US Growth Keeps Beating Expectations

The American Economy Closes out 2023 By Posting Another Quarter of Strong GDP Growth

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 38,000 people who read Apricitas weekly!

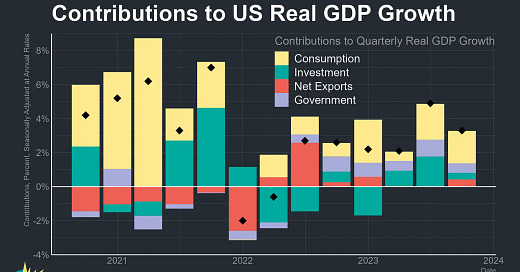

The US economy closed out 2023 by beating expectations yet again—in Q4, GDP grew at a 3.3% annualized rate amidst a wide-ranging expansion led by some of the fastest real consumption growth of the last two years. Were it not for a large temporary drop in motor vehicle output caused by the United Auto Workers’ strike, GDP growth would have been even higher—likely north of 4% annualized. Still, domestic investment increased despite higher interest rates, government output continued its steady recovery, and net exports rose as the trade deficit narrowed.

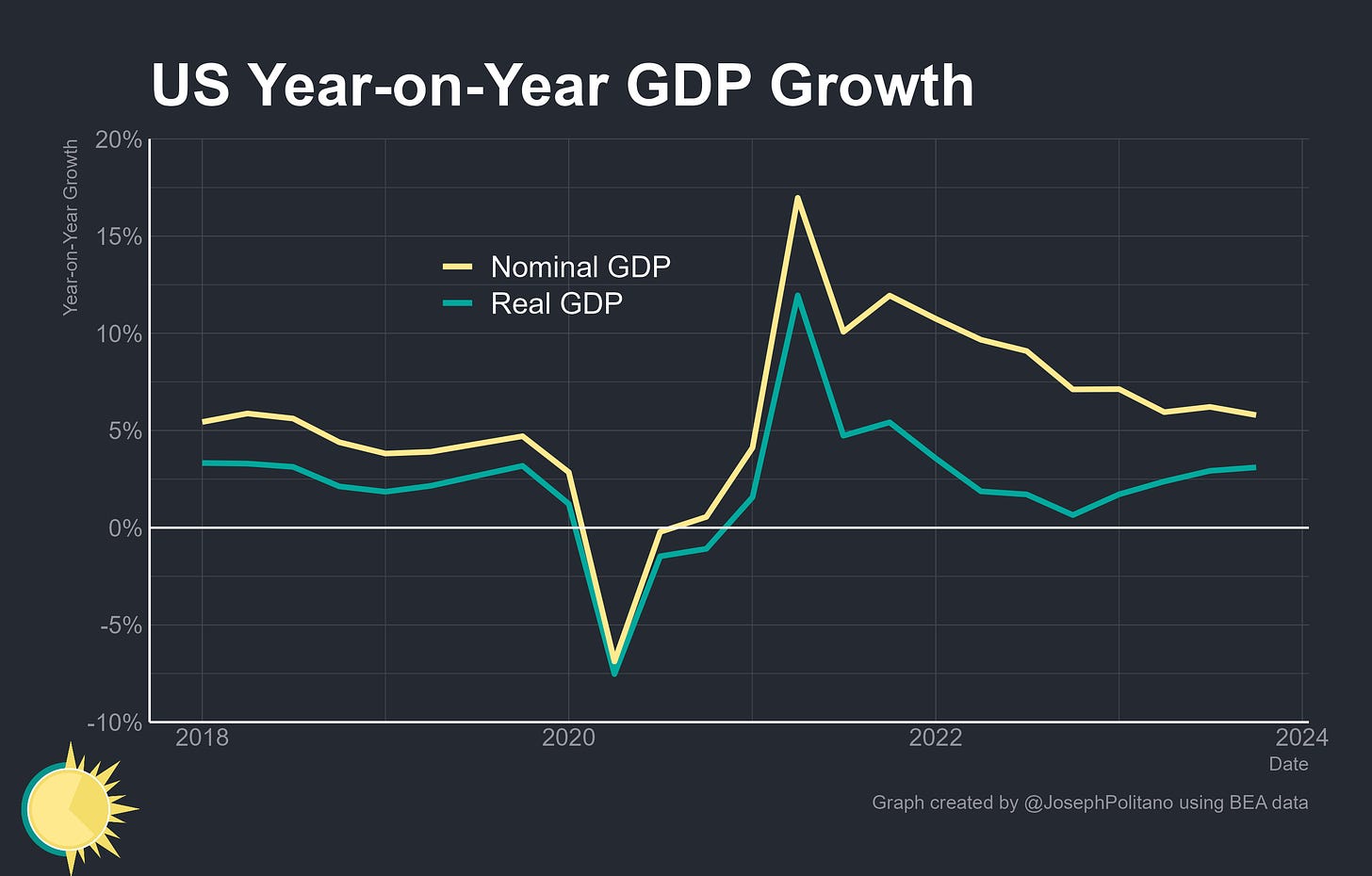

Real GDP has thus grown 3.1% over the last year, up from the meager 0.7% growth seen throughout 2022, even as nominal GDP growth decelerated from 7.1% to 5.8%. That highlights the important role easing supply-side constraints have had on this year’s growth rebound, as many key items saw their prices fall alongside an increase in their quantities consumed or produced. Given slowing private-sector employment growth, Q4’s robust GDP gains also imply another strong residual increase in measured US labor productivity, which is already up 5.7% since the start of COVID.

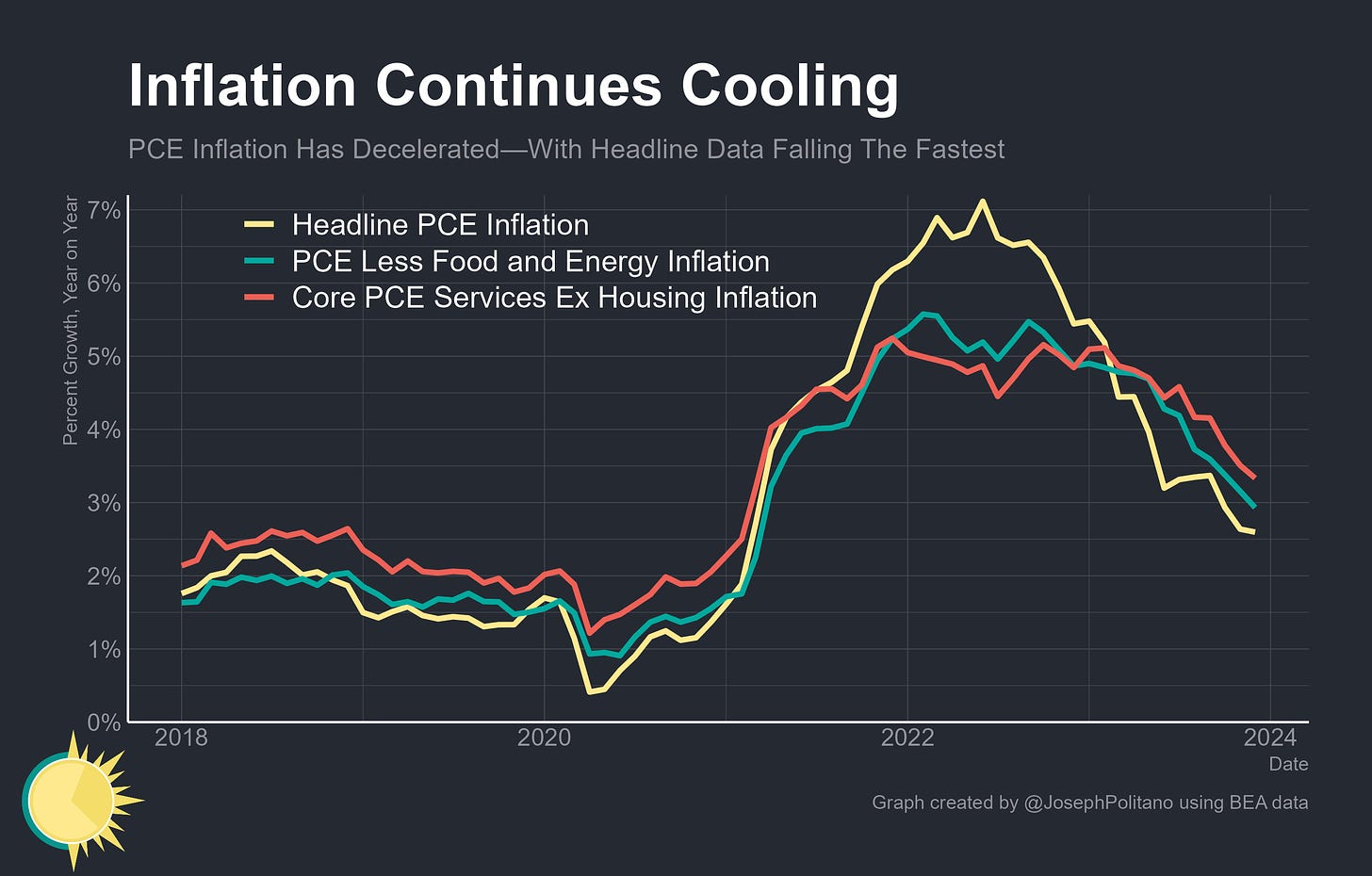

Decelerating nominal spending growth coupled with rising real output also implies falling inflation, and this year has seen rapid decelerations in headline, core, and core-services-ex-housing inflation within the Personal Consumption Expenditures Price Index (PCEPI). In fact, across both of the last two quarters, core PCE inflation has come in at precisely the Federal Reserve’s 2% target rate. It all makes for another instance where the US economy soundly beat expectations in 2023—as recently as March, the median Federal Reserve official projected that the year would end with GDP growth at 0.4% (it was actually 3.1%), unemployment at 4.5% (it was 3.7%), and core inflation at 3.6% (it was 2.7%).

Breaking Down Strong US Growth

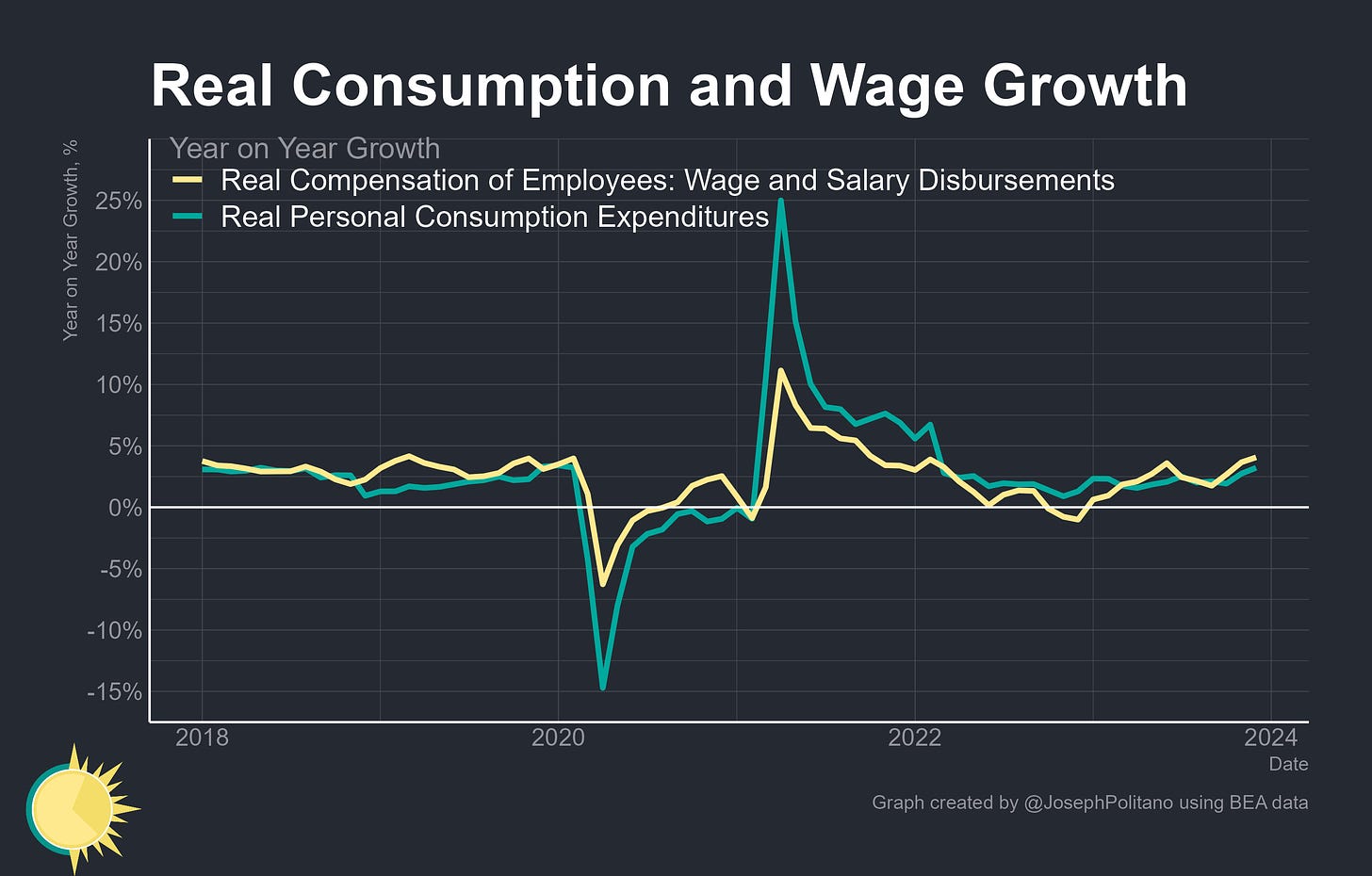

2023 has seen a significant rebound in real consumption from the extremely weak pace of growth seen throughout 2022. Services again led the way in Q4, with growth in food services & accommodation consumption contributing 0.37% to GDP alone and growth in healthcare services consumption contributing another 0.36%, both building on similarly robust growth from last quarter. Yet 2023 also saw real consumption of durable and nondurable goods break out of the previous year of stagnation, and the two categories saw broad-based growth across all their major subcomponents.

That rise in spending has remained supported by strong income growth—increases in real aggregate wages have accelerated from their 2022 lows to the fastest pace since late 2021 and are now outpacing consumption growth. Real personal income excluding transfer payments are also at a record high, rising 3.1% over the last year, with real disposable personal income rising 4.2% as a fall in government transfer payments was more than offset by a drop in taxation.

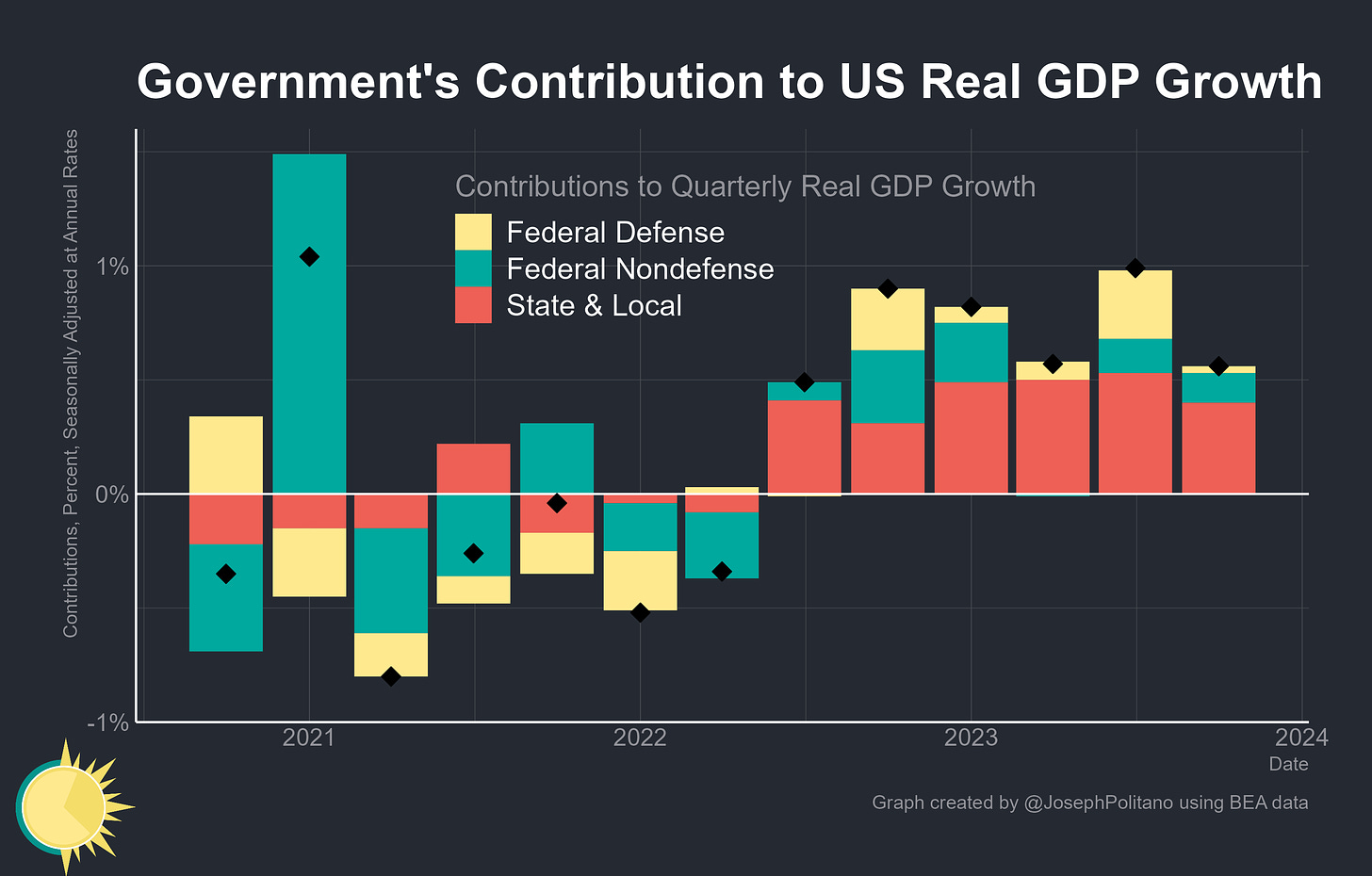

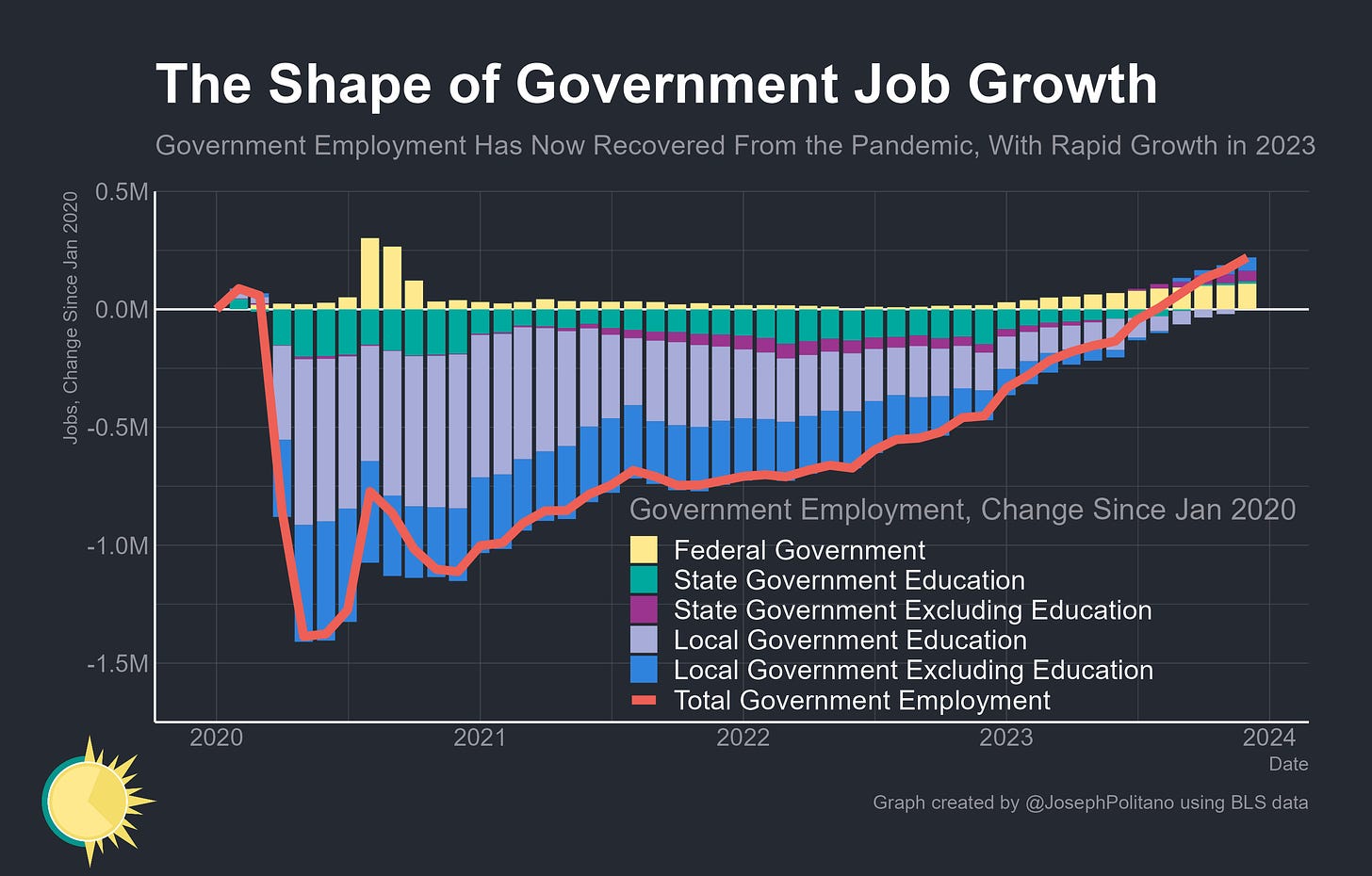

The US also continues to see a robust recovery in government output (which measures the direct provision of public-sector services and investments undertaken by government entities, not fiscal transfers like Social Security or unemployment insurance). That’s been particularly true at the state & local level, which has contributed roughly 0.5% to year-on-year GDP growth as it finally recovered from the pandemic this year. After the 2008 recession, it took a decade for state & local government output to make that recovery and federal output remained down even until early 2020—yet this time state & local output has fully recovered in only three years and federal output has always remained above 2019 levels.

That’s also remarkable because the public sector’s employment recovery from COVID had previously been extremely slow—schools and universities, where roughly 45% of government employees work, were hit particularly hard by the pandemic and subsequently struggled to attract workers amidst the strong labor market of 2021 and 2022. This year, however, a slower private-sector labor market allowed states and localities to deploy their stockpiled COVID-era savings in a rapid hiring spree—government entities have added 672k new jobs over the last year, and local public schools alone have been responsible for 159k of those. That, plus a boost to investment from the Inflation Reduction Act and Bipartisan Infrastructure Law, has come together to drive a robust increase in state and local government output throughout the last year and a half.

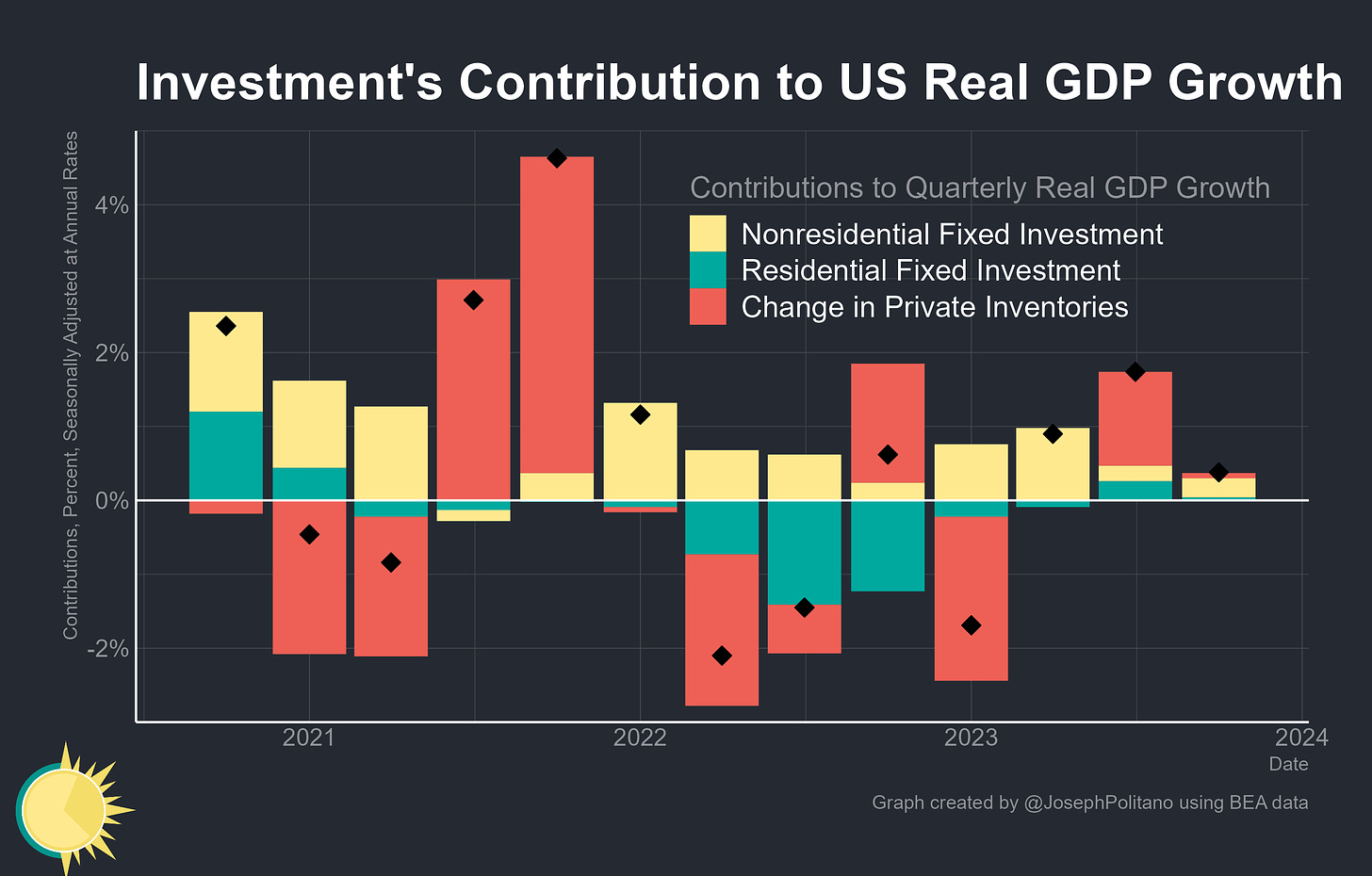

Meanwhile, private US investment continued a strained recovery amidst the ongoing effects of higher interest rates. Residential fixed investment growth was slightly positive over the last two quarters after getting clobbered by higher mortgage rates throughout 2022 and early 2023, but the bulk of this quarter’s increase came from outside the housing market—real nonresidential fixed investment rose thanks to increased construction activity and some slower growth in intellectual property investments.

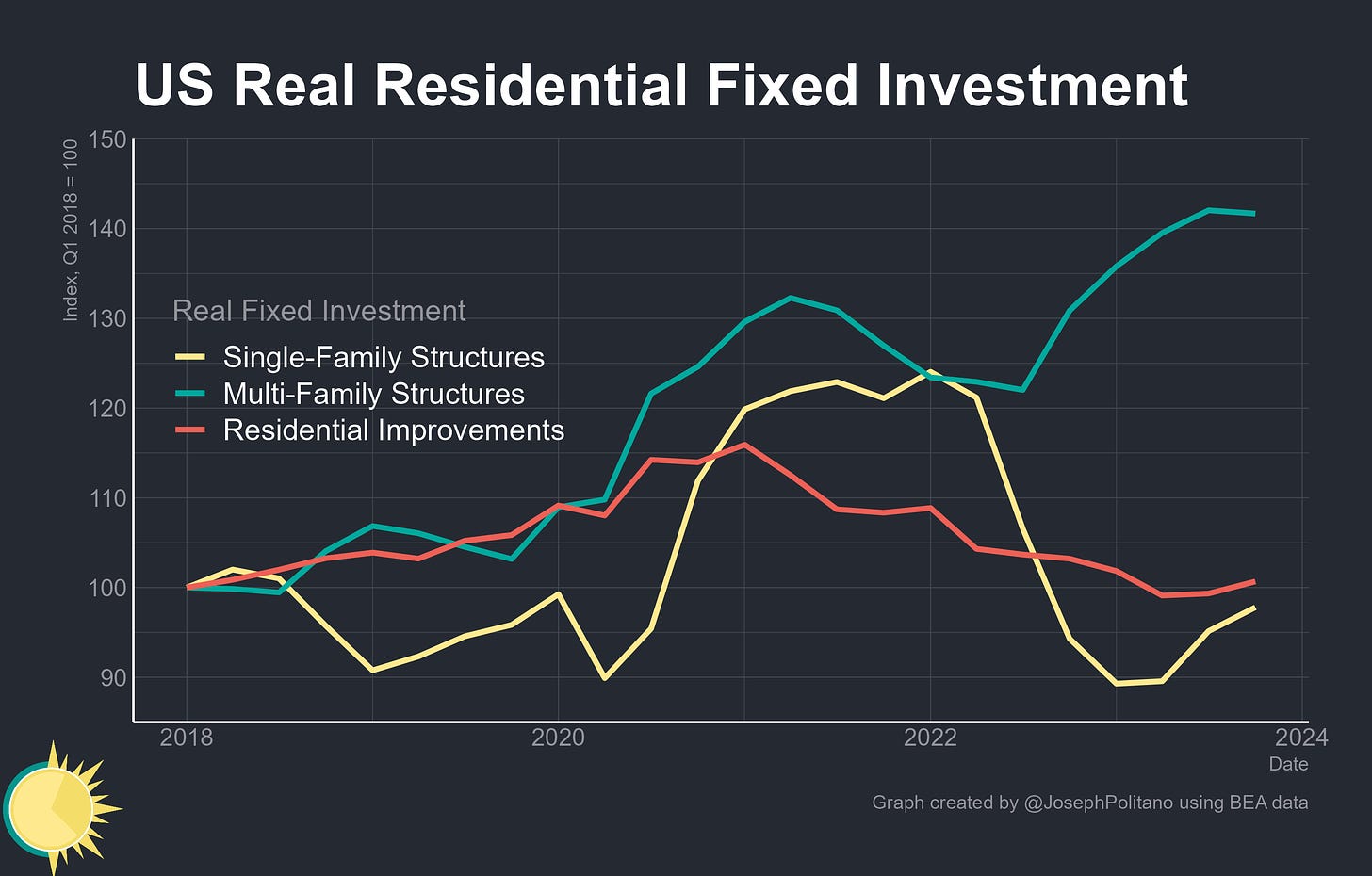

First, within residential investment, multifamily housing construction fell slightly from the 50-year-highs seen last quarter, although this was more than offset by a small rebound in single-family construction and improvements to existing residential structures.

The largest drag on housing activity is instead coming from outside construction—high interest rates have caused a rapid fall in existing home sales and a commensurately large drop in brokers’ commissions and other ownership transfer costs, which made up more than 20% of residential fixed investment in 2021. Real brokers’ commissions have now fallen more than 45% from their pandemic-era peak, including an 8% drop in the last quarter alone, sinking below even the lowest levels seen during the Great Recession.

On the flipside, real nonresidential fixed investment continues to boom thanks to manufacturing construction, which grew to another all-time high amidst the ongoing rise in semiconductor fabricator construction in the wake of the CHIPS Act. Over the last year, manufacturing construction has contributed more than 0.3% to overall GDP growth, its largest contribution in postwar American history. Real investments in electric power infrastructure have also risen more than 13.3% over the last year, and even real construction within the remote-work-battered office sector is up 2.7%.

Finally, the last year has seen a substantial deceleration in the pace of real investments in intellectual property as the tech industry slows down and higher interest rates weigh on research and development decisions. Over the last year, software investments have grown at the slowest pace since late 2015 while real R&D output outside the software sector has shrunk for the first time since the early pandemic—and even investment growth in artistic originals like new movies, TV shows, and books has slowed considerably. Tighter monetary policy tends to reduce these kinds of “investments in innovation”, though the effects of this tightening cycle are being somewhat counteracted by rising public sector investment (real government R&D output and software investment have both risen by about 6.4% over the last year). Still, slowing investment today is likely to be a bit of a drag on future US productivity growth.

Conclusions

Overall though, real investment has decidedly recovered from its cyclical fall in 2022, and it carries the potential for a further rebound if the recent drops in mortgage rates start manifesting as higher housing activity. Real consumption growth remains robust, in fact growing faster than it did throughout 2019. Looking at the data now, you could be completely forgiven for forgetting how low the bar of expectations was set at the start of 2023.

Joseph. This is excellent. You are on to something with the industrial investment boom. May I suggest looking into a company called Eaton? They manufacture electrical equipment and have good slides on the industrial boom underway.

I have a similar bullish outlook but for different reasons... https://open.substack.com/pub/austinmuhs/p/the-real-economics-of-america