Weight Loss Drugs Continue to Power Denmark's Economy

Exports of GLP-1 Drugs like Ozempic & Wegovy are Driving the Majority of Danish GDP Growth

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 47,000 people who read Apricitas!

This Thanksgiving, many Americans ended up with more leftovers than usual—the use of recently discovered GLP-1 drugs is rapidly increasing as millions of people turn to them for help in battling obesity and cardiovascular diseases. These drugs work as appetite suppressants, helping patients regulate food intake by reducing feelings of hunger, and they are one of few medications able to reliably induce long-run weight loss and its downstream health benefits. Thus, prescriptions for Ozempic (a GLP-1 diabetes medication often sought for weight loss despite not being FDA-approved for that purpose) and Wegovy (an explicitly obesity-treating drug) are both on the rise—and that’s been great news for the drugs’ manufacturer, Danish pharmaceutical giant Novo Nordisk.

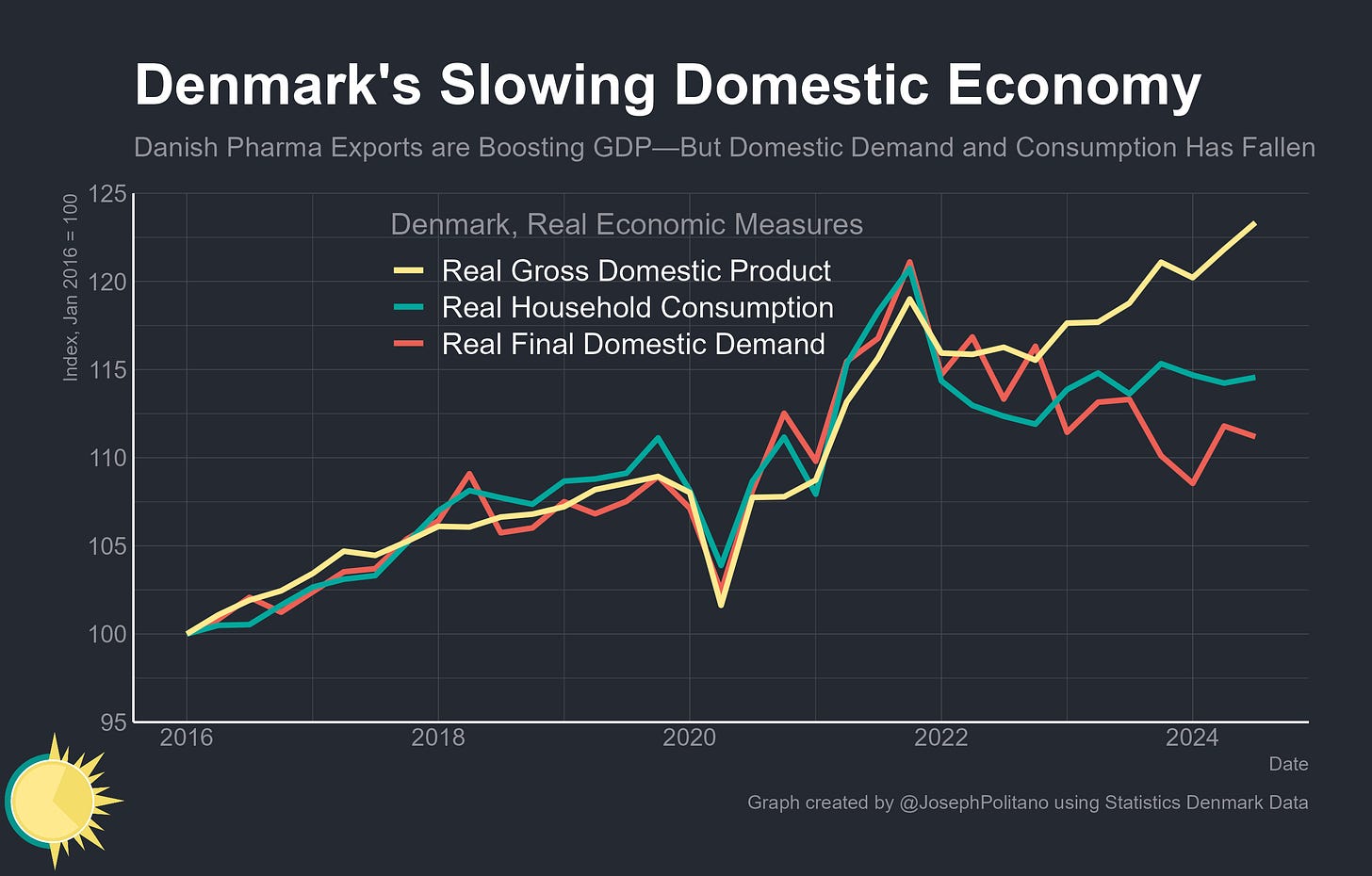

In fact, the GLP-1 boom has been such good news for Novo Nordisk that rising drug exports are currently driving the majority of Denmark’s GDP growth—since late 2021, Danish GDP has increased by 3.6%, but economic growth would have been 0% without the contribution of rapid increases in pharmaceutical manufacturing output. In fact, the pharmaceutical boom has been so strong that it has almost singlehandedly made Denmark one of the fastest-growing economies in the European Union.

In total, the real output of Danish drugmakers has increased by 47% over the last year and has cumulatively risen by 167% since late 2019. That growth broke Danish industry out from a long period of relative stagnation, with total real manufacturing output growing by more in the last four years than it did during the prior 20.

Most of that pharmaceutical production boom has gone towards meeting foreign demand for GLP-1 drugs, especially in the United States. Real Danish goods exports have increased by roughly 37% over the last four years, easily dwarfing the comparatively tepid growth in imports and thus netting Denmark a large increase in its trade surplus.

Yet despite the country’s increase in economic output over the last two years, Denmark has struggled to fully translate the GLP-1 boom into rising personal spending or domestic investment. Real Danish household consumption and capital formation have both been stagnant for more than three years, mirroring many of the economic struggles seen in Germany and many other parts of the EU.

To some extent, that should not be particularly surprising—pharmaceutical manufacturing is not a labor-intensive industry and the returns to successful drug discovery usually come in the form of increased corporate profits. Yet Denmark is economically synonymous with the Nordic model that has long successfully converted innovative growth into broad-based welfare, and Novo Nordisk itself is unique for being majority-controlled by a charitable fund that is now the world’s largest. The task laid ahead for them is clear—to continue the current GLP-1 boom while more durably translating it into general economic prosperity.

Denmark’s Unprecedented Pharma Boom

Over the last few years, Denmark’s unprecedented weight-loss drug boom has driven a massive increase in the country’s exports. That’s been particularly true for exports to the United States, which leapfrogged Germany to become the number one foreign destination for Danish goods in 2023. Today, exports to the US have surged further to a new record high of more than 250B Danish Kroner annualized, with America now importing more than Germany and Sweden combined.

Danish industrial production of pharmaceuticals has also more-than-tripled since 2018, driving a roughly 50% increase in overall manufacturing production despite most of the country’s other industrial sectors stagnating.

Yet even as Danish pharmaceutical production continues rising, manufacturing capabilities are struggling to keep up with the surge in global demand for GLP-1 drugs. The country’s drug companies say they have been continually utilizing between 97% and 99% of their available manufacturing capacity over the last year even as new production facilities steadily come online.

In fact, Novo Nordisk and other Danish drugmakers are currently struggling with supply chain issues at unprecedented rates. The share of pharmaceutical manufacturers facing material shortages sat at functionally zero for decades before briefly spiking to record highs amidst the initial COVID-19 vaccine production rush. Yet those supply-chain issues proved short-lived in comparison to current ones—over the vast majority of the last year-and-a-half, Danish drugmakers have once again faced a persistent lack of key inputs that is holding back production.

As a result, the majority of Danish drug production growth has come via increasing the complexity of value chains to meet the new demand. The rise in sales for Danish pharmaceutical manufacturers has come almost entirely from companies like Novo Nordisk outsourcing production to other domestic and international partners rather than strictly increasing their internal production. Likewise, the vast majority of Danish exports to the US are not leaving the port of Copenhagen fully prepared for final sale, but rather as intermediate products that see further manufacturing processes before finally reaching patients in America.

The amount paid by foreigners, especially Americans, for Danish intellectual property has also increased significantly as part of the country’s pharmaceutical boom. Danish net exports of IP have risen to more than 30B Kroner annualized, with net exports to the US reaching 25B Kroner in the most recent data. In this case, the IP exports mostly represent American production and distribution partners paying Novo Nordisk to use the patents and other research output relevant to GLP-1 drugs.

This complex system of export-oriented global pharmaceutical production chains based on Danish IP has meant the country’s GLP-1 boom has primarily translated into increased income for its capital holders. Danish manufacturing’s share of GDP is at some of the highest levels in more than 30 years, but this is almost entirely because of increases in corporate profits, returns to intellectual property, and other components of gross operating surpluses. Manufacturing workers’ share of national economic output has increased, but only enough to bring it roughly in line with pre-pandemic levels and well below historical peaks.

Yet even if most of the pharmaceutical boom has occurred in the form of rising corporate profits, that does not mean there has been no benefit to Danish workers. Jobs in pharmaceutical manufacturing, though still a small share of overall employment, saw the largest annual increase on record in 2023—on top of steady increases in wages. Healthcare, business, and other sectors downstream of or related to pharmaceuticals are also seeing a boost.

Conclusions

Plus, Novo Nordisk has rapidly become one of Denmark’s top taxpayers, helping defray the fiscal costs of dealing with the COVID recovery and European energy crisis. Danish corporate income tax receipts are highly elevated as a result of the GLP-1 boom, now running at about 110B Kroner annualized, a 50% jump from pre-COVID levels. That helped propel Denmark to a budget surplus worth 3.3% of GDP last year, the highest in the EU, while driving national debt-to-GDP to the lowest level since the late 70s. The budgetary room for household tax reductions, increased social spending, or more public investment is significant, should Denmark choose to use it.

Meanwhile, distributions from the Novo Nordisk Foundation continue to rise as the organization becomes flush with cash from its 28% stake in the pharmaceutical company. The total annual grants paid by Danish foundations rose 83% over the last four years, reaching a record high of more than 20B Kroner in 2023. Given the rapid gains in wealth for the Novo Nordisk Foundation, that increased spending could persist as a boon to Denmark’s economy long into the future.

In many ways, this is a success story for technological innovation and gains to international trade. The discovery of GLP-1 drugs represented a genuine breakthrough in addressing one of the world’s most common health afflictions, and the immediate rush to access them signaled just how valuable they are to patients. As part of scaling up production Denmark has benefitted tremendously, but so have thousands of people in dozens of factories, laboratories, and businesses across the world who made indispensable contributions to the growing supply chain.

There are, however, some major risks that remain for Denmark’s pharmaceutical boom. The core patent for Ozempic expires in 2026, and Danish growth could slow if competitors—like pharmaceutical giant Eli Lilly—seize future opportunities to gain market share. There could also be more American scrutiny on Novo Nordisk’s pricing and competitive position, as happened recently with the increasing regulation of insulin prices. Yet at least for now, the GLP-1 boom continues delivering historic economic growth for Denmark.

Great piece!

Thank you for all this data and analysis. I was previously unaware that Novo Nordisk is controlled by a charitable foundation (77% of voting shares). Very interesting because of the populist case (on the right and left) that big pharma is evil rich guy master manipulators. Any evidence that this company behaves any different than others as a result of their ownership structure?