Trump's 2nd Trade War Begins

A Detailed Look at the Economic Impacts of Trump's Wide Ranging New Tariffs on China, Mexico, Canada, Steel, Aluminum, and Much More

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 57,000 people who read Apricitas!

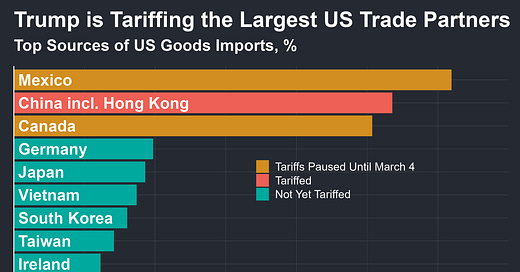

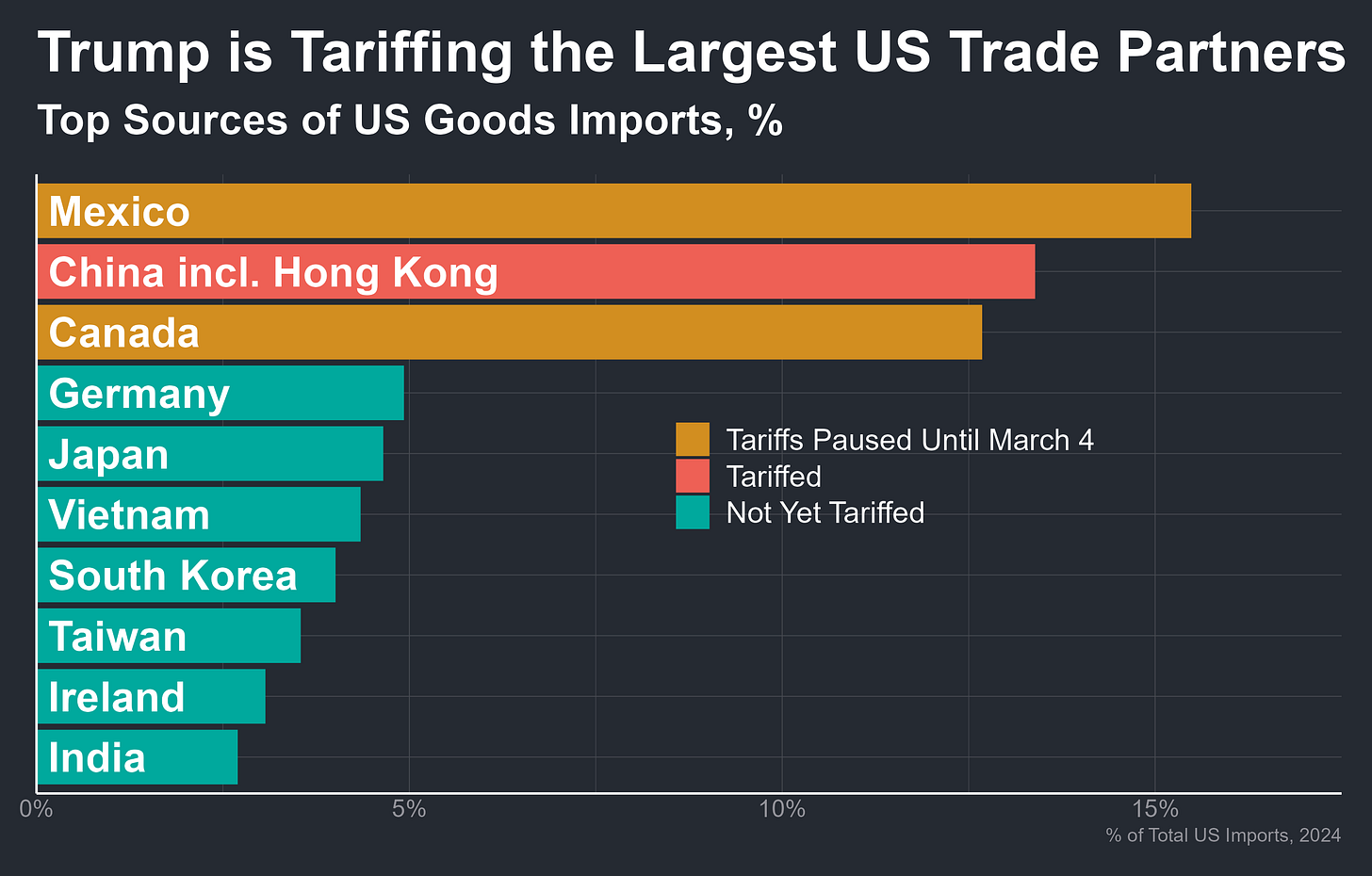

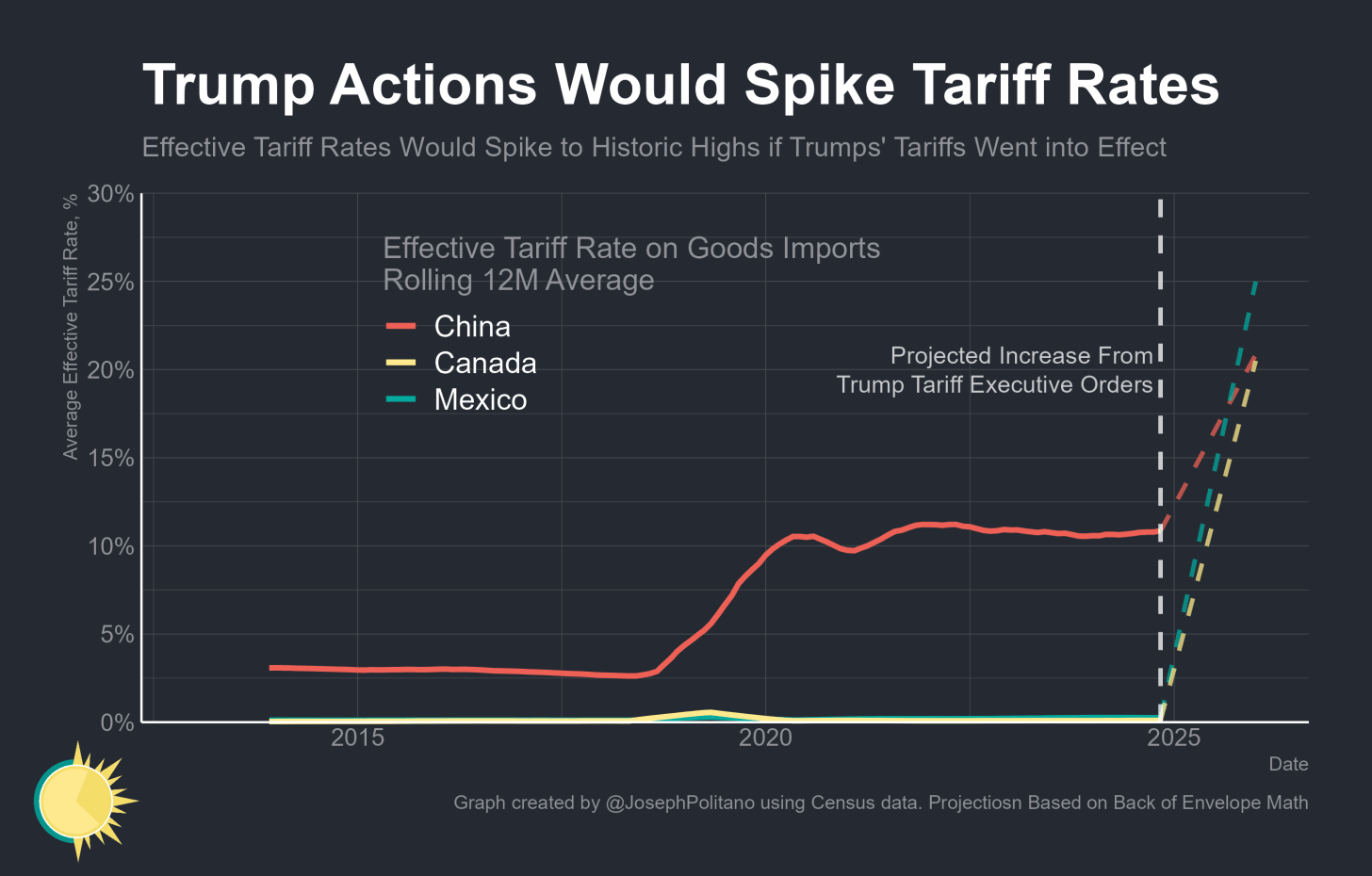

At the start of this month, Donald Trump signed the largest US tariff hike in a generation—a 25% universal tax on all imports from Canada and Mexico, plus a 10% tax on goods from China. These 3 countries are America’s largest trading partners, representing $1.3T worth of imports or roughly 43% of all goods brought into the United States. Trump backed down on the Mexican and Canadian tariffs just hours before they were scheduled to go into effect, announcing a 30-day pause after achieving negligible concessions, but the tariffs on China were allowed to come into full force—just weeks into office, the 2nd Trump Trade War had already begun.

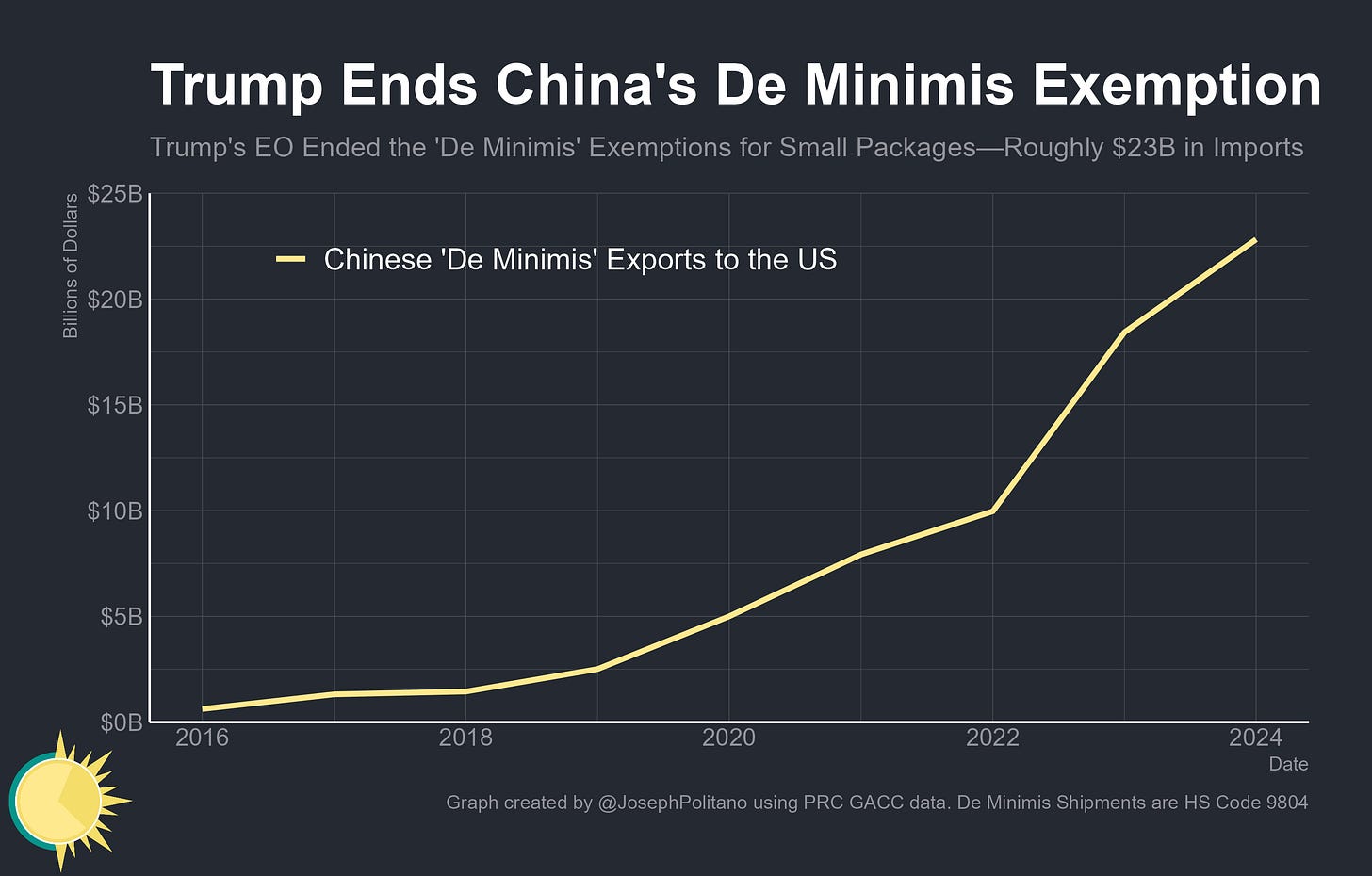

No exemptions of any kind were made—not even for specialty agricultural goods or raw minerals found only in the targeted countries. The only carveout was a slightly lower 10% tariff for Canadian energy products, most of which consist of crude oil that travels by pipeline to key US refineries in the Midwest. The “de minimis” exemption that allows small packages of under $800 in value to enter the US tax-free was removed, which will primarily impact large-scale low-cost Chinese e-commerce shippers like Temu and Shein but would also heavily impact goods from Canadian & Mexican small businesses. Likewise, there are no “duty drawbacks” that would allow companies to recoup tariffs paid on goods that cross borders multiple times as part of the normal manufacturing process. On their own, each of these tariffs would represent some of the largest trade war actions in postwar American history, combined they represent the largest possible tariff hike in more than a century.

The tariffs on Canada and Mexico would impose massive costs on the US economy—driving up the price of gas and groceries, paralyzing key industries like auto manufacturing, and inspiring retaliation against American exporters. They would have even more devastating impacts on the Canadian and Mexican economies, where trade with the US is a much larger share of GDP than vice-versa. The pretextual justification that this was about “drug trafficking” and “migration” rang hollow as Trump repeatedly made economic arguments about America’s trade balance to justify the tariffs. The threat of brutal tariffs on Canada, whose contribution to US undocumented immigration and fentanyl smuggling are minuscule to say the least, highlighted the ridiculousness of the whole enterprise.

These tariffs were so near-universally detested that markets and businesses found it difficult to take the threats seriously even as Trump signed formal executive orders and repeatedly saber-rattled at Canadian and Mexican officials. Yet the possibility of tariffs alone has done large amounts of harm by increasing economic uncertainty while undermining confidence in the USMCA trade deal Trump himself signed in his first term. They damaged public opinion of the US among some of its closest allies while driving both Canadian and Mexican leaders to try diversifying away from the US. Plus, the nightmare scenario where tariffs actually come into force might yet occur—the pause leaves the sword of Damocles in place and sets the stage to repeat the last-minute crisis as the new March 4th deadline approaches.

However, the implemented tariffs against China alone already rival some of the largest moves of Trump’s 1st-term trade war—affecting $445B in regular imports and roughly $20-$40B in “de minimis” imports. There are no exemptions, even for politically salient consumer goods like laptops, cell phones, and toys that were spared from Trump’s first trade war. There was also remarkably little warning, as tariffs were officially signed late on February 1st and began at midnight on February 4th. This is a Trump administration that is less afraid of spooking markets or consumers than in its first term.

Yet the tariffs were clearly not part of a well-thought-out plan either. Take the sudden ending of the “de minimis” exemption for Chinese imports—US Customs & Border Protection (CBP) didn’t have the capacity to process the millions of “de minimus” packages through the new formal means required by the Trump Executive Order. The result was that USPS abruptly stopped accepting packages from China & Hong Kong altogether and millions of packages began piling up at US airports much faster than CBP could clear them. The White House relented after just a couple of days, amending the executive order to restore “de minimis” to Chinese imports until the Secretary of Commerce could affirm that adequate processing systems are in place. This was an extremely predictable problem, which is why the prior administration’s significant restrictions on Chinese “de minimis” imports were taking time to implement, but the new White House is instead shooting first and asking questions later.

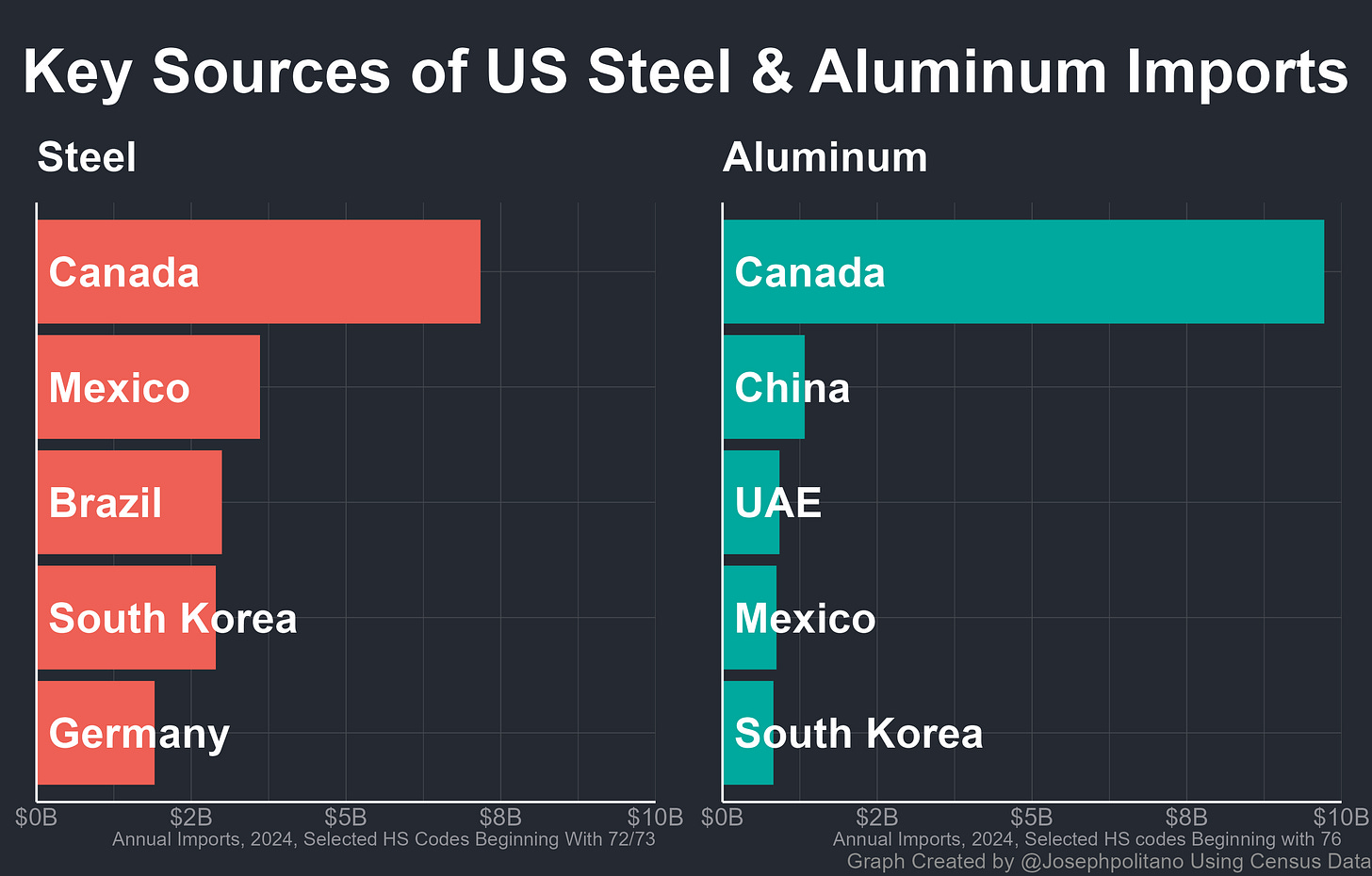

Then, the Trump administration formally announced 25% tariffs on all steel and aluminum imports entering the country beginning March 12th, restarting a trade war he began in his first term while ending all the prior country exemptions and tariff exclusions he negotiated. These hit a much smaller dollar value than the tariffs on China, with US steel and aluminum imports tallying roughly $45B in 2024, but they mainly affect trade with close US allies like Canada, Mexico, South Korea, and the EU. Unlike the China, Canada, or Mexico tariffs, they also provide no way to ease the economic impacts by allowing companies to source imports from different countries—all steel and aluminum will have to be made in America or subject to high tariffs.

Finally, on February 13th Trump announced a vague but extremely wide-ranging policy of imposing “reciprocal” tariffs on all foreign nations. Ostensibly, this is just the US mass-retaliating against the existing tariffs imposed by places like India, Argentina, and the EU. Yet the proposal also claims authority to retaliate against policies that are explicitly not trade barriers (like value-added taxes) and gives the president a wide range to determine what other policies count as “unfair” trade barriers. Given that, and the enormous complexity of theoretically going country-by-country and tariff-by-tariff in retaliation, the proposal seems closer to a way to justify large blanket tariffs against any nation the same way fentanyl was used as an excuse for tariffs on imports from Mexico, Canada, and China.

Combined, these moves are setting the tone for Trump’s 2nd trade war—expect lots of proclamations, many of which will not be followed through on or will only happen after some can-kicking. There will be a ramping up of the bipartisan focus on China and Chinese businesses abroad, on top of prior tariffs and at a faster pace than his first term. There will be some global tariffs on amorphous categories of key goods—starting with metals and likely spreading to automobiles, semiconductors, pharmaceuticals, and more. Finally, there will be mixed attempts at watered-down versions of the universal tariffs Trump promised during his campaign through mechanisms like the “reciprocal” tariff proposals released last week.

Looking at the New Tariffs Already in Place

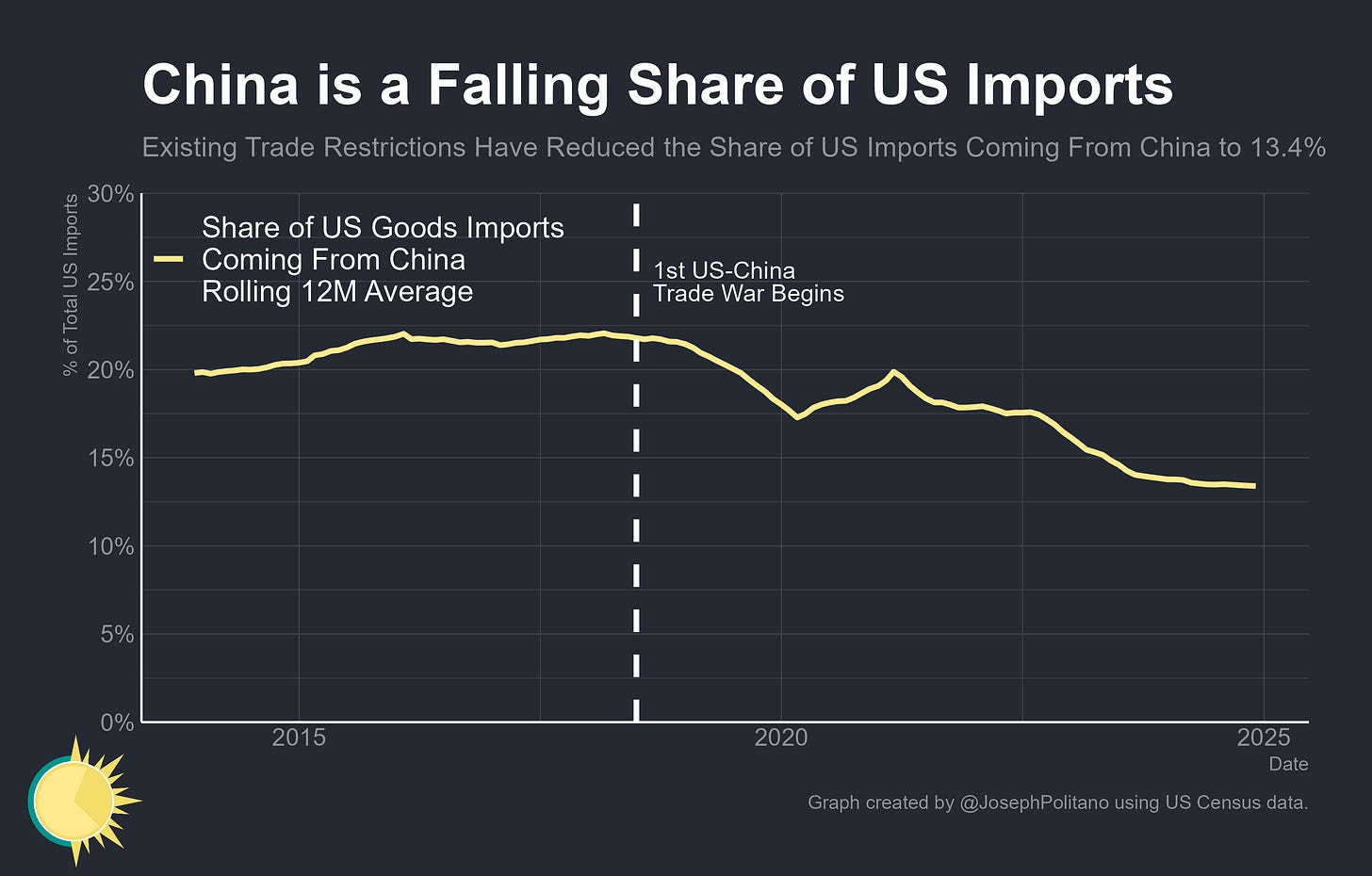

Trump’s first-term trade policy was dominated by his long-running trade war with China, which began in 2018 and escalated for several years until roughly 2/3rds of all goods once imported from China were affected by tariffs. Washington and Beijing signed a phase-one deal to begin resolving the trade war in early 2020, yet that deal broke down shortly after implementation. The large China tariffs put in place by the Trump administration were thus mostly left in place by the Biden administration, who also added some additional tariffs on Chinese batteries, semiconductors, metals, and critical minerals. Amidst all of these tariffs, China went from representing 21.8% of all US goods imports pre-trade-war to 13.4% of US goods imports today—and Trump’s 10% tariff on all Chinese imports already rivals the most dramatic of all prior trade war actions.

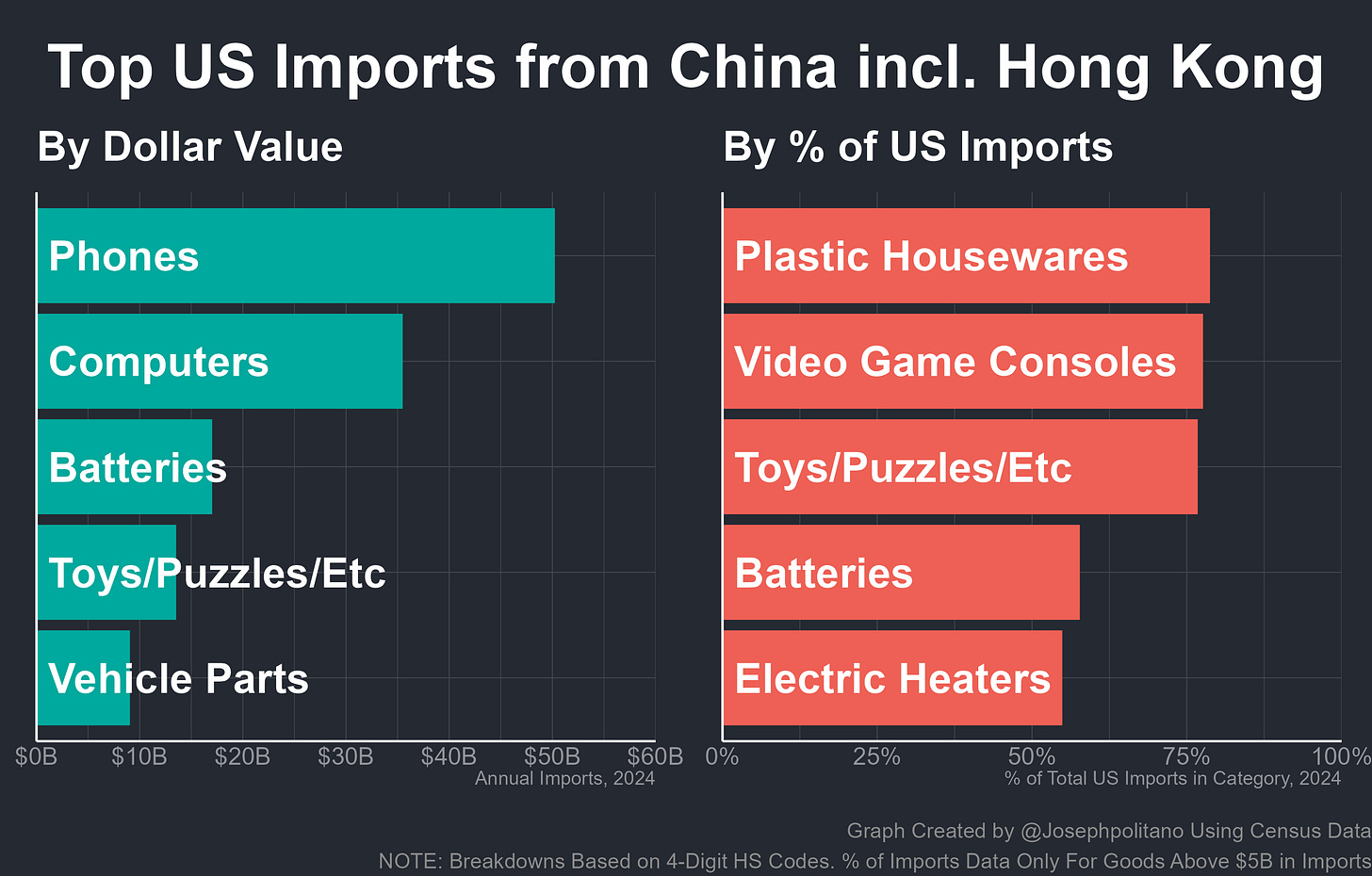

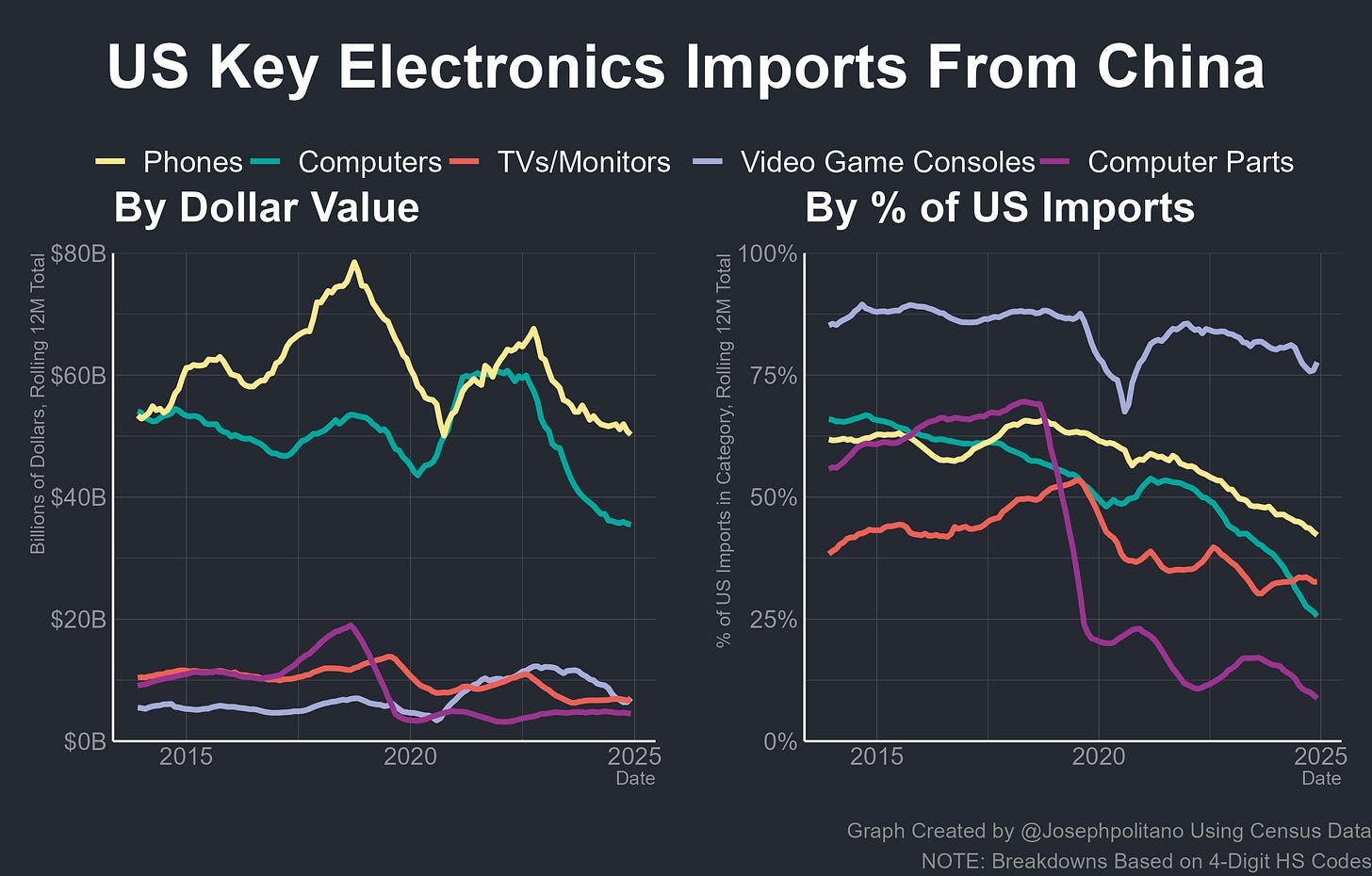

These new universal tariffs hit all the goods previously spared from the trade war, most importantly the bevy of consumer electronics deemed too salient for tariffs by the first Trump administration. In 2024, the two largest US imports from China were phones ($50B) and computers ($36B), most of which represent smartphones and laptops heretofore exempt from tariffs. Game consoles and TVs/Monitors were the sixth and seventh largest imports, both at roughly $7B and also mostly exempt from tariffs until now. The US also still imports billions of dollars in computer parts from China, even though they were hit hard by the first-term trade war.

In most of these goods, there has already been some import diversification away from China since Trump first took office (the country represented 66% of US laptop imports in 2024, down from 93% in 2017, and 72% of US cell phone imports, down from 80% in 2017), but the US still remains heavily dependant on the PRC. Already, some electronics companies are passing on the tariff to consumers—computer giant Acer is hiking laptop prices by 10% and the CEO stated he expects many competitors will do the same.

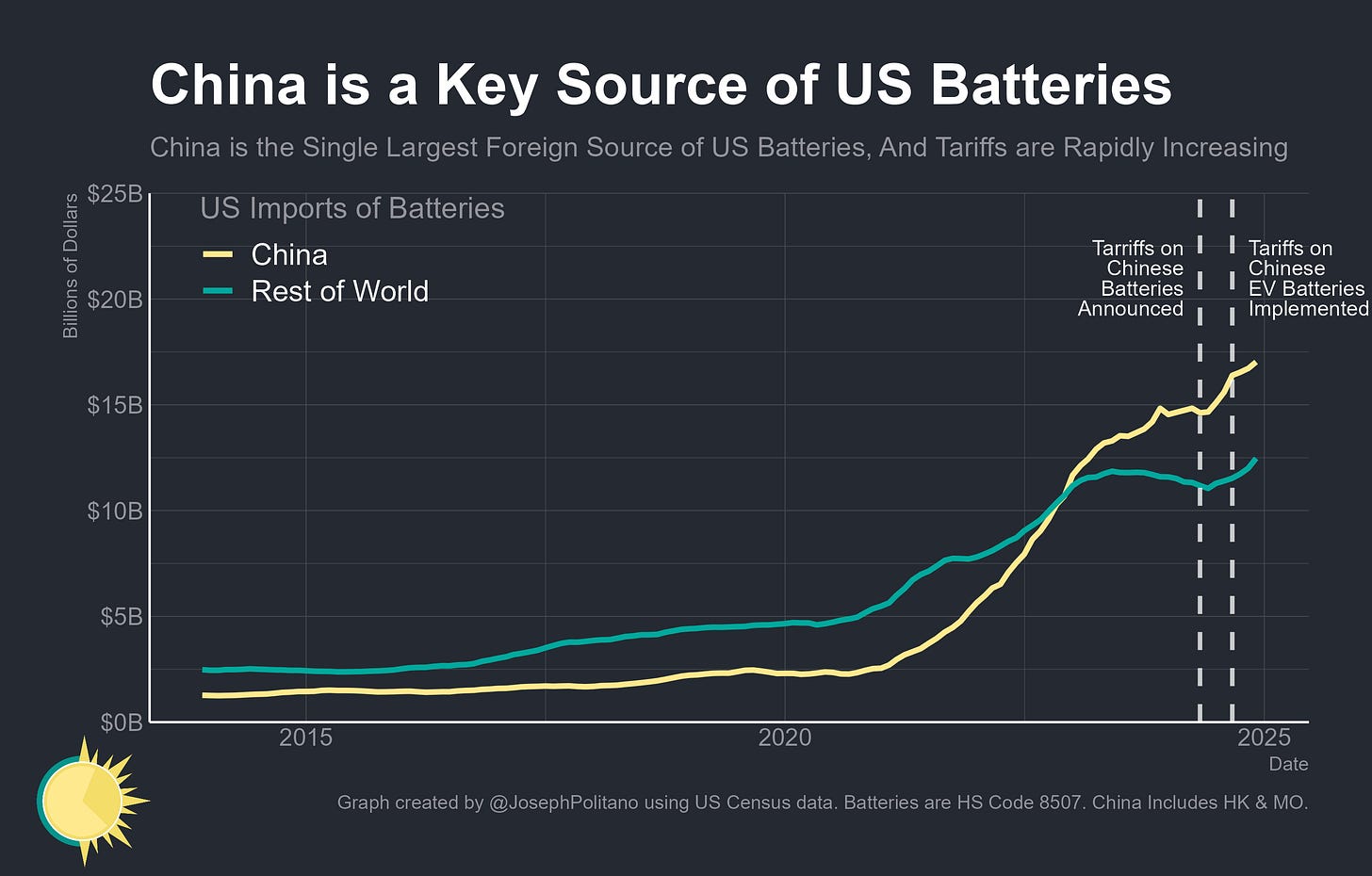

Batteries are another major Chinese import hit by tariffs, and they have exploded in economic importance since the first trade war amidst the rise of electric vehicles and large-scale battery energy storage systems. China is the world’s largest producer of batteries by a wide margin, and the US imported more than $17B worth of batteries from them in 2024. Efforts to decouple the US from reliance on US batteries have been underway for years, especially in the wake of the Inflation Reduction Act’s subsidies for domestic production. Those have also been coupled with increased tariffs from the Biden administration, who hiked taxes on the $2.4B worth of Chinese EV battery imports from 7.5% to 25% as of September 2024 and planned the same hike for the $13.2B of Chinese non-EV battery imports for January 2026. The new 10% tariffs are additive on top of those increases, forcing EV makers and battery storage facilities to eat price hikes or find new battery sources even faster.

As mentioned earlier, the executive order also excludes China from America’s “de minimis” system for imports of small packages. The “de minimis” system is a legal exemption for packages under $800 per person per day designed so that minor purchases from individual consumers don’t have to go through the expensive and resource-intensive formal import process or pay tariffs. That exemption became an important tool for hyper-low-cost e-commerce giants like Temu and Shein—companies could ship directly to US consumers and sidestep the tariffs faced by large retail stores on imported clothes or goods from China. It’s impossible to get an exact number for the value of these imports precisely because they don’t go through the full formal import process, but data recorded from China’s side estimates it at $23B while US CBP estimates it at roughly $45B. Yet both agree that the volume of packages has hit record levels and has been surging for years, especially since the pandemic. Ending the “de minimis” exemption for Chinese imports, should it be formally implemented and survive legal challenges, would heavily impact these packages—simultaneously hitting them with higher processing costs, normal US tariff rates, preexisting trade war tariffs, and the new 10% China tariff.

Finally, remember that in addition to all these goods being hit with tariffs for the first time, there’s already a wide range of Chinese goods with high tariffs from the first trade war which will now see further 10% tariff hikes. Since these products are still being imported from China despite 5-7 years of continuous tariffs, it stands to reason that they represent categories where decoupling from China is more difficult and thus the economic cost of further tariffs is higher. In 2024 America collected $2.4B of tariffs on $9B worth of imported Chinese car parts—if suitable replacements for them were easy to find, they would have been found already.

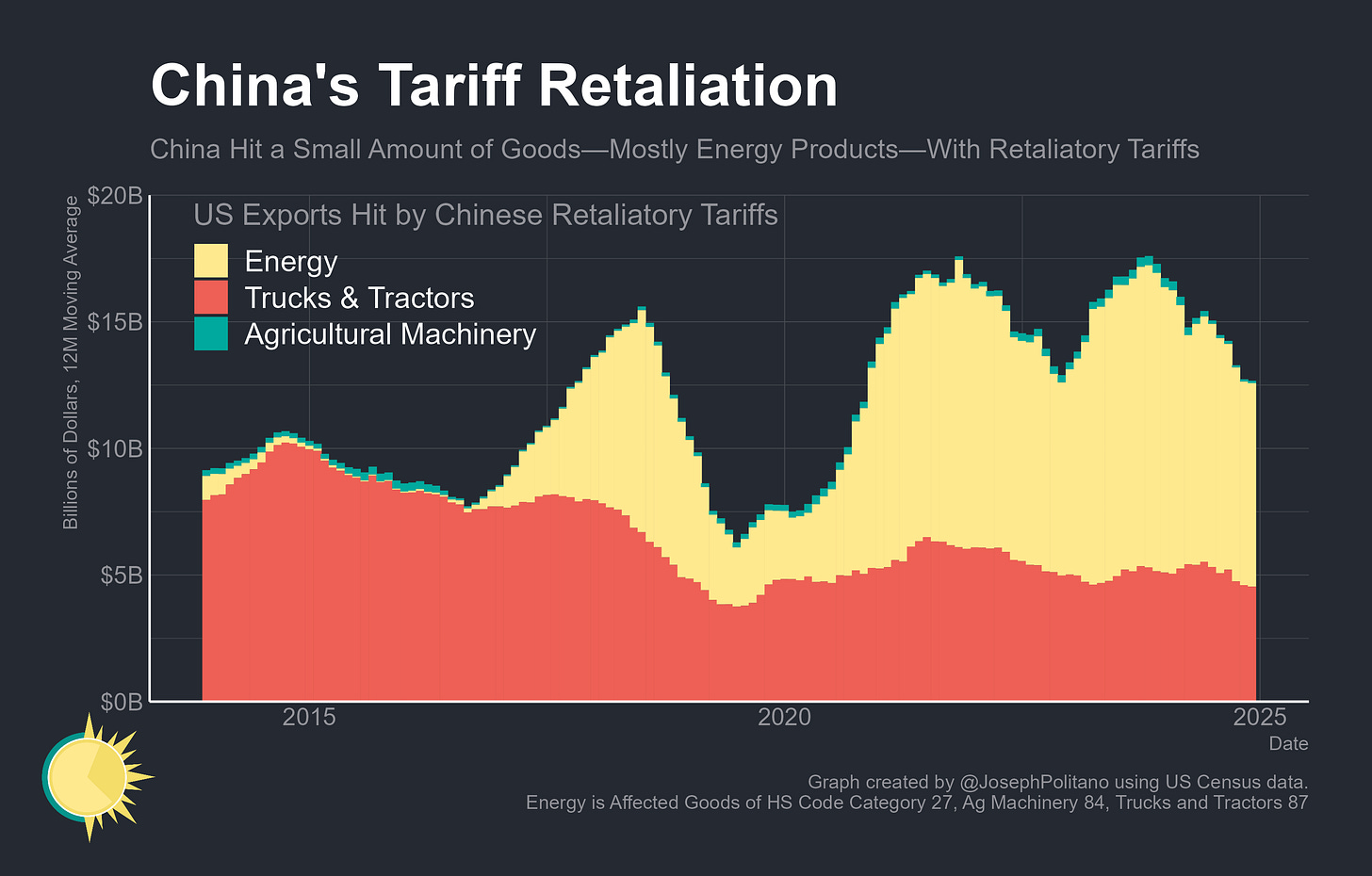

In response to the 10% tariff hike, China has already implemented retaliatory measures against the US—however, the relative size of Chinese tariff increases has been small. Beijing only imposed tariffs on roughly $12B of US exports in contrast to the roughly $470B worth of Chinese exports affected by American tariffs. Chinese retaliation also primarily focused on commodity energy exports—crude oil, coal, and natural gas—where bilateral trade flows can shift more easily without major economic costs to either country. There were also roughly $5B worth of American trucks, tractors, and agricultural machinery exports hit by Chinese retaliatory tariffs, a narrower measure designed to hit Trump-supporting constituencies hardest. In addition this, China also took several other non-tariff measures to respond—export controls on key minerals, an antitrust investigation into Google, and restricting biotech company Illumina’s ability to operate in China.

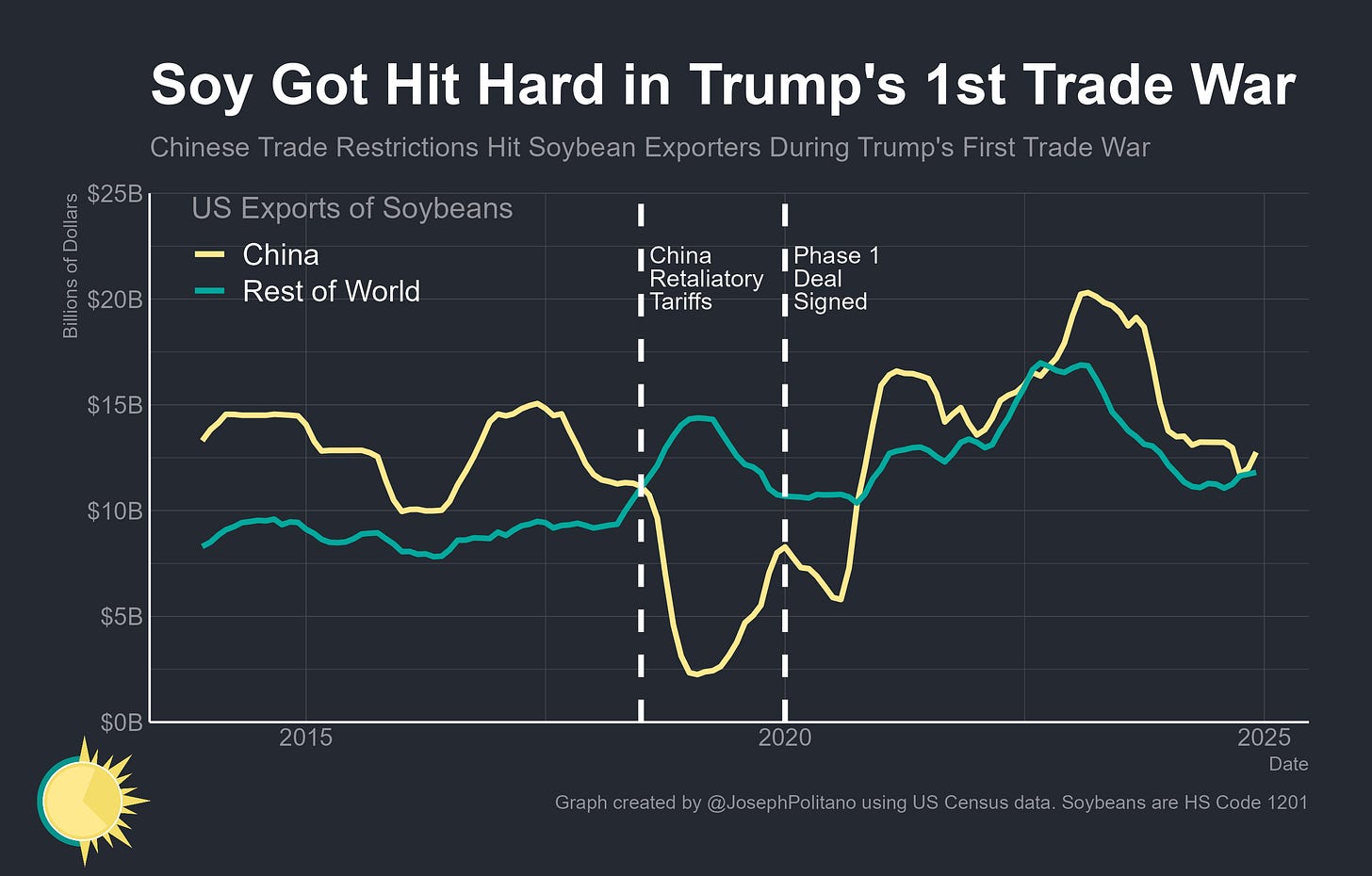

Beijing appears content to wait out the initial wave of trade restrictions and is holding its ammo in case it’s needed for further rounds of tariffs (after all, Trump promised tariffs of up to 60% on China on the campaign trail). The country still holds significant leverage over US farmers—soybeans are the single-largest US export to China, totaling $12.7B in 2024 (roughly 10% of total exports to China), and they were hit so hard by the first trade war that they required a US government bailout. Beijing could turn the screws on American farmers again by targeting US soy—as well as other agricultural commodities like cotton, sorghum, and select meats. They could also go after Boeing (aircraft & related parts are America’s second-largest export to China) and US semiconductor manufacturers, who still export decent amounts to the country. Yet for now, the primary impacts of the China trade war escalation on the US economy come from rising import costs rather than any implemented retaliatory measures.

The Tariffs Possibly Coming Soon

Before the flurry of tariffs on China, Canada, Mexico, steel, and aluminum, it briefly looked as though this Trump administration wouldn’t focus on trade policy right from the gun—In his first few days in office, the President didn’t take any immediate action to raise tariffs, only directing various agencies to prepare studies on the negative impacts of international trade by April. Those studies span the range from symbolic (drawing up an “external revenue service” to take over the responsibility of collecting tariffs) to vague (countering “currency manipulation”), to serious (reviewing the USMCA, looking at more ways to expand the current trade war with China, and raising the possibility of ending Permanent Normal Trading Relations with Beijing). Yet all of them share an aversion to strict policy formulation, instead posing a wide latitude of trade policies and leaving the executive branch discretion to either impose or negotiate them away.

The recent memo on “reciprocal” tariffs is a good example of the discretionary chaos—the proposal claims to restore “fair” trade by hitting other countries with tariffs in proportion to their existing tariffs on American exports, yet it’s missing even basic details of what this would mean in practice. The White House complains about India’s large tariffs on motorcycles—will they retaliate by putting large tariffs on the vanishingly few motorcycles imported to the US from India, by picking a different import of a similar size, or by hitting India with an across-the-board tariff on all imports? It’s completely unclear. This is also only framed as a ratcheting-upwards, as there will be no tariff reductions for countries with preexisting lower tariffs on US exports than vice-versa. It’s also another violation of basic World Trade Organization rules by the US—the most-favored-nation system was designed so that countries would set tariff rates on all WTO members equally by type of good, and could only negotiate them downwards on a country-by-country basis through trade agreements. The idea that America would hit India specifically with an extra tariff just because India tariffs motorcycles from all countries flies in the face of this principle, and if taken literally would turn the US tariff schedule into a Frankenstein’s monster of complexity with thousands of unique rates depending on the type of good and country of origin.

Yet the proposal also goes well beyond simply retaliating against foreign tariffs or trade barriers by claiming that foreign value added taxes (VATs) are “unfair” and “discriminatory” towards the US and thus equivalent to tariffs. This is patently ridiculous—Germany’s VAT hits all domestic consumption evenly, whether it’s an American car or a German one—but it provides a pretextual justification to slap basically any country with tariffs since nearly all of them have VATs. If that wasn’t enough, there’s another catch-all that allows retaliation against any practice the US Trade Representative deems “unfair”—in essence, the President is directing agencies to make up possible wide-ranging tariff hikes on all countries by April, with only a loose nod to the idea that they should somehow be “reciprocal”.

Chair of the White House Council of Economic Advisors Stephan Miran and Treasury Secretary Scott Bessent have mused about a system where countries would face differentiated tariff rates based on a variety of factors including their rate of tariffs against the US, whether they facilitate transshipment of Chinese goods to America, their geopolitical relationship to the US, how they treat American multinationals, and more. Importantly, they have also hinted at tariffs against close allies for not meeting defense spending targets and against neutral nations for voting the “wrong way” at the United Nations or “grandstanding” against the US. In practice, the vagueness of the reciprocal tariff memo can be read as the first steps required to implement such a system—even if countries have low tariff rates on US exports, the White House can point to their VATs or other policies to fabricate a justification for hitting enemies or noncompliant allies with tariffs.

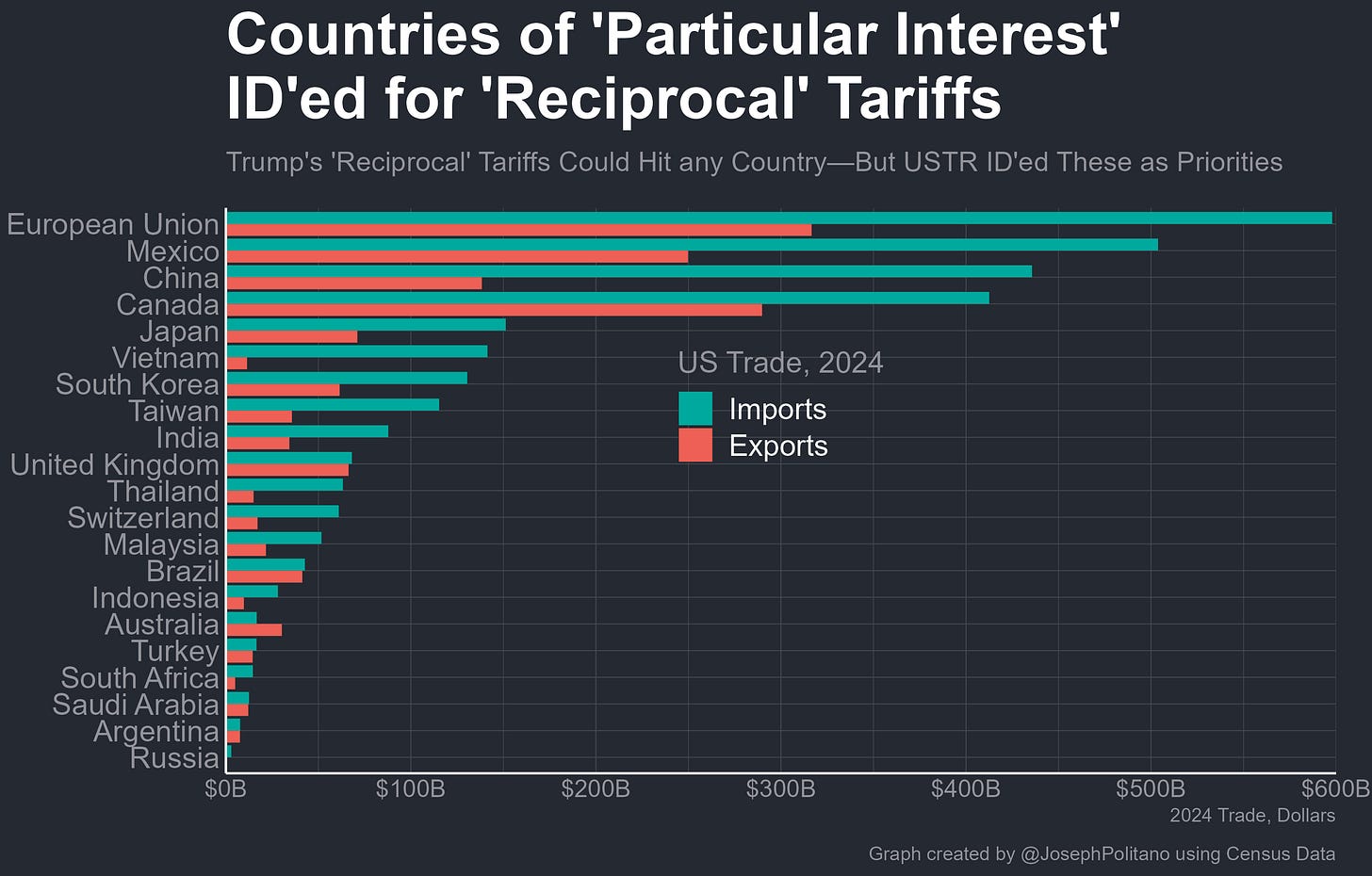

It’s impossible to make any accurate predictions about what the effect of these “reciprocal” tariffs would be without more details, but a literal interpretation where America retaliates 1-1 against foreign tariffs and VATs would drive US tariff rates to the highest levels since the Great Recession’s infamous Smoot-Hawley Act. It’s doubtful Trump will actually implement tariffs that high, but he may threaten massive uniform tariffs against the EU, UK, Japan, India, Brazil, and others the way he already is against Canada and Mexico. In seeking public comment on the “reciprocal tariff” proposal, the Office of the United States Trade Representative has named the places it is “particularly interested” in—a list that consists of twenty countries plus the EU and thus composes the vast majority of overall US trade. Among those, they’re also focusing on countries where the US has a large bilateral goods trade deficit—that means China, the EU, Mexico, Vietnam, Canada, Japan, Taiwan, South Korea, India, and Thailand. The “reciprocal” tariff proposal will likely be used to slot foreign countries into several tariff bins which can then be threatened as part of negotiations or implemented to to raise overall tariff rates and reshape trade relationships.

In addition to these more general or country-specific tariffs, the White House has repeatedly discussed its desire to implement universal tariffs on specific goods, which began with the renewed tariffs on all imported steel and aluminum. It’s unclear precisely what other categories will be hit with tariffs, but Trump and other administration officials have repeatedly mentioned other metals, lumber, motor vehicles, pharmaceuticals, and semiconductors. These tariffs are much more straight-up mercantilist and even less geopolitically driven than China or “reciprocal” tariffs, would primarily hit close US allies, and would leave less room for the kind of nearshoring effects that eased the impacts of first-term tariffs.

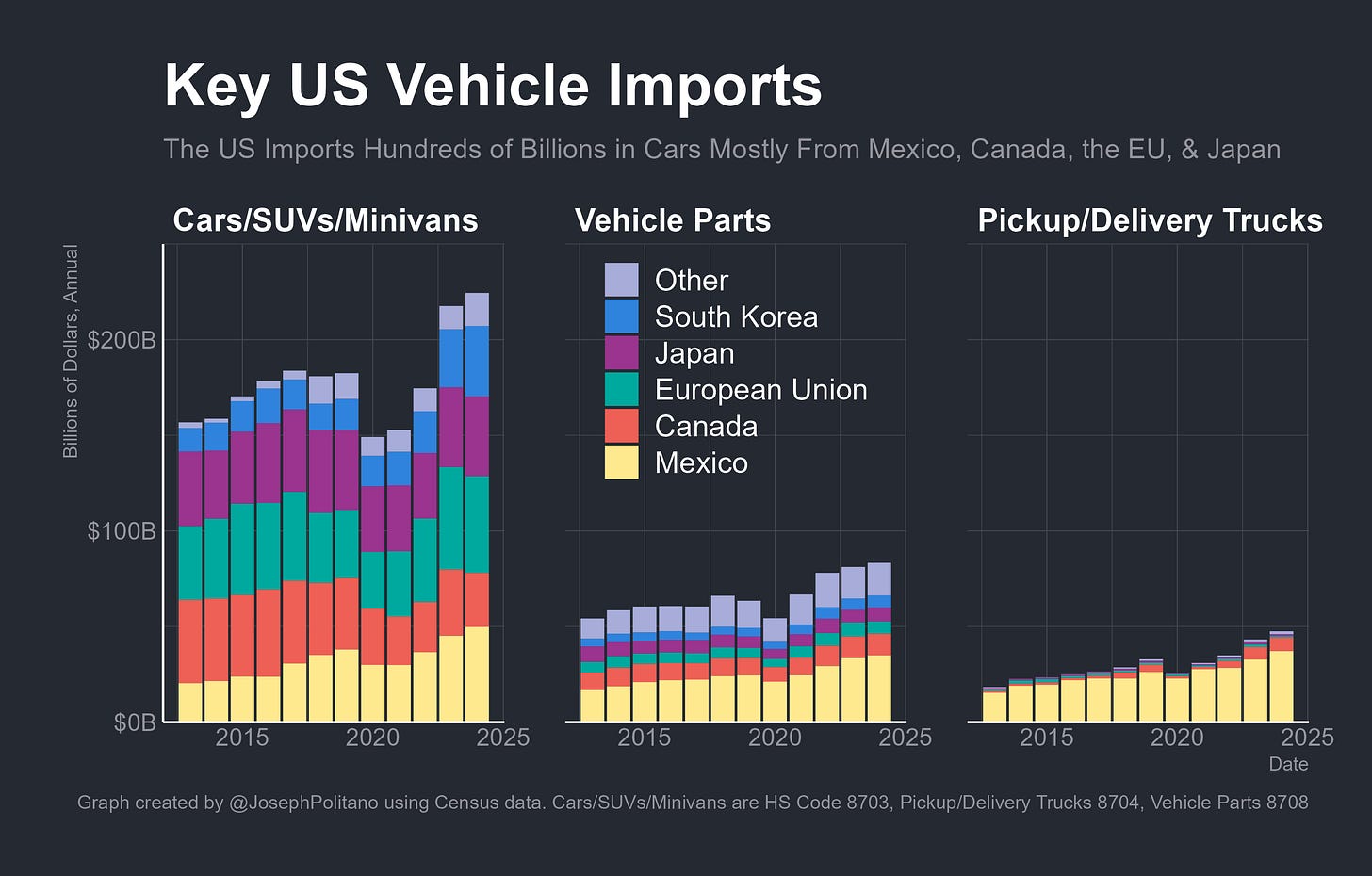

Start with the largest of these sector-specific tariff threats: motor vehicles. The Trump administration already went through the motions of a section 232 investigation into vehicle and parts imports during his first term and threatened the same 25% universal tariffs he is threatening today, but ultimately backed down. The size of US vehicle trade meant large tariffs would have prohibitive economic costs—cars are the single-largest US import category, representing $224B on their own in 2024, and when combined with car parts and light trucks compose nearly 11% of all US imports. Yet now that Trump is back in office and less concerned about backlash, he’s resurrecting the large tariff proposal with renewed vigor.

Except for those heavily tariffed car parts from China, US vehicle-related imports almost universally come from close allies like Canada, Mexico, Japan, South Korea, and the EU. For the North American auto trade in particular, components and vehicles often cross borders multiple times before a consumer ends up behind the wheel, and deintegrating supply chains would be extremely disruptive. The auto industry is also still in a precarious position, as prices for new and used vehicles remain extremely elevated from pandemic-era disruptions while US vehicle manufacturing employment has dropped by 30k over the last year.

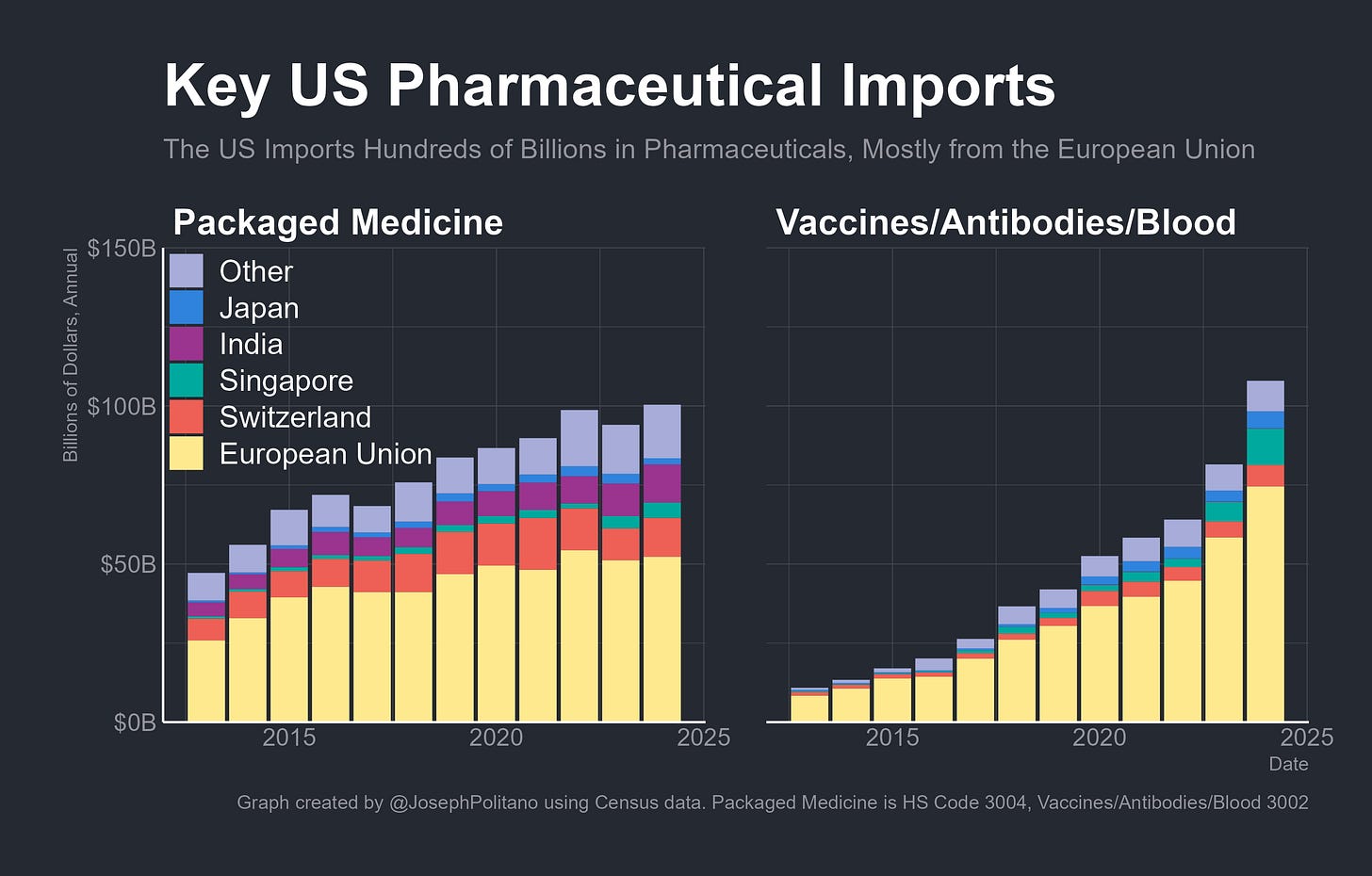

Next, there are the floated 25% tariffs on imported pharmaceutical products. In terms of details, there’s been even less provided than for steel or autos, yet the contours of policy are visible. Just looking at the likely targets of prepackaged medicines and immunological drugs, the US imports more than $200B worth of goods, the vast majority of which come from the European Union or elsewhere in Europe. The continent’s advanced drugmaking industry and the attractive tax-shifting implications for many pharmaceutical multinationals have caused US-EU pharma trade to boom over the last ten years.

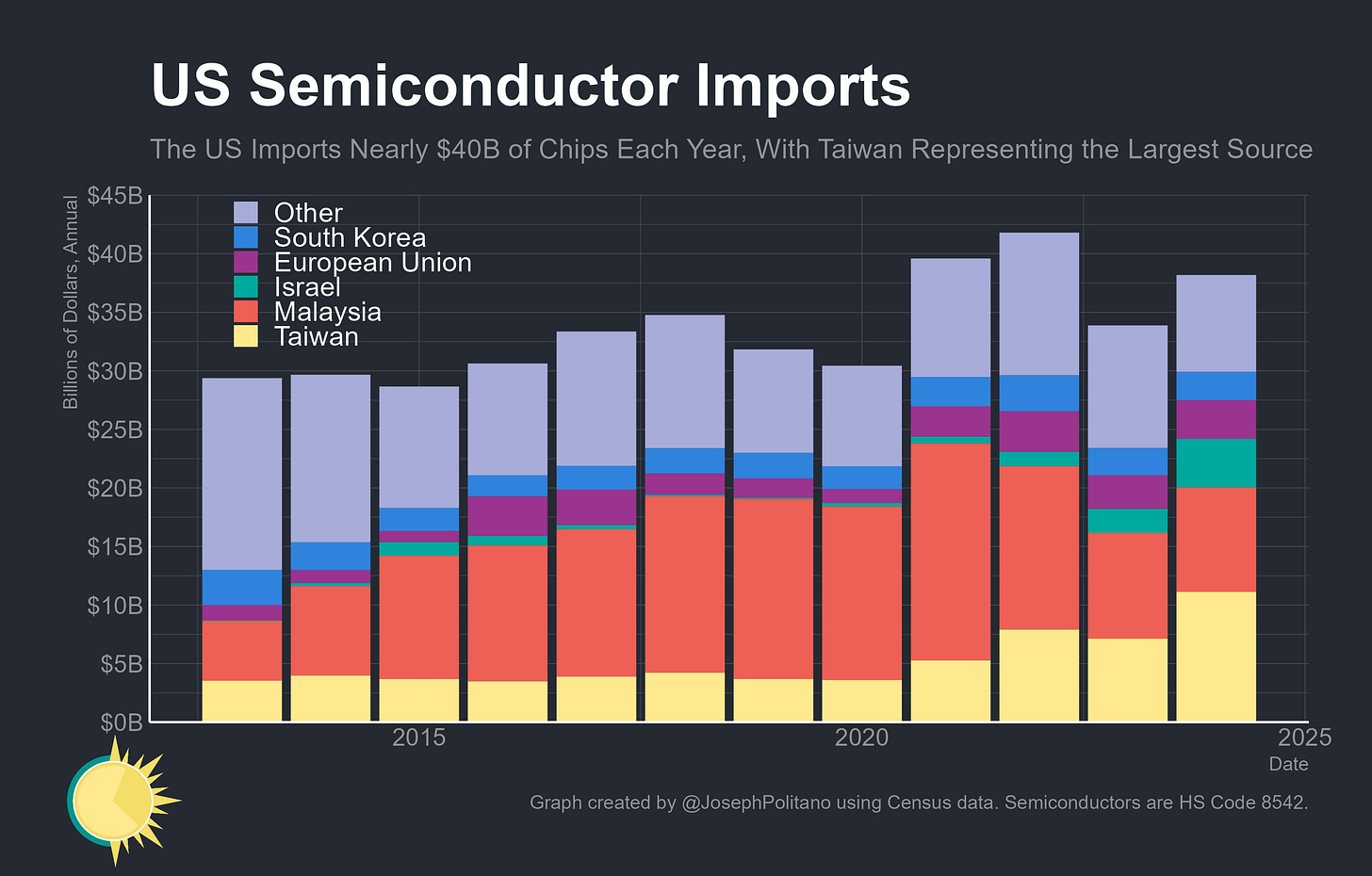

Finally, the last repeated proposal is for universal tariffs on semiconductor imports. The US bought $38B worth of chips in 2024, with direct imports of high-end chips from countries like Taiwan skyrocketing amidst the AI boom. Yet the US also imports a wide variety of less-cutting-edge semiconductors as components for vehicles, consumer electronics, appliances, medical devices, and more, and tariffs would affect input costs for all of these industries. The implemented policy might even be more expansive than just hitting chips—tariffs would also have to hit computers and other electronics made with semiconductors to prevent companies from sidestepping them by simply assembling electronics outside the US. As a result of fabricator subsidies passed in the 2022 CHIPS Act, US production of semiconductors has been rising for years and will continue rising through the early Trump administration, but America remains far from wholly chip self-sufficient and tariffs here would still have wide-ranging negative impacts.

Conclusions

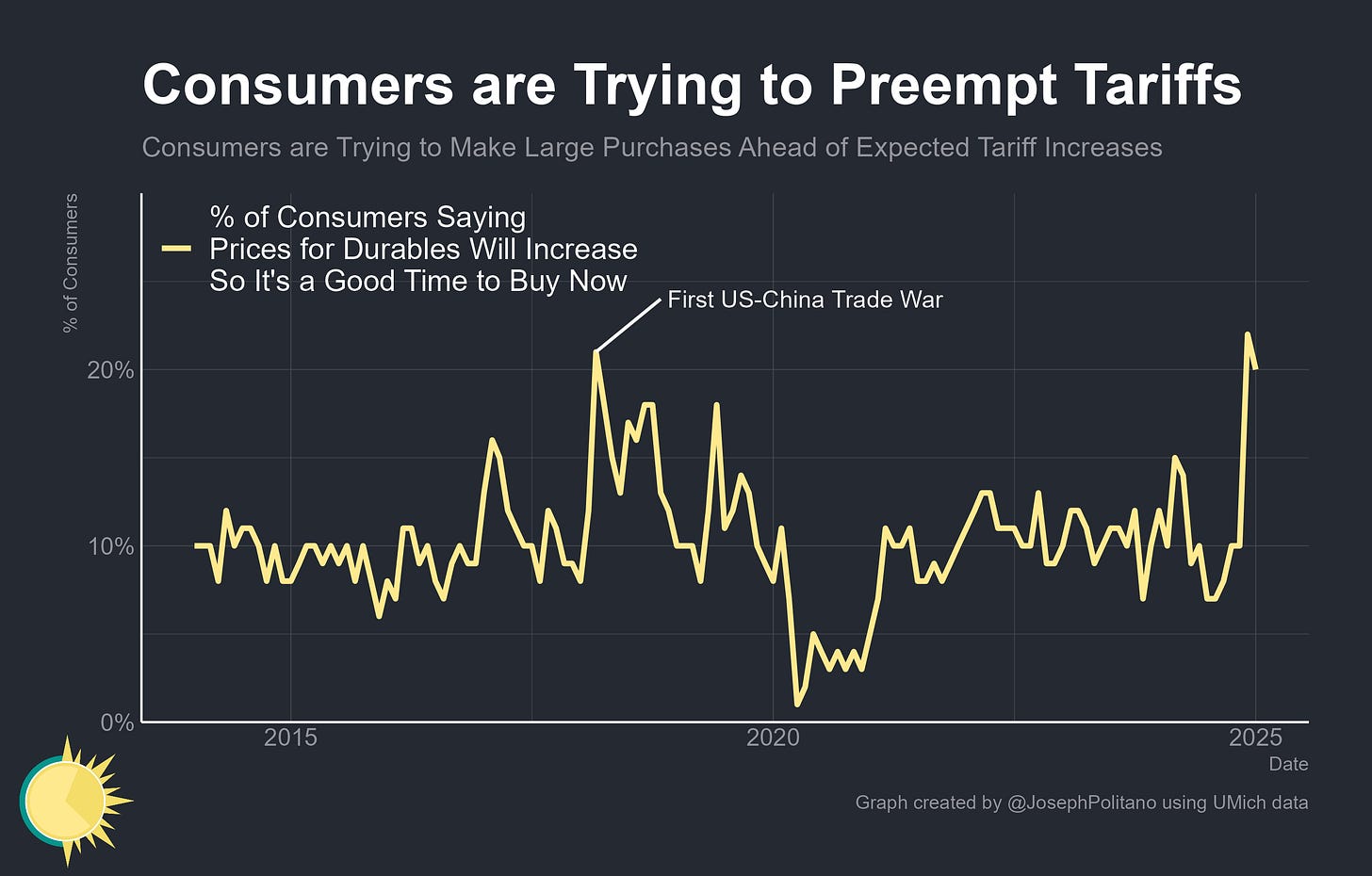

Throughout all of this, American consumers are growing increasingly worried about the impact of tariffs. In December and January, Americans rushed to buy vehicles and other durables out of fear that tariffs would soon cause price hikes, then the February tariff executive orders against Canada, Mexico, and China caused consumer sentiment to plummet. Economic policy uncertainty has spiked significantly, making it even more difficult for businesses to make planning and investment decisions. Yet Trump remains largely undeterred, pursuing even more aggressive versions of the trade policy strategies that dominated his first term.

The 10% tariffs on China and universal tariffs on steel/aluminum are blatant reruns of first-term policies just with greater speed and at larger levels. The 25% tariff threats against Canada and Mexico over “fentanyl and immigration” are larger versions of the 5% tariffs against Mexico that Trump threatened in 2019 over migration but never followed through on. Trump placed universal tariffs on washing machines during his first term and is now expanding those policy ideas toward larger imports like vehicles, semiconductors, and pharmaceuticals. Even the “reciprocal tariff” memo is just a more serious attempt at policy frameworks that Trump was openly proposing as early as 2017.

Those strategies didn’t achieve their economic goals during Trump’s first term, with the academic consensus showing that the costs far outweighed the benefits. Doubling down in a second term is unlikely to change that. Yet the first-term tariffs may have achieved some of their political goals by signaling support for communities and workers negatively impacted by globalization even if they didn’t help them materially. A louder, brasher trade policy following an era of much larger inflation might have the opposite effect, costing the President political support among voters mostly concerned about their pocketbooks. For the self-described tariff man, backlash from Main Street and Wall Street might be the only thing keeping his second-term trade war ambitions in check.

The irony of Trump's tariffs is that by not exempting tariffs on intermediate goods in the manufacturing process (which raises the cost of US manufacturing compared to the rest of the world), he is discouraging the revival in American manufacturing that would've been inevitable due to automation and cheap US energy.

Spectacular decomposition of the tariff wars.