from goods and towards services. Truck transportation is one great example—the addition of small or owner-operated trucking firms has been the source of large amounts of marginal land transportation capacity during the pandemic but employment is now stagnating as goods demand growth wanes. The effect in warehousing has been even starker—just as with trucking, warehousing employment was propelled forward by the boom in goods spending during the pandemic, and just as with trucking, employment in the sector is suffering. The difference is that while trucking employment is stagnating, warehousing employment is actively shrinking headed into the holiday season.

Residential construction is another major sector where employment is stagnating, which is important given how much of an early indicator it has been for housing-driven business cycles. Rising mortgage rates have caused single-family housing starts to drop nearly 30% from the start of this year, and it is only the record-breaking backlog of units under construction that is likely keeping employment from dropping.

Local government employment also remains well below pre-pandemic levels as K-12 schools struggle to retain teachers, janitorial staff, bus drivers, and other support workers. Issues with public school work quality and pay during the pandemic have given many schools trouble in trying to fill critical positions.

Finally, temporary help services employment has also started to shrink marginally in recent months. Temp help plays an important role as an leading employment indicator for professional industries, as marginal drops in labor demand tend to manifest first in reduced temp help demand before direct hiring slowdowns or layoffs. Although the industry has more than recovered to pre-pandemic levels—actually setting a record high earlier this year—it has lost about 50,000 employees since August. That coincides with a significant slowdown in employment growth in professional and business services, which added only 6,000 workers in November. Still, overall wage and employment growth remains strong—possibly too strong for the Federal Reserve’s tastes as the Fed continues its fight against inflation.

Keep reading with a 7-day free trial

Subscribe to Apricitas Economics to keep reading this post and get 7 days of free access to the full post archives.